Key Department Store Stocks Underperform in the Market

As of September 4, department store stocks for Macy’s fell by 11.1% since the start of 2015. Despite 1H15 sales growth, Nordstrom’s stock also fell by 7%.

Dec. 4 2020, Updated 10:53 a.m. ET

Stock performance to date

As of September 4, 2015, the stock price of Macy’s (M), the largest department store in the US, has declined by 11.1% since the beginning of the year. Despite its strong sales growth in 1H15, Nordstrom’s (JWN) stock price also declined—by 7% since the start of the year. Stock prices of Kohl’s (KSS), and Sears Holdings (SHLD) have declined by 15.3% and 8.8%, respectively, since the start of this year as well.

As of September 4, the Consumer Discretionary Select Sector SPDR Fund (XLY) has appreciated by 3.1% since the beginning of the year. Macy’s, Nordstrom, and Kohl’s together constitute 1.8% of the portfolio holdings of the XLY ETF. Macy’s and Nordstrom together account for 0.8% of the iShares Russell Mid-Cap Growth ETF (IWP).

Department stores versus market

Excluding J.C. Penney (JCP), department stores stocks have underperformed in the overall market represented by the S&P 500 Index, which declined by 6.7% since the start of the year. J.C. Penney’s stock price has appreciated by 53.9% since the beginning of this year.

J.C. Penney’s turnaround strategy has helped to bring down its losses in 2Q15. The recent decline in the stock prices of Macy’s and Kohl’s was due to their disappointing results in 2Q15. The drop in stock prices of department stores was also caused by a spillover effect of global factors, primarily turmoil in the Chinese economy, which impacted the broader market as well.

Relative valuation

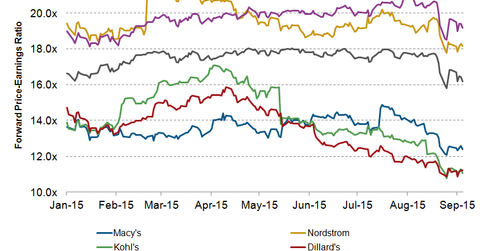

As of September 4, 2015, Macy’s, Nordstrom, Kohl’s, and Dillard’s (DDS) were trading at forward PEs (price-to-earnings) of 12.4x, 18.2x, 11.1x, and 11.2x, respectively. Nordstrom’s higher valuation is supported by its strong performance in 1H15 and by the growth prospects of the company’s Rack stores. Nordstrom raised its fiscal 2015 guidance following its better-than-expected 2Q15 results.

However, Nordstrom’s valuation multiple has declined by 6.6% since the beginning of 2015. The recent decline in Nordstrom’s valuation despite strong 2Q15 results stems from a cautious market outlook, given the weakness in the department store industry and uncertainty in global markets.

The valuation multiples of Macy’s and Kohl’s have declined significantly since the beginning of this year. Macy’s recently issued a bleak outlook following its dismal 2Q15 results.

Department stores are part of the consumer discretionary sector (XLY) (FXD) (VCR), which is influenced by the level of consumer confidence in the economy. This global uncertainty might impact both consumer confidence and consumer spending on discretionary goods, which could further hurt department store stocks.

For more updates and analysis, visit our Department Stores page.