iShares Russell Mid-Cap Growth

Latest iShares Russell Mid-Cap Growth News and Updates

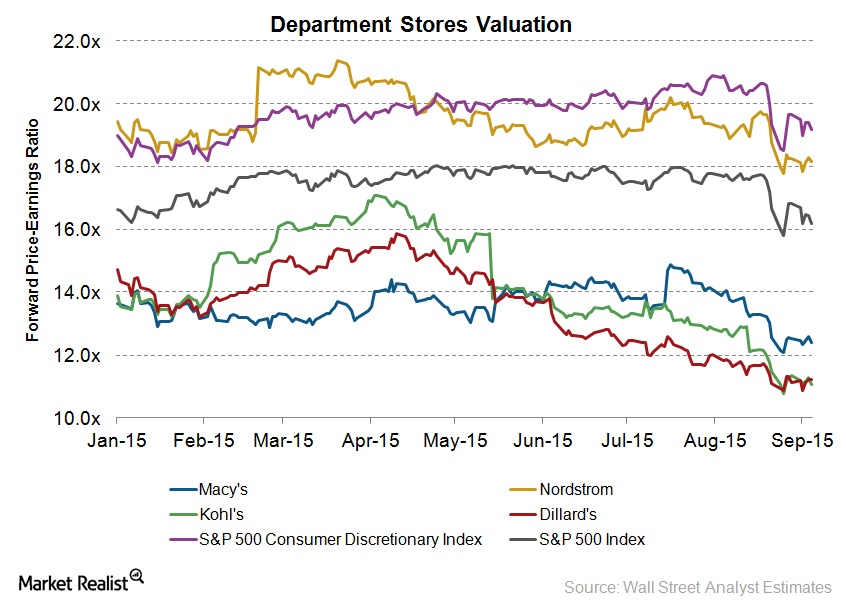

Key Department Store Stocks Underperform in the Market

As of September 4, department store stocks for Macy’s fell by 11.1% since the start of 2015. Despite 1H15 sales growth, Nordstrom’s stock also fell by 7%.

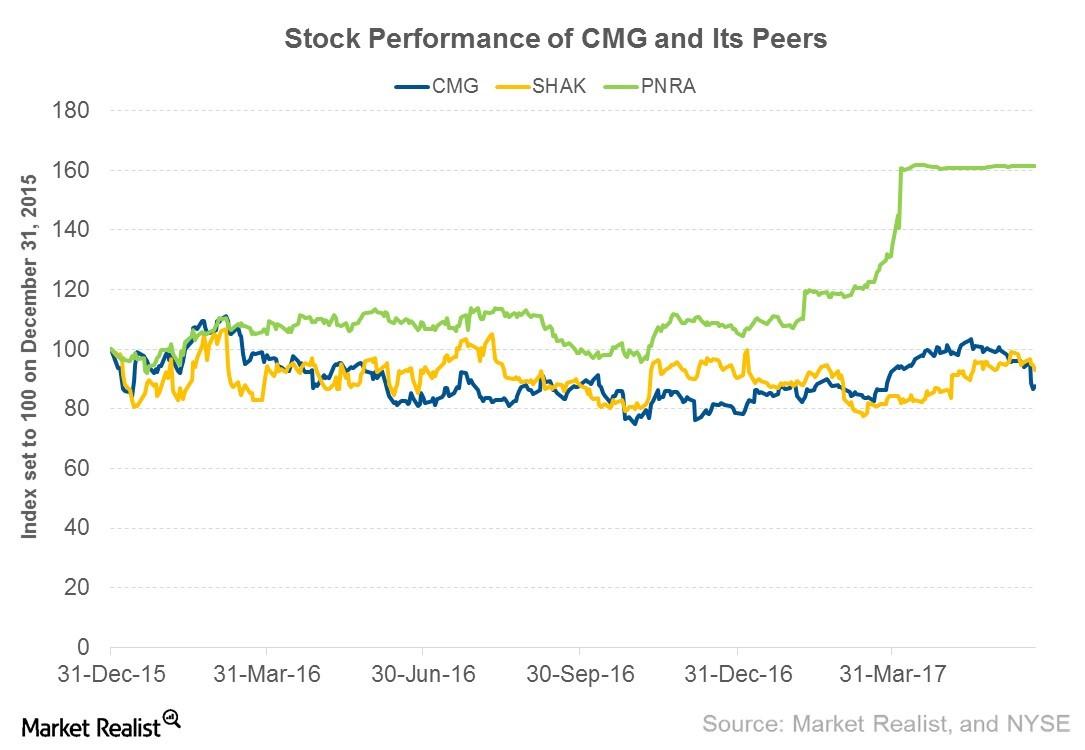

Has Chipotle’s Stock Price Bottomed Out?

After posting better 1Q17 earnings on April 25, Chipotle’s stock price rose to $496.14 by May 16, 2017. Since then, it has experienced downward momentum.

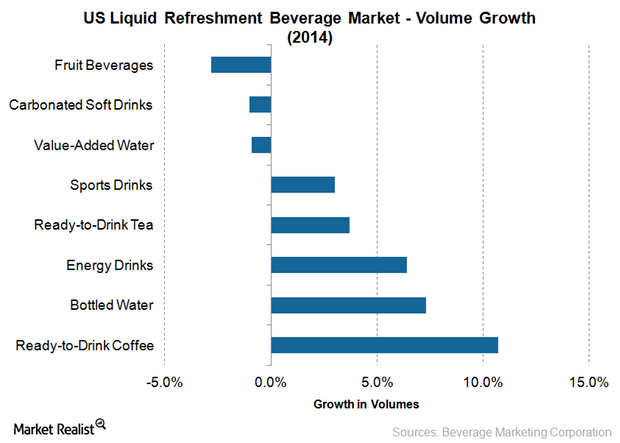

Dr Pepper’s Prospects in Other Non-Carbonated Beverages

Dr Pepper Snapple adopted a strong strategy by acquiring an 11.7% stake in BodyArmor. But it could grow more in other non-carbonated beverage categories.

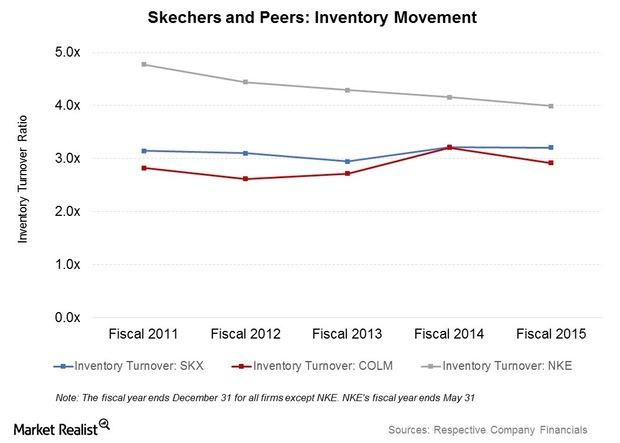

How Does Skechers Manage Its Inventory and Distribution?

In recent years, Skechers has reported improved working capital metrics. The company’s inventory turnover (or ITR) rose from 2.9x in 2013 to 3.2x in 2015.

Foot Locker’s e-Commerce Sales Growth: Potential and Prospects

Foot Locker (FL) operates several e-commerce websites under the Foot Locker and other store banners. It reports e-commerce sales under the direct-to-customer segment.

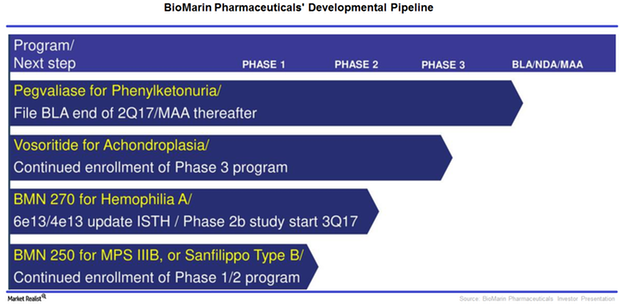

BioMarin’s Strong Pipeline Could Be a Long-Term Growth Driver

After success in the company’s phase 1/2 trial with BMN 270, an investigational gene therapy for hemophilia A, BioMarin Pharmaceuticals (BMRN) is expected to start phase 3 trials.

Can Edwards Intuity Elite Boost Edwards Lifesciences’ Revenues?

With the Edwards Intuity Elite valve system, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients.

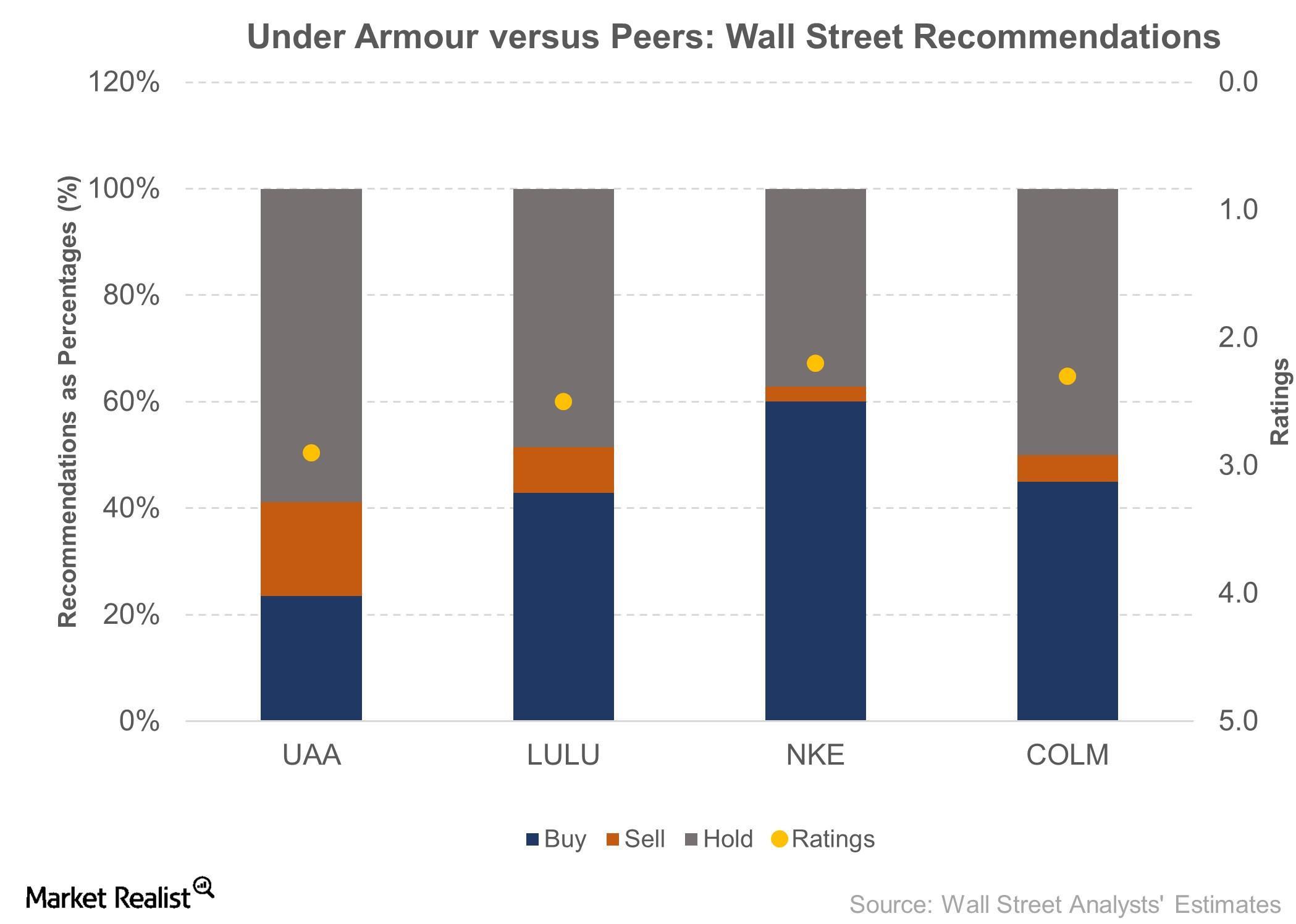

Susquehanna: Under Armour Changes Are ‘Temporary Pause’ to Growth

UAA is covered by 34 Wall Street analysts who together rate the company a 2.9 on a scale of 1.0 for “strong buy” to 5.0 for “sell.”

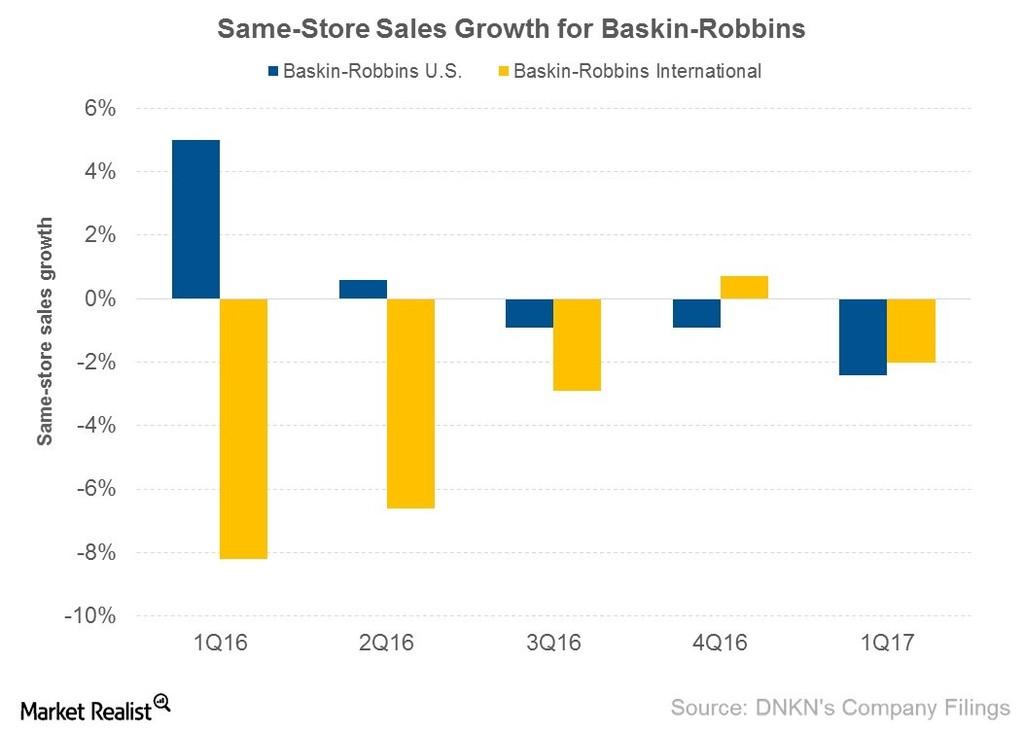

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

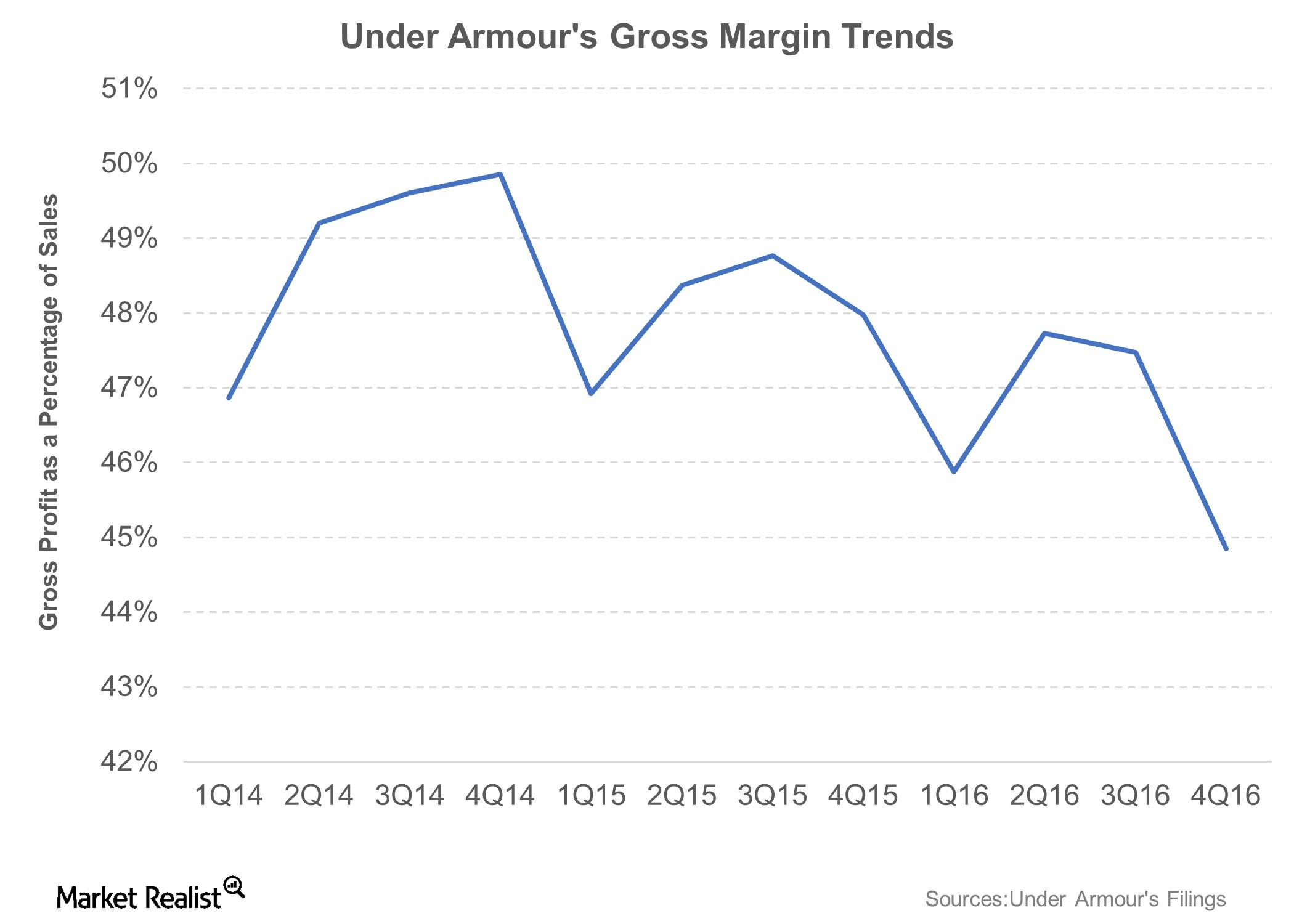

What Hampered Under Armour’s 4Q16 Profitability?

In 4Q16, Under Armour’s adjusted earnings per diluted share stood at $0.23, which was $0.02 lower than what analysts were expecting.

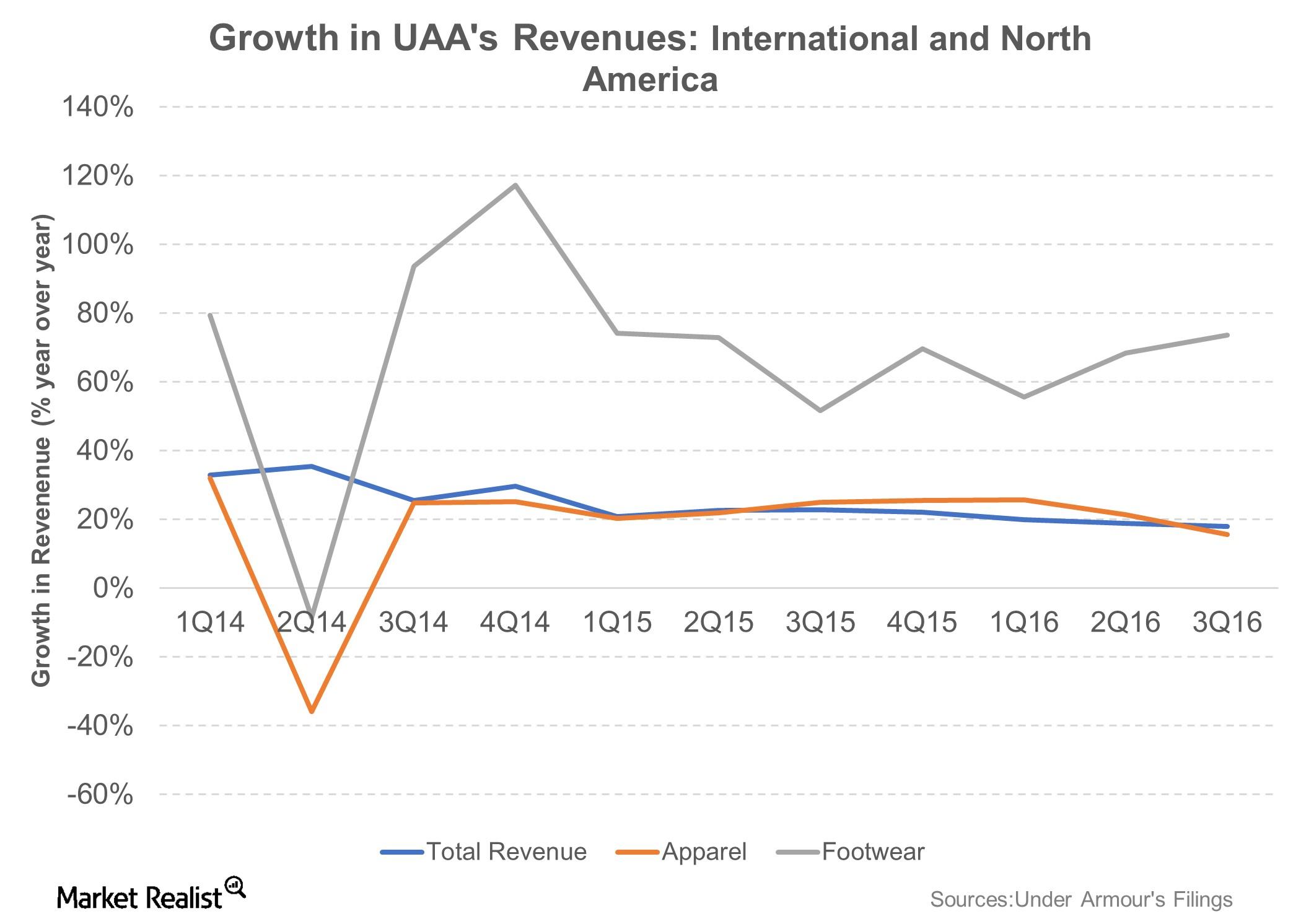

Under Armour Plans to Expand Its International Presence

International sales account for about 15.0% of UAA’s total sales compared to less than 6.0% in fiscal 2013. It has plans to further expand that business.

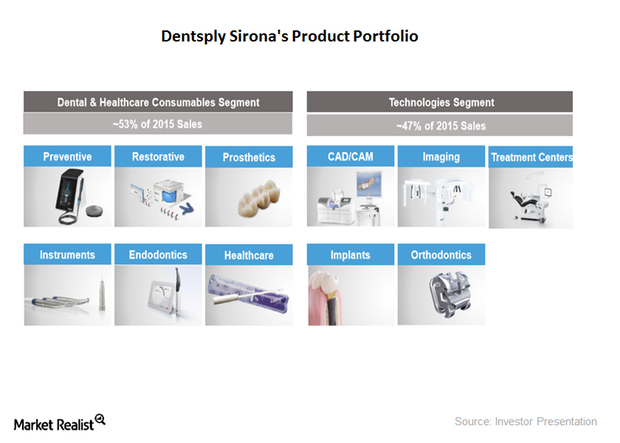

A Brief Look at Dentsply Sirona’s Business Model

Dentsply Sirona (XRAY) offers a broad portfolio of dental equipment and consumables that have urological and surgical applications.

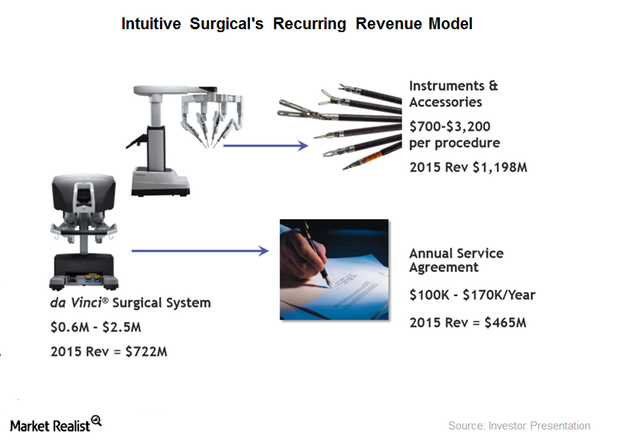

What Does Intuitive Surgical’s Business Model Look Like?

Intuitive Surgical (ISRG) defines its business model as a “razor/razor blade” model. What does this mean?

Newell Rubbermaid–Jarden Deal: Strategic Rationale

Strategic rationale of the deal Both Newell Rubbermaid (NWL) and Jarden (JAH) are US-based consumer products conglomerates operating in diverse industries, with presences in several global markets. Both companies have strong portfolios of leading brands that are number one or number two in their categories. The combined company will have a concentrated portfolio of brands, […]

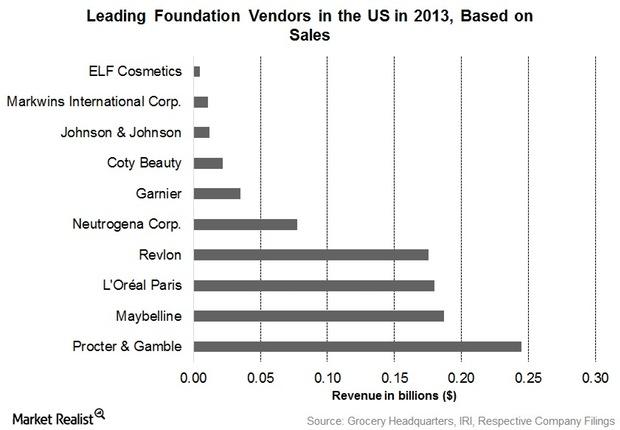

Analyzing Coty’s Level of Competition

High-end companies like Coty rely on repeat customers and mainly compete on the basis of product quality and product differentiation.

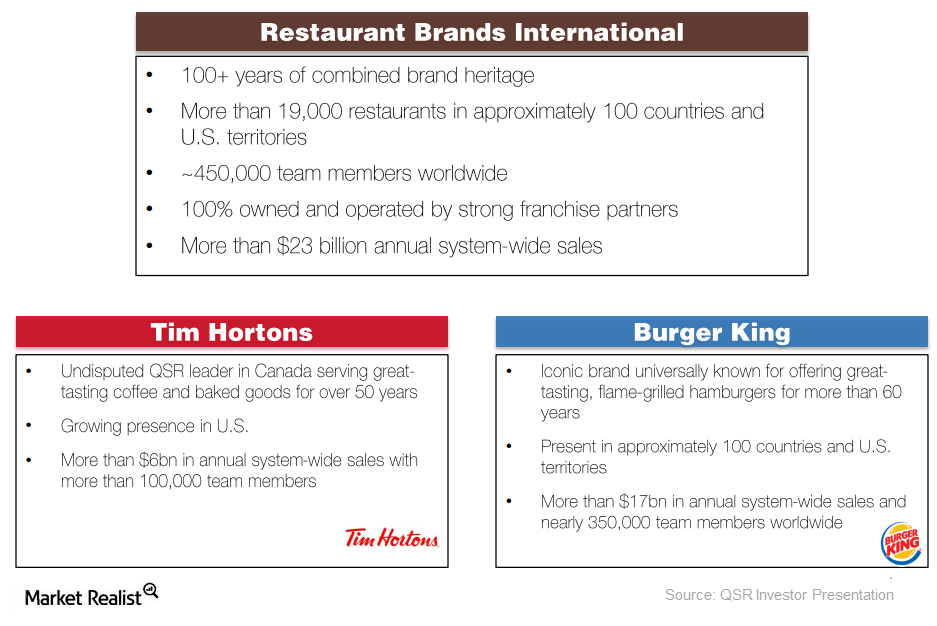

Magnetar Purchases New Stake in Restaurant Brands International

Magnetar Capital added new stake in Restaurant Brands International (QSR) in 4Q14. The position represented 0.73% of its holdings at the end of the year.

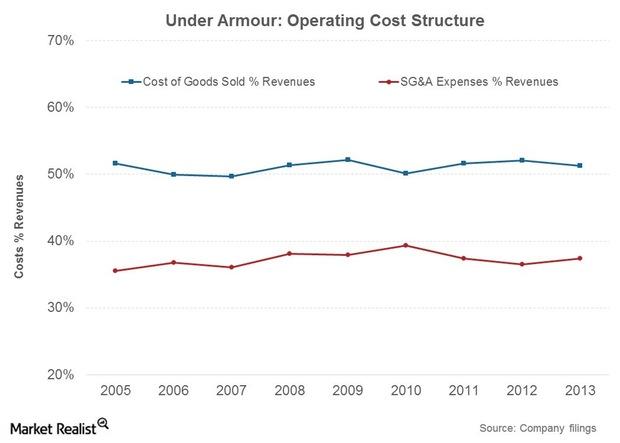

Under Armour’s Cost Profile And Outlook

Under Armour, Inc.’s cost of goods sold margins have been fairly steady over the years. SG&A costs are likely to trend higher in the near to medium term.