Oasis Petroleum Inc

Latest Oasis Petroleum Inc News and Updates

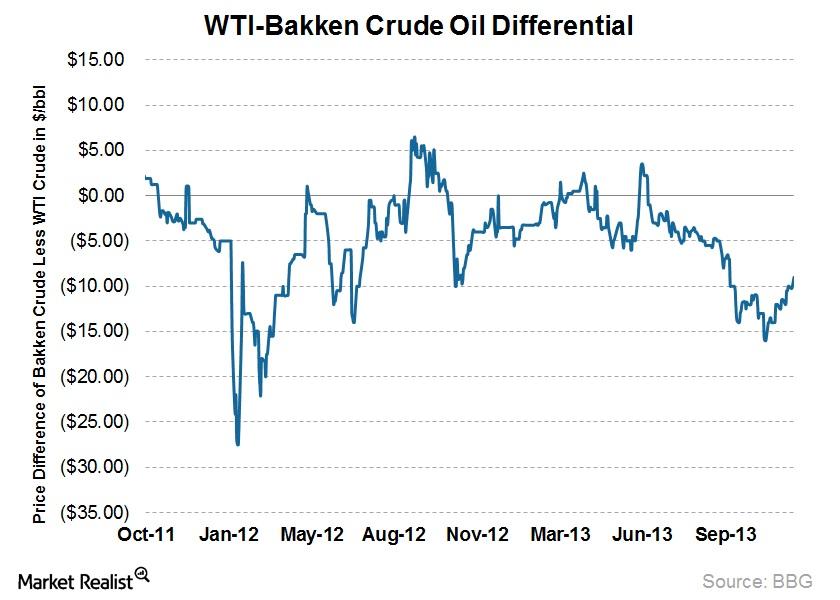

Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

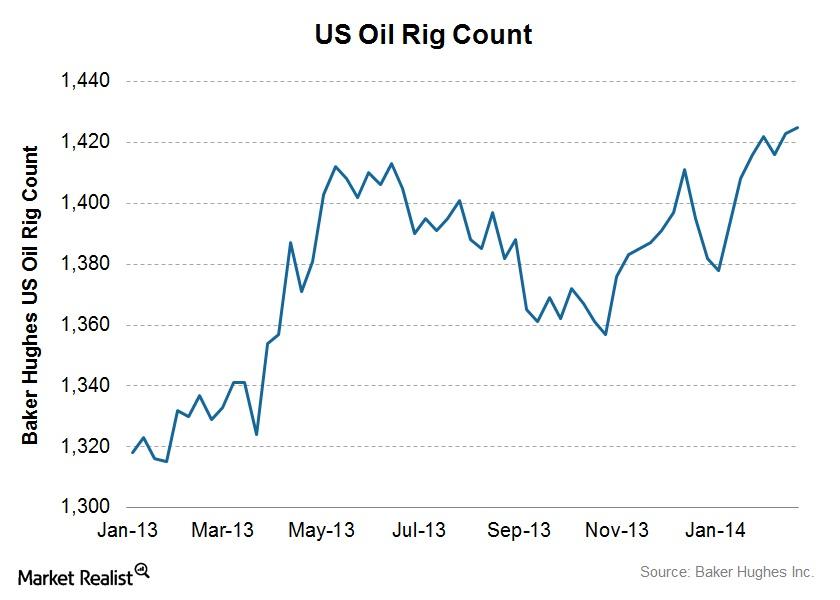

US oil rig counts continue to rally, reaching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.

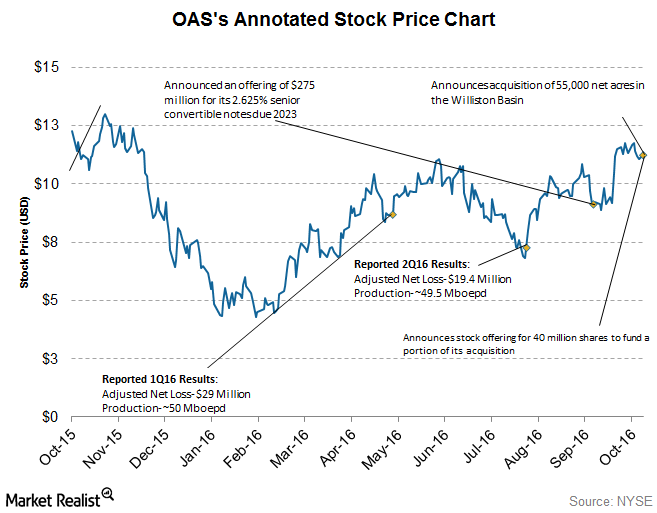

How Has Oasis Petroleum’s Stock Performed This Year?

Oasis Petroleum’s (OAS) stock has shown an uptrend for the most part of 2016. Its stock dipped between June 2016 and August 2016….

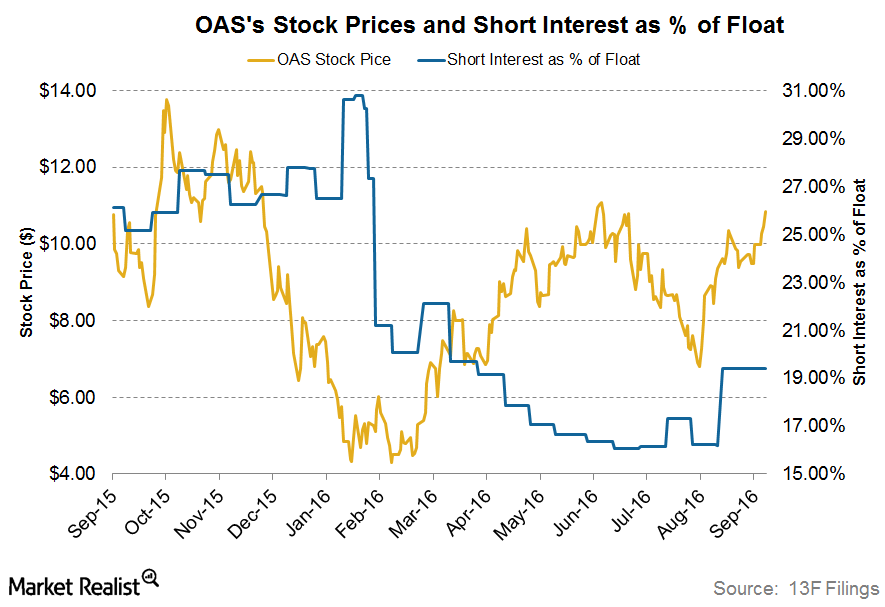

Analyzing Short Interest Trends in Oasis Petroleum

Oasis Petroleum’s short interest ratio on September 13, 2016, was ~19.4%. Its short interest ratio on June 30, 2016, was 16.1%.

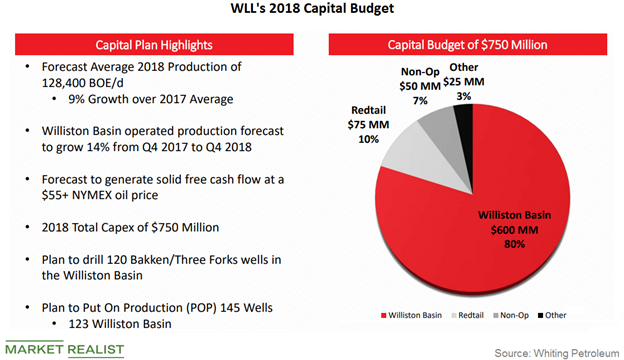

Whiting Petroleum’s Capex Plans for 2018

Whiting Petroleum’s (WLL) 2018 capital expenditure forecast is $750 million, compared to its capex of $912 million in 2017.

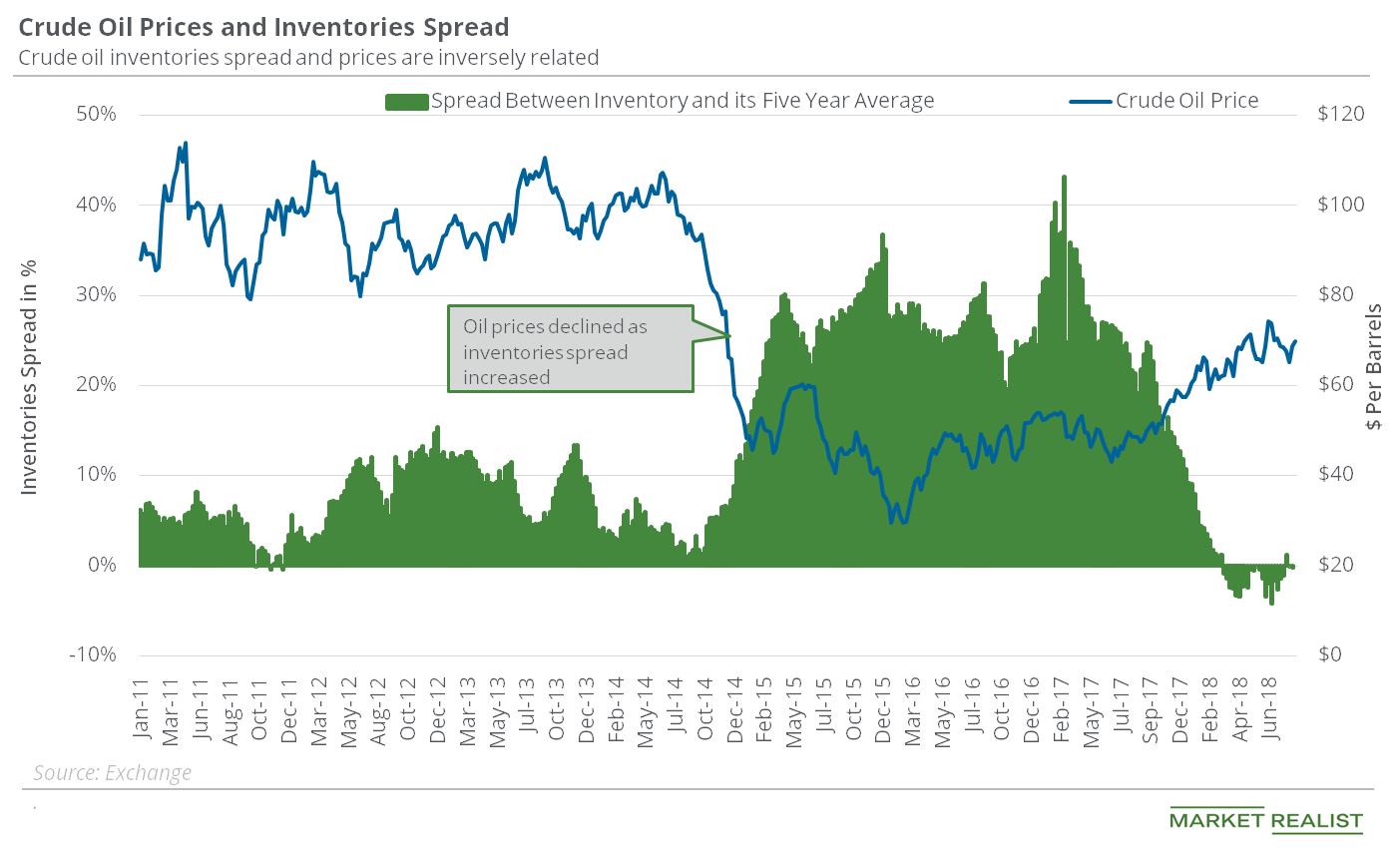

Why Inventory Data Might Boost Oil Prices

In the week ended August 31, 2018, US crude oil inventories were almost on par with their five-year average.

Why US Crude Oil Prices Are Steady

On June 14, Russia and Saudi Arabia announced a bilateral framework to increase cooperation and manage the oil market.

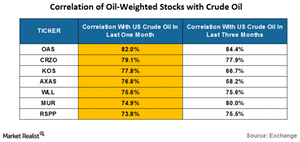

Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

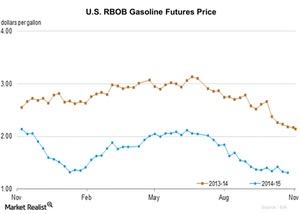

Why Did RBOB Gasoline Outperform Heating Oil?

The EIA reported RBOB gasoline futures contract 1 prices at $1.30 per gallon on November 23, representing a fall of ~1.8% from $1.32 per gallon on October 16.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.

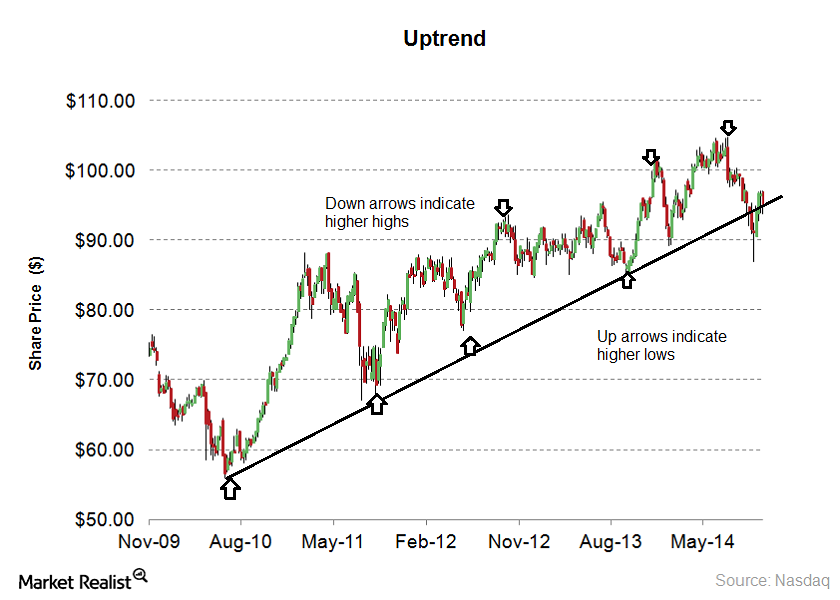

Why investors should buy stocks during an uptrend

Stocks are in an uptrend when they’re making higher highs and higher lows. An uptrend forms when psychological or fundamental factors are improving.

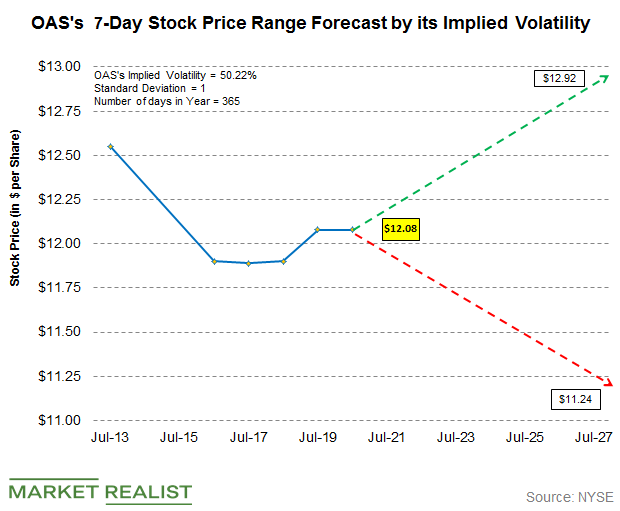

Using Implied Volatility to Forecast Oasis’s Stock Price Range

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%.

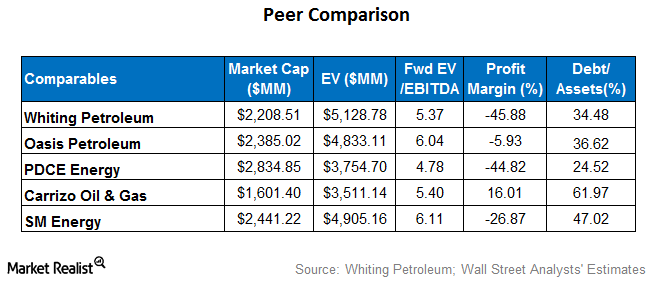

Where Whiting Petroleum Stands Next to Peers

Whiting Petroleum’s (WLL) forward EV-to-EBITDA multiple of ~5.4x is mostly in line with the peer average of 5.5x.

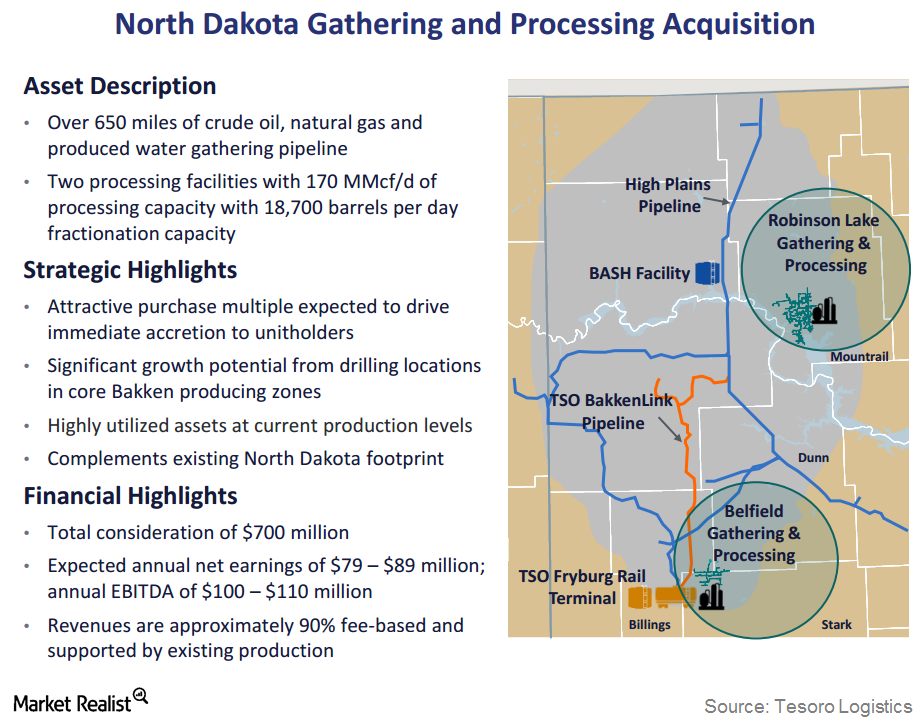

Whiting Petroleum Announces Bakken Midstream Divestiture

On November 21, 2016, Whiting Petroleum announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies for $375 million.

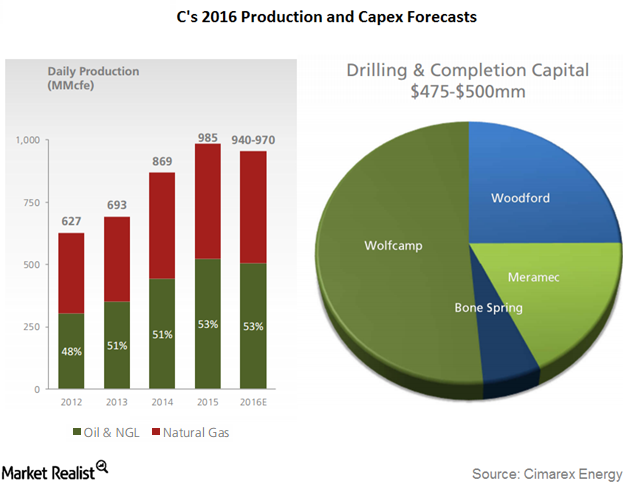

What Happened to Cimarex’s 1Q16 Production Volumes and Realized Prices?

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY

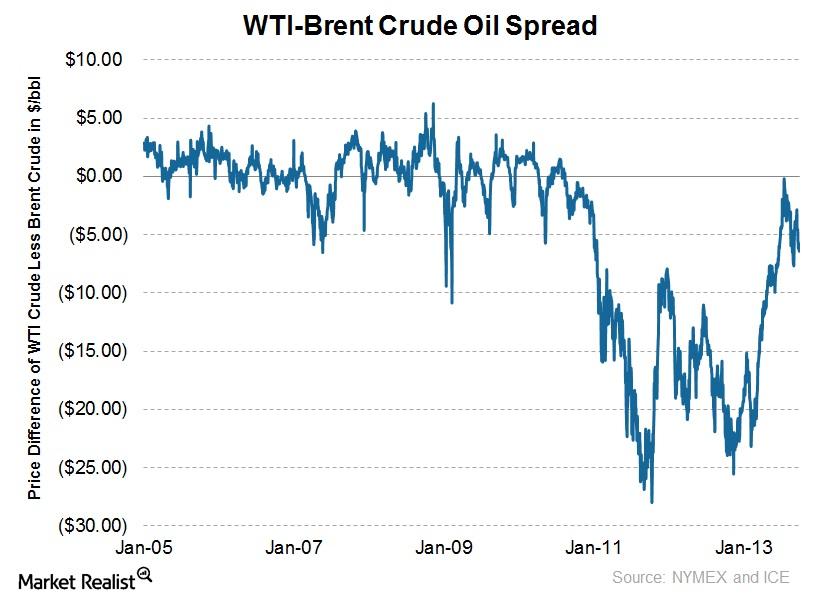

Why the spread between WTI and Brent oil drifted wider

The spread between WTI and Brent closed through most of 2013, but it has experienced some volatility in recent months, given events in Libya and Syria.