SPDR® S&P Biotech ETF

Latest SPDR® S&P Biotech ETF News and Updates

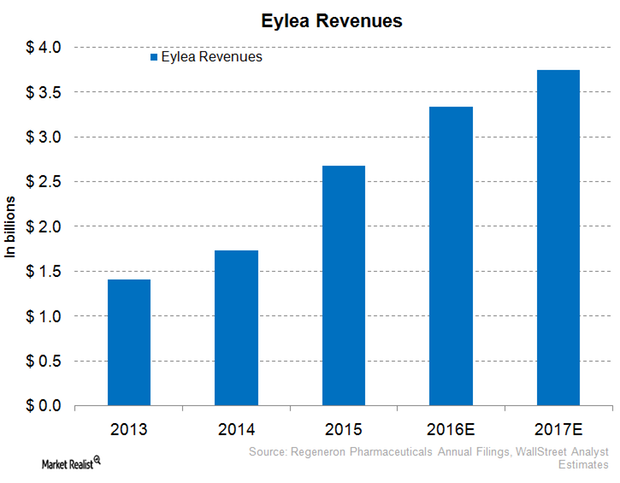

Why Eylea Could Face Tough Competition in 2016

In 2016, Regeneron expects to face increased competition from Roche Holding’s Lucentis (Ranibizumab) and Avastin (Bevacizumab) for Eylea.

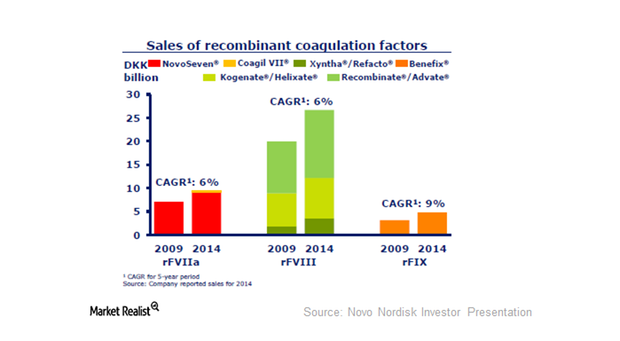

What Are the Current Treatment Options for Hemophilia?

Hemophilia treatment primarily includes factor replacement therapy and prolonged half-life therapy such as factor VIII or factor IX infusion.

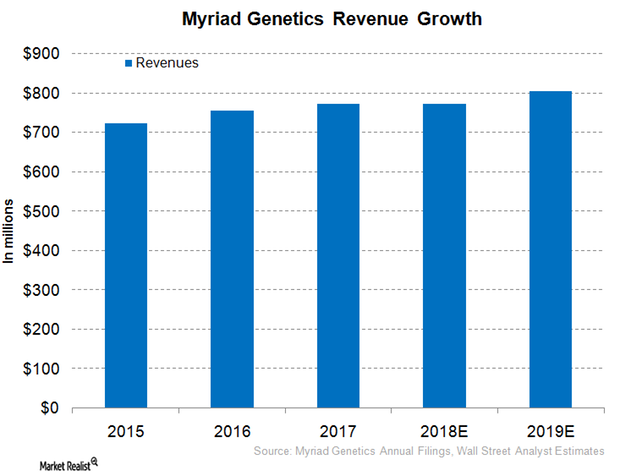

Myriad Genetics Expected to Report Flat Revenue Growth in Fiscal 2018

Myriad Genetics (MYGN) expects to report revenues in the range of $750 million–$770 million in fiscal 2018 (ended June 30, 2018).

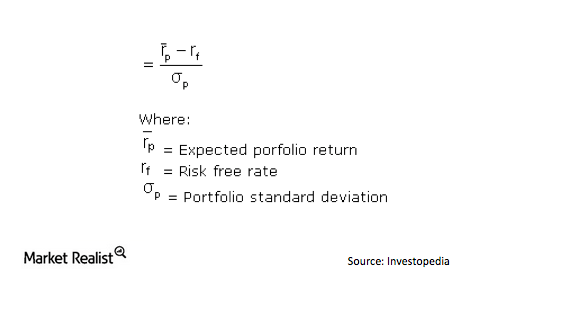

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]

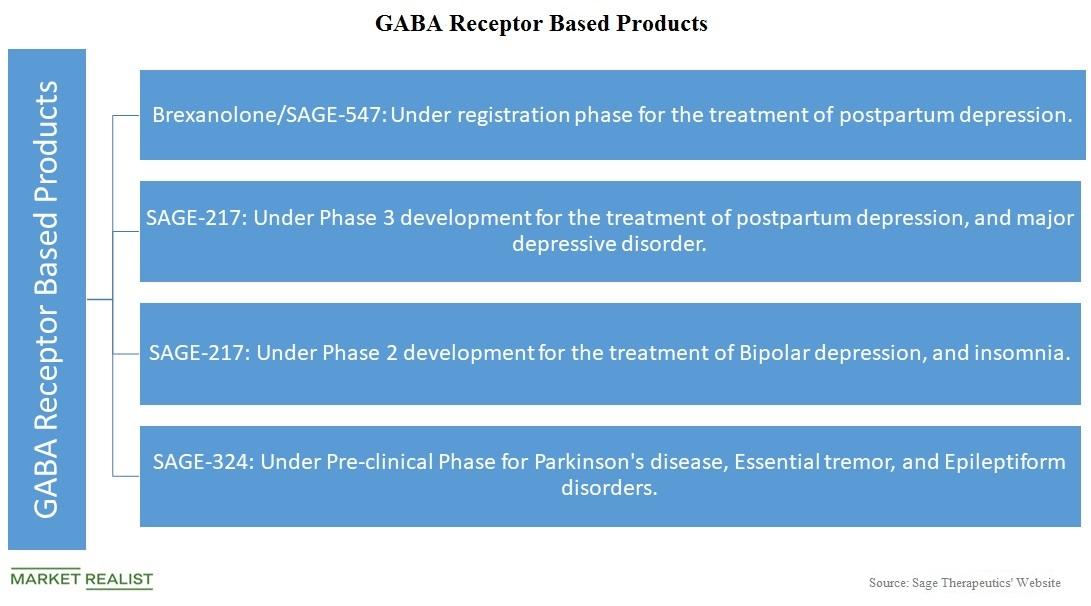

Sage Therapeutics’ GABA Receptor–Based Products

On June 12, Sage Therapeutics announced its expedited development plan for SAGE-217.

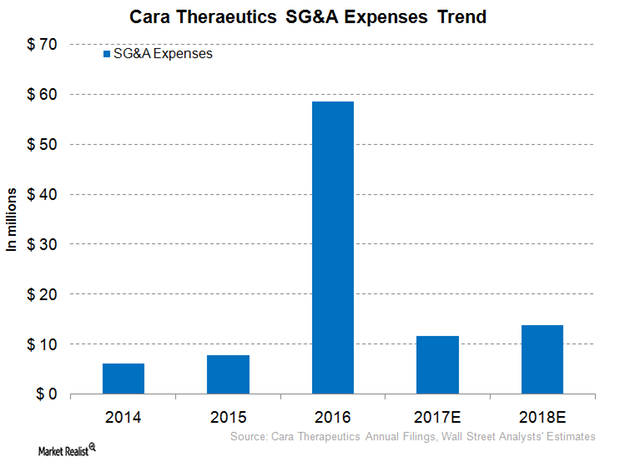

Comparing Cara Therapeutics’ Financial Performance

Financial performance In 3Q17, Cara Therapeutics (CARA) incurred $9.6 million in research and development expenses, compared with $9.1 million in 3Q16. This fall in expenses was due to a $3.1 million decrease in expenses for oral CR845’s Phase 2B clinical trial, and partially offset by increased expenses for its intravenous CR845 safety study. Meanwhile, the company’s general and administrative expenses rose from […]

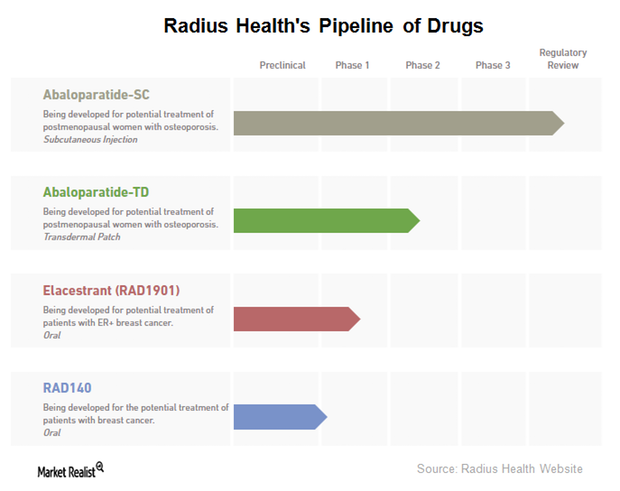

A Strong Pipeline of Drugs Bodes Well for Radius Health

The drug candidates in Radius Health’s (RDUS) pipeline include an investigational abaloparatide transdermal patch for possible use in treating women with postmenopausal osteoporosis.

Are Stock Returns during Summer Months That Bad?

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign.

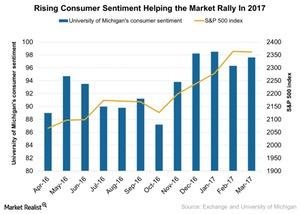

Is Rising Consumer Sentiment Helping the Market Rally in 2017?

The S&P 500 Index (SPX-INDEX) has posted a rise of ~5% since the beginning of 2017, with banks and energy stocks leading the rally as of March 29, 2017.

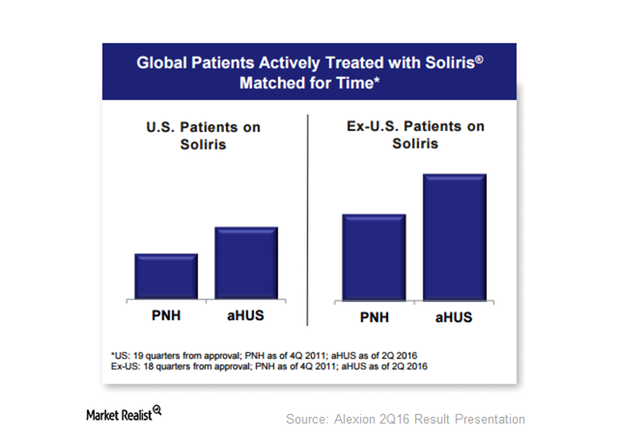

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

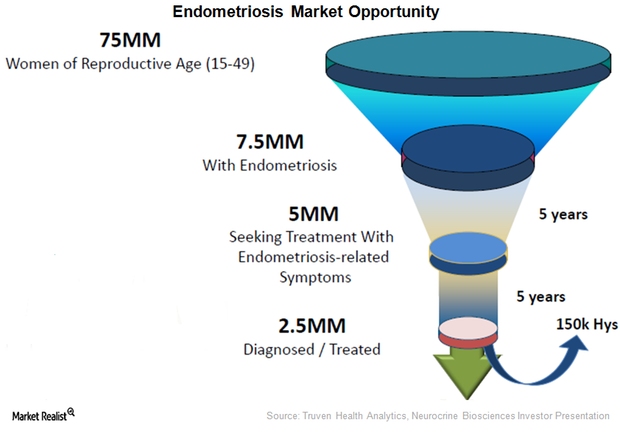

Will Elagolix Make Neurocrine Biosciences a Key Women’s Health Name?

If approved, Elagolix could present fierce competition for existing drugs like Teva Pharmaceuticals’ (TEVA) Aygestin and Astrazeneca’s (AZN) Zoladex.

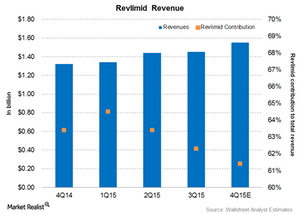

Revlimid Continues to Drive Celgene’s Revenue

Revlimid (lenalidomide) is one of Celgene’s (CELG) main revenue drivers. It had revenues of $1.4 billion in 3Q15, excluding the adverse impact of foreign exchange fluctuations.

How Actavis Has Emerged through Mergers and Acquisitions

In October 2012, Actavis completed the acquisition of Actavis Group. In 2013, the company’s revenues outside the US increased to 29% from 16% in 2012.