State Street Corp

Latest State Street Corp News and Updates

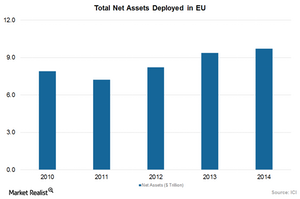

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

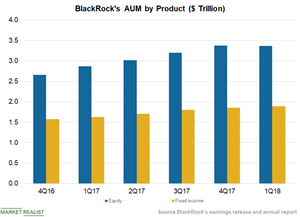

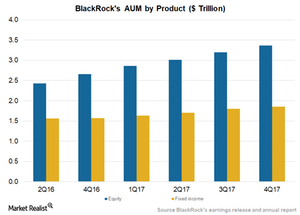

BlackRock’s Diversified Offerings Can Benefit from Rate Hikes

In the first quarter, BlackRock managed ~$1.9 trillion in fixed income offerings, up from ~$1.6 trillion in the first quarter of 2017.

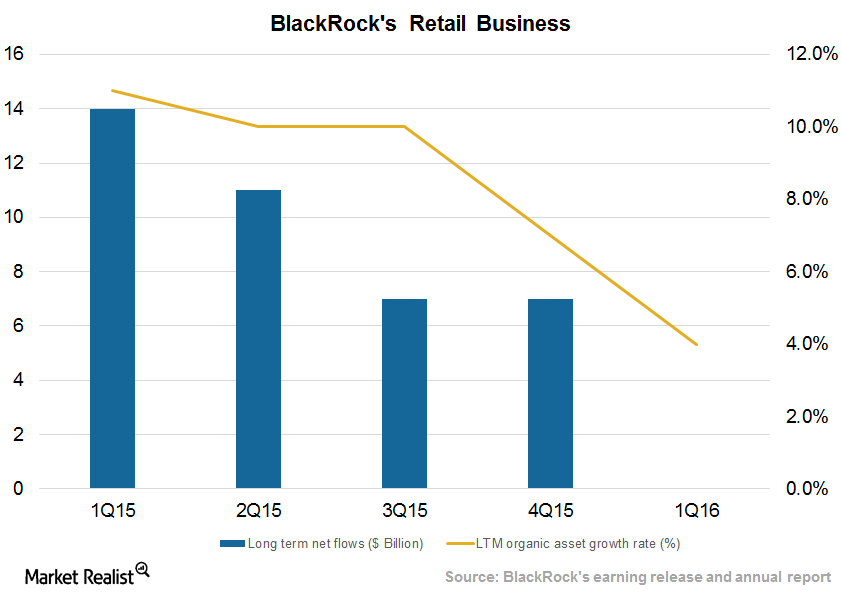

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

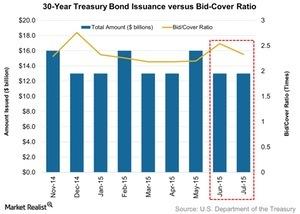

10-Year Treasury Note Market Demand Barely Moved Last Week

On July 8, ten-year Treasury notes worth $21 billion were auctioned—the same as the previous week.

How Could a Trade War Impact Asset Managers?

After Trump announced that Chinese investments in US tech stocks would be restricted, the Dow Jones Industrial Average spiked downward.

Interest Rate Expectations Have Jolted Equity and Debt Alike

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

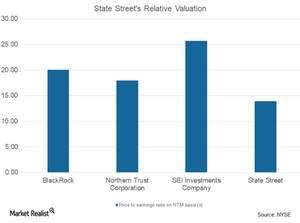

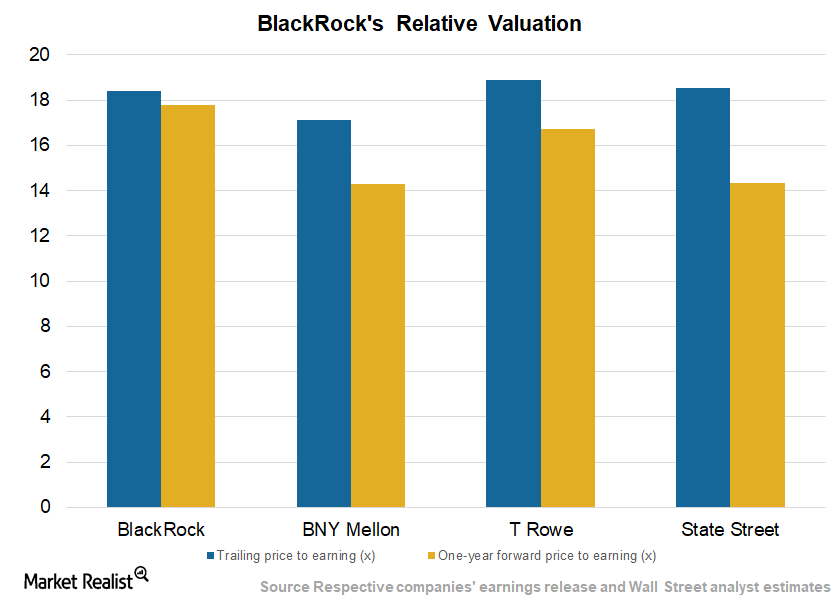

Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

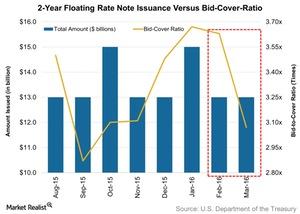

Why Overall Demand Tanked for 2-Year Floating-Rate Notes

Overall, $13 billion worth of floating-rate notes were auctioned, the same as in February’s auction.

How to Pick Asset Management Stocks to Invest in

If you’re looking to diversify your portfolio, asset management stocks are worth a look. Here’s how to pick the right asset management stock to invest in.

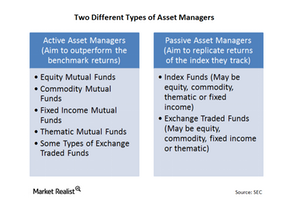

Traditional assets: Defining active and passive management

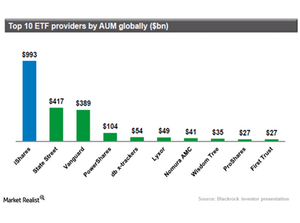

Active asset management refers to those asset managers that essentially try to outperform the average market return, a benchmark, or a hurdle rate that may have been set internally.Financials The big 3 ETF providers in the US—iShares, SPDR, and Vanguard

In the U.S., Blackrock (BLK), State Street GA (STT), and Vanguard are the top three ETF providers. They have a 40.1%, 22.3%, and 20.7% market share, respectively.

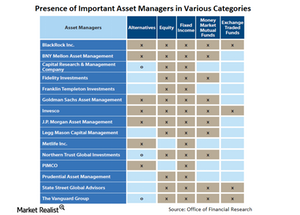

The main players in asset management

The efficient market hypothesis maintains that the market prices everything correctly and so it isn’t possible to outperform the market in the long run.

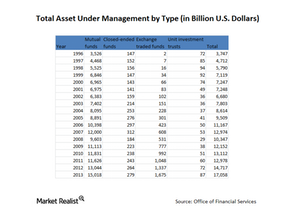

How big is the asset management industry?

Audited and verified annual figures at the end of 2013 indicate that total assets under management of US registered investment companies equalled nearly $17.1 trillion.

BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

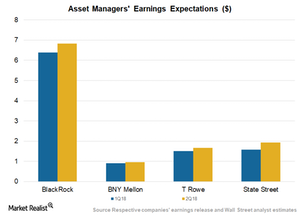

BlackRock and Competitors Look at Strong 1Q18 Numbers

Among the major asset managers, BlackRock (BLK) is expected to post sequential and year-over-year growth in earnings per share to $6.38 in 1Q18 and $6.83 in 2Q18.

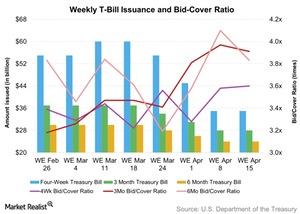

Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

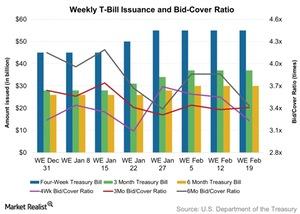

How Was Market Demand for the 13-Week Treasury Bill Auction?

The U.S. Department of the Treasury conducted the weekly auction of 13-week Treasury bills on February 16, 2016. The total issuance was worth $37 billion.

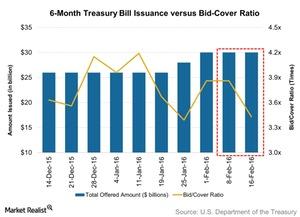

Bid-to-Cover Ratio Fell for 26-Week Treasury Bill Auction

The U.S. Department of the Treasury held the weekly 26-week Treasury bill auction on February 16, 2016. T-bills totaling $30 billion were on offer.

How does BlackRock compare to its peers?

How does BlackRock compare to its peers? BlackRock faces major competition from State Street and Vanguard.

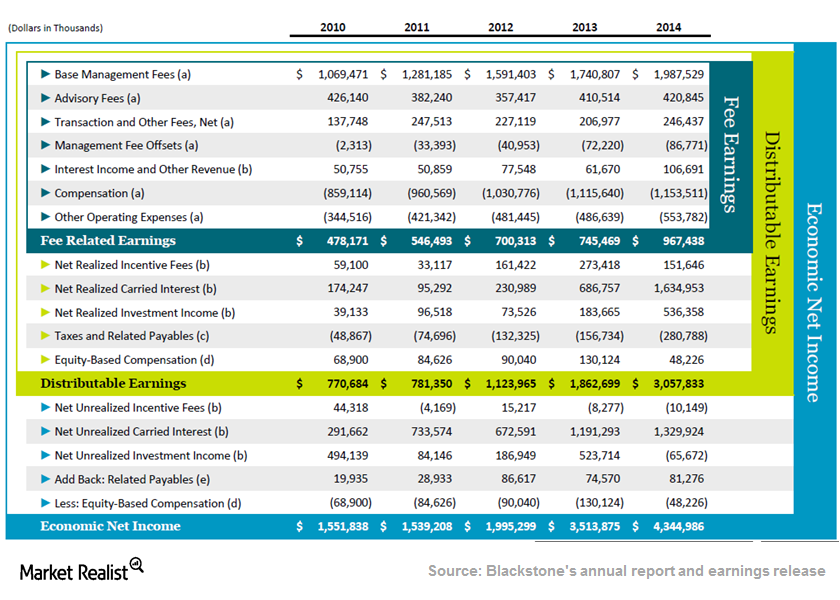

Blackstone’s revenue model

The company’s revenue model is based on charging management and performance fees for managing the portfolios in its investment advisor firms.

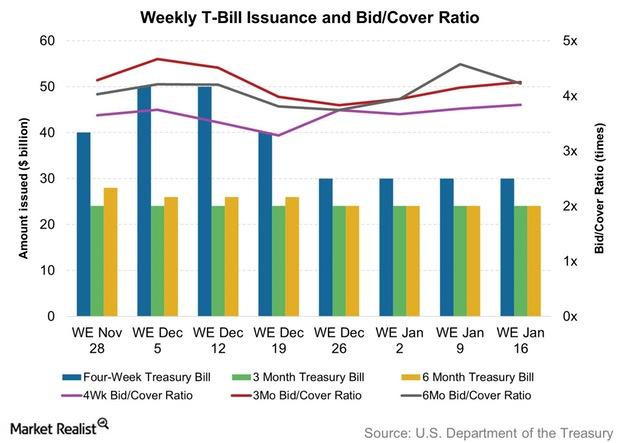

The bid-to-cover ratio rose at the 13-week T-bills auction

The US Department of the Treasury auctioned 13-week, or three-month, Treasury bills (BIL) (MINT), or T-bills, worth $24 billion on January 12.Financials Overview: What makes custodian banks different from other banks?

Custodian banks like a warehouse and store other financial institutions’ and individuals’ assets—they help in keeping financial instruments safe.