Decoding the Major Oil Producers’ Meeting in Algeria

OPEC producers’ meeting was held from September 26–28, 2016. Crude oil prices rose 12% in August 2016 due to speculation about the meeting’s outcome.

Nov. 20 2020, Updated 2:29 p.m. ET

Major oil producers’ meeting

OPEC (Organization of the Petroleum Exporting Countries) producers’ meeting was held from September 26–28, 2016. Crude oil prices rose 12% in August 2016, partially due to speculation around the outcome of this meeting.

On September 28, 2016, OPEC producers reportedly reached an agreement to cap production in the November OPEC meeting. US crude oil rose 8% in September 2016—partly due to the announcement of a reduction in crude oil production between 700,000 barrels per day and 1 million barrels per day by OPEC members. The details of the quotas for OPEC members will be furnished in the November meeting. For more on OPEC production in September 2016 and crude oil prices, read Part 3 and Part 1 in this series.

Non-OPEC producers

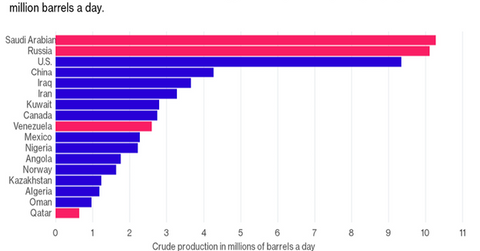

Russia is the world’s largest crude oil producer and exporter. It isn’t a member of OPEC. It showed interest in capping its crude oil production along with OPEC. Read Will Russia’s Crude Oil Production Reach Historic Levels? and Will Iran’s Crude Oil Production Pressure Crude Oil Prices? to learn more about Russia and Iran’s crude oil production.

The US is also one of the largest crude oil producers and importers. It’s a non-OPEC member. Higher crude oil prices will support US drillers and producers to increase crude oil production. For more on US crude oil production, read Slowing US Crude Oil Production Could Boost Crude Oil Prices.

Also, read How OPEC Crude Export Revenues Could Impact Oil Producer Meeting, Saudi Arabia, Russia, and the US Impact the Crude Oil Market, and What Will Happen if the Oil Producer Meeting Succeeds? to learn more.

Impact on oil stocks and ETFs

Oil producers’ meeting increased the volatility in the crude oil market. The volatility in crude oil prices impacts oil and gas producers’ profitability such as QEP Resources (QEP), Synergy Resources (SYRG), Range Resources (RRC), and Goodrich Petroleum (GDP).

Volatility also impacts funds such as the Vanguard Energy ETF (VDE), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the Fidelity MSCI Energy (FENY), and the Guggenheim S&P 500 Equal Weight Energy ETF (RYE).

In the next part of the series, we’ll look at Cushing crude oil inventories.