iShares Russell 3000

Latest iShares Russell 3000 News and Updates

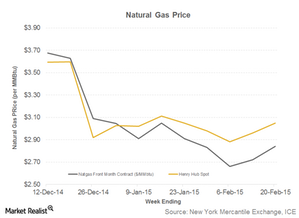

Challenges before Peabody Energy’s US operations in fiscal 2015

The retirement of coal-fired power plants and the impact of new regulations proposed by the EPA present two major blows to the US thermal coal industry.

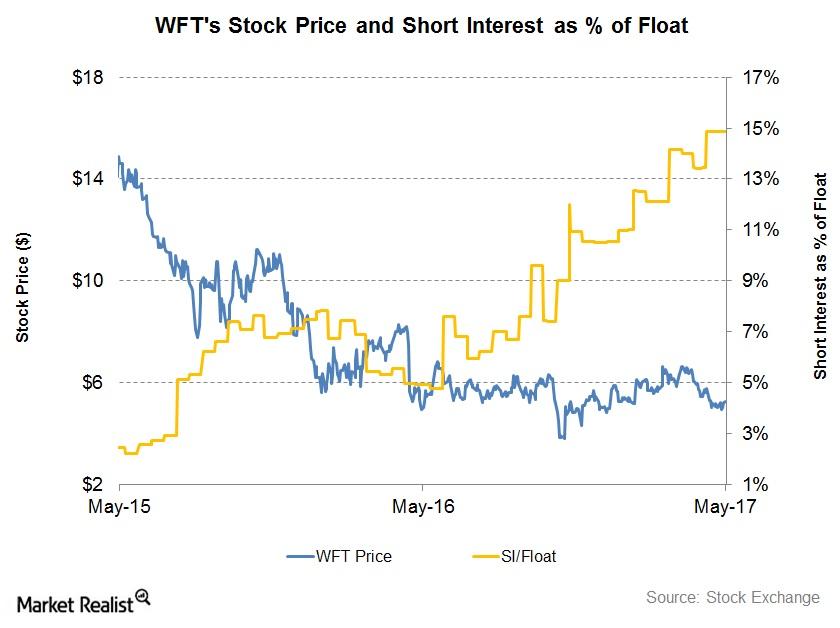

What Short Interest in Weatherford Indicates

Weatherford International’s (WFT) short interest as a percentage of its float was 14.9% as of May 22, 2017, compared to ~14% as of March 31, 2017.

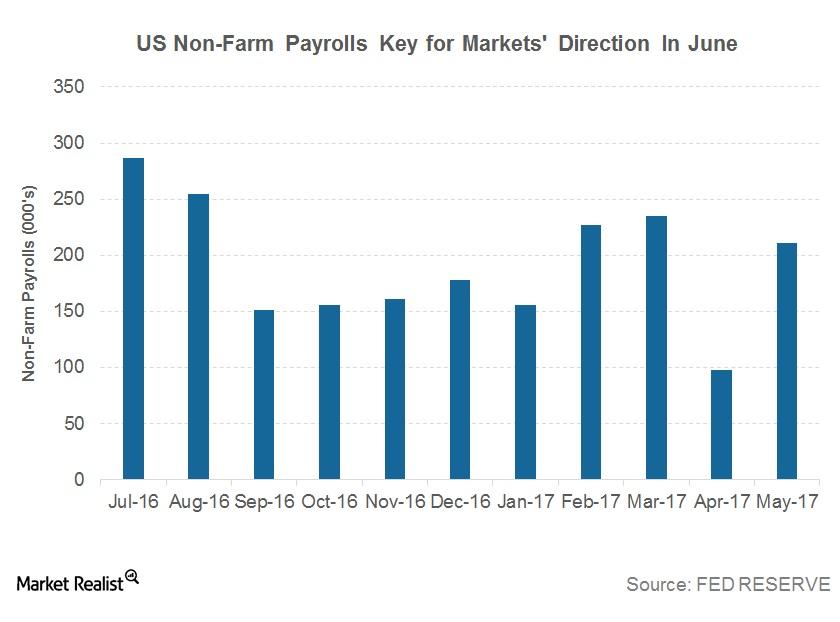

What to Look Forward to in June

In recent weeks, we’ve witnessed volatile behavior in the markets (SCHB) due to political turbulence in the United States and increased investor impatience.

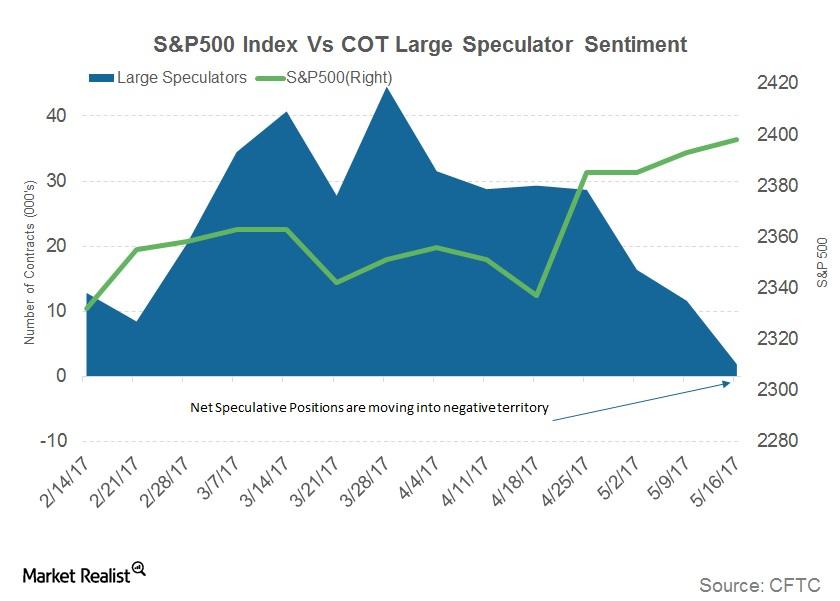

Why S&P 500 Speculative Bets Are off the Table

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week.

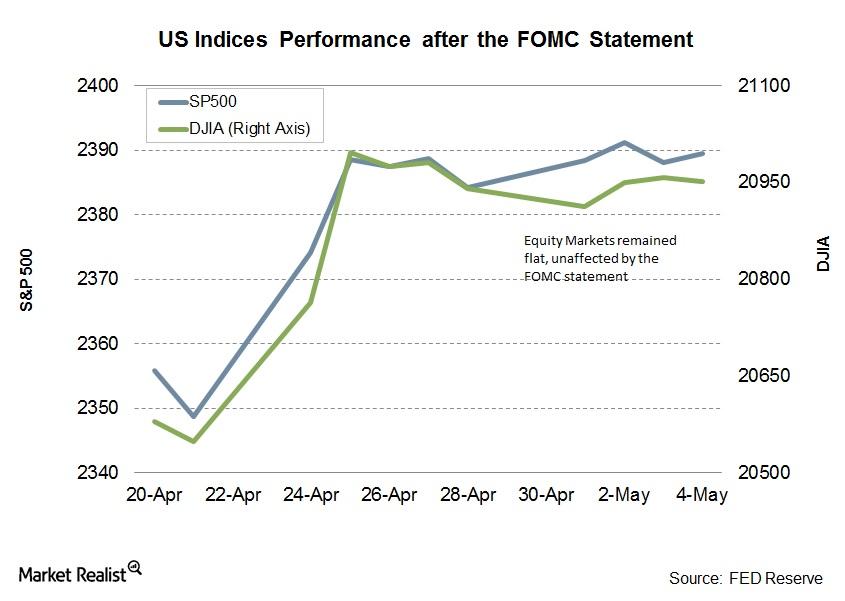

Why the FOMC Statement Didn’t Affect Equity Markets

Since the previous Fed meeting in March, where the Fed announced a 0.25% rate hike, equity markets (IWV) around the globe remained dovish.

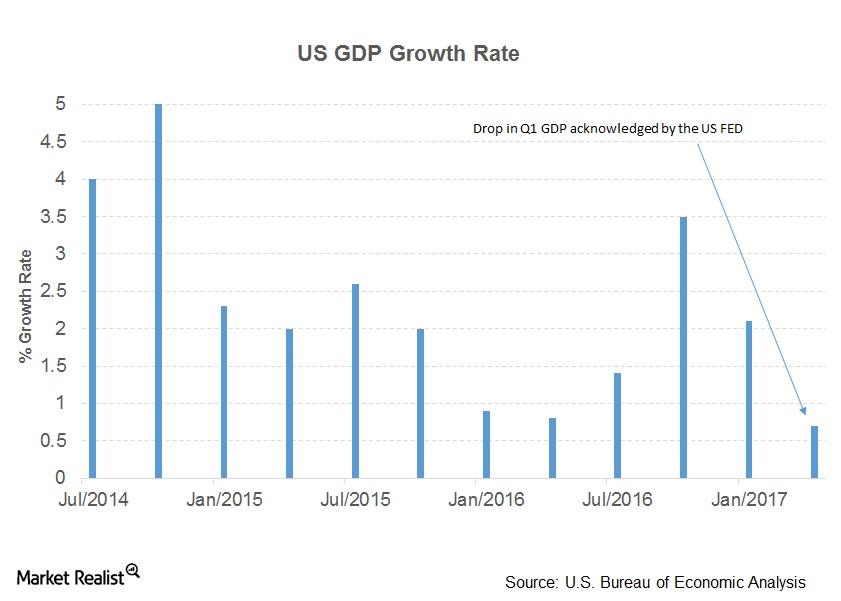

Unpacking the Fed’s Outlook on the US Market

In its May statement, the Fed seems to have gone the extra mile to explain the slowdown in the first quarter.

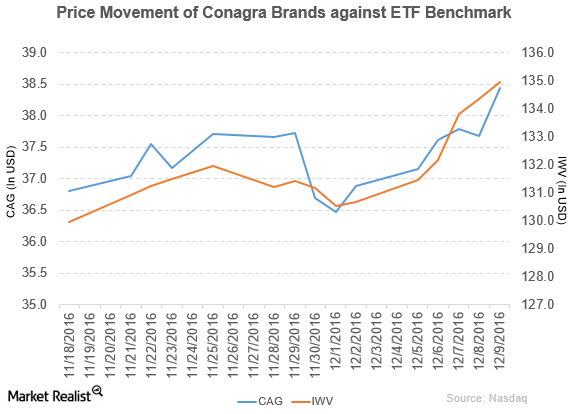

Conagra Brands Declares a Dividend and a New Board Appointment

Conagra Brands (CAG) rose 4.2% to close at $38.44 per share during the first week of December 2016.

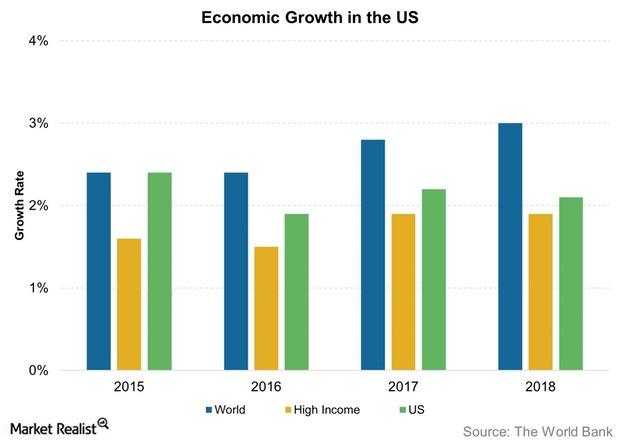

What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

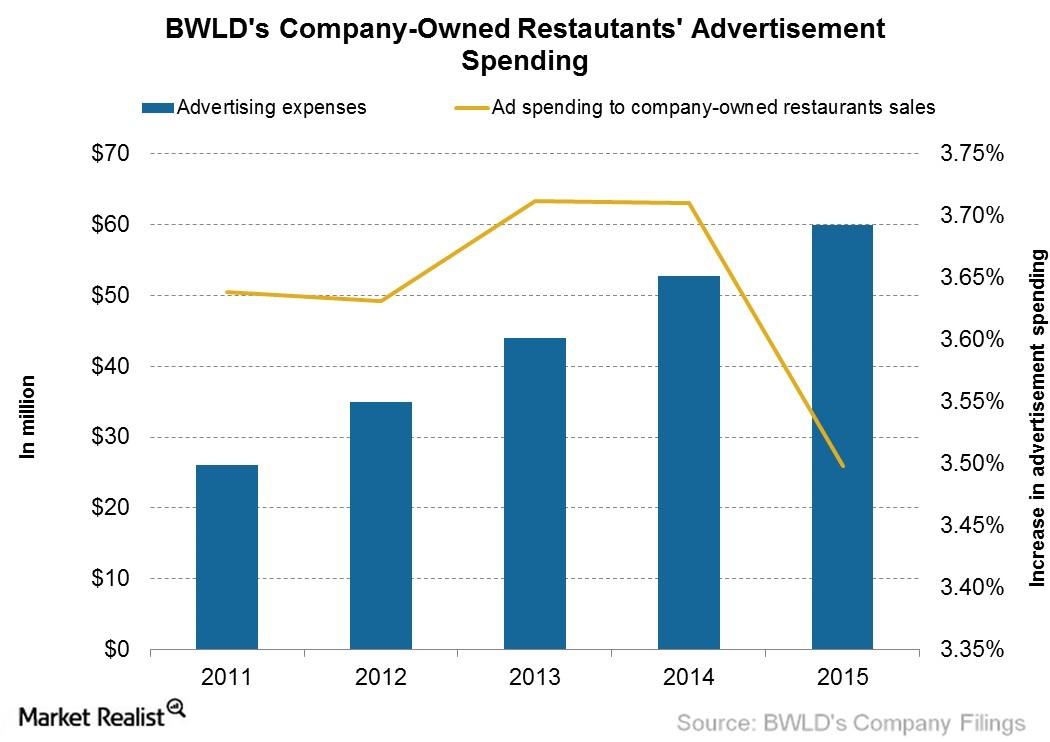

Inside Buffalo Wild Wings’ Marketing Strategies

Buffalo Wild Wings is competing in the highly competitive restaurant business, wherein innovation is a must to keep up with the changing needs of customers.

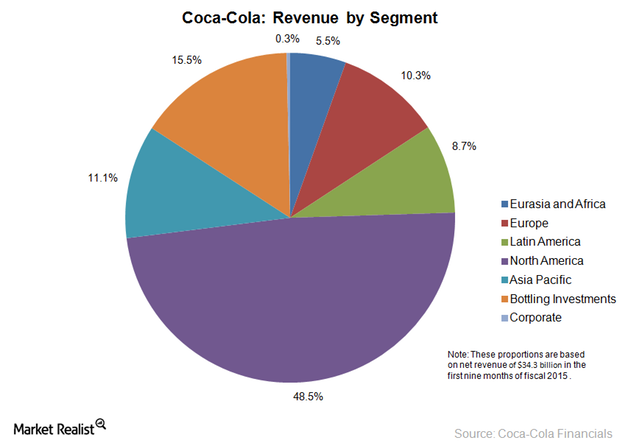

Coca-Cola Strengthened Presence in Africa with Stake in Chi

Beverage giant Coca-Cola (KO) has expanded its presence in Africa with the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

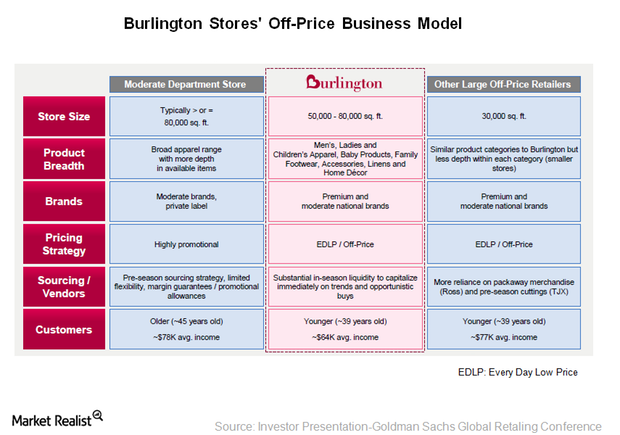

An Inside Out Look at Burlington’s Business Model

Burlington follows an EDLP model, which helps customers get up to 60–70% savings off prices of similar merchandise in department and specialty stores.

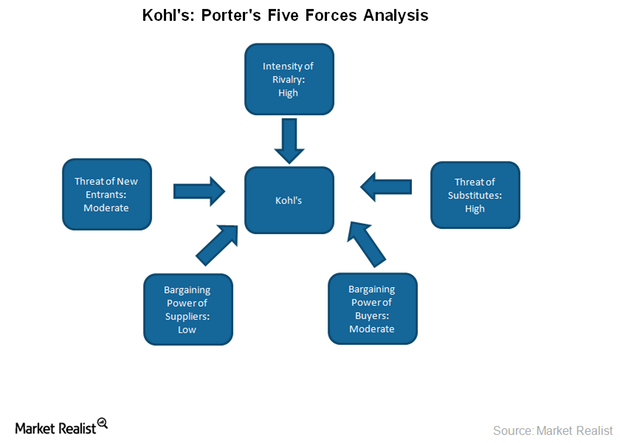

Analyzing Kohl’s Positioning Based on Porter’s Five Forces

Kohl’s sells private label merchandise as well as national brands. The company purchases merchandise from several domestic and foreign suppliers.

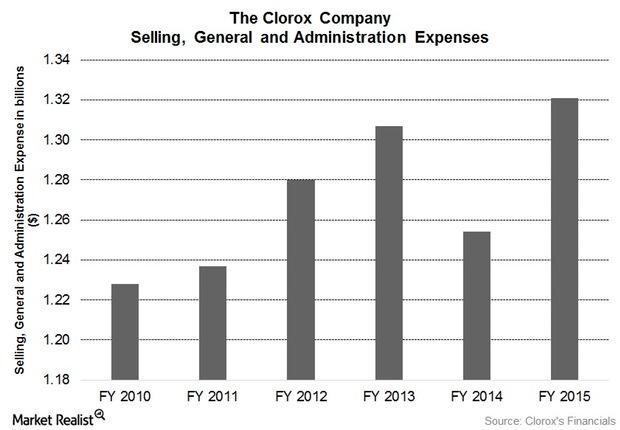

Why Clorox’s Marketing Strategies Are Reaching More Households

Clorox’s (CLX) SG&A expenses increased 5.3% in fiscal 2015 compared to fiscal 2014. The increase was primarily due to increased advertising and marketing programs.

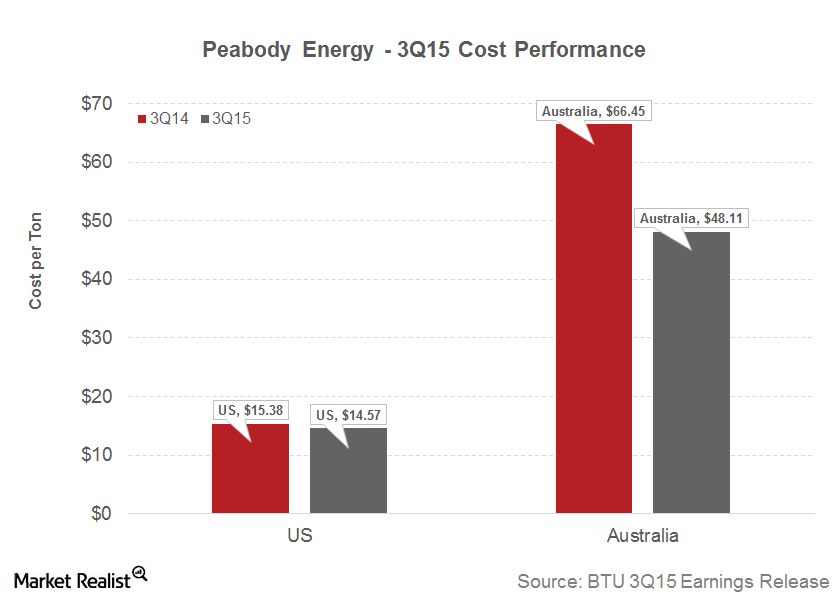

Will Peabody Energy’s Impressive 3Q15 Cost Performance Help?

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14.

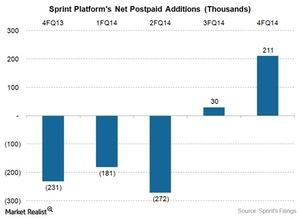

Why Do We Need to Analyze Sprint Promotions?

After Sprint CEO Marcelo Claure joined the company, Sprint added ~30,000 postpaid connections in fiscal 3Q14 and ~211,000 postpaid connections in fiscal 4Q14.