Dillards Inc

Latest Dillards Inc News and Updates

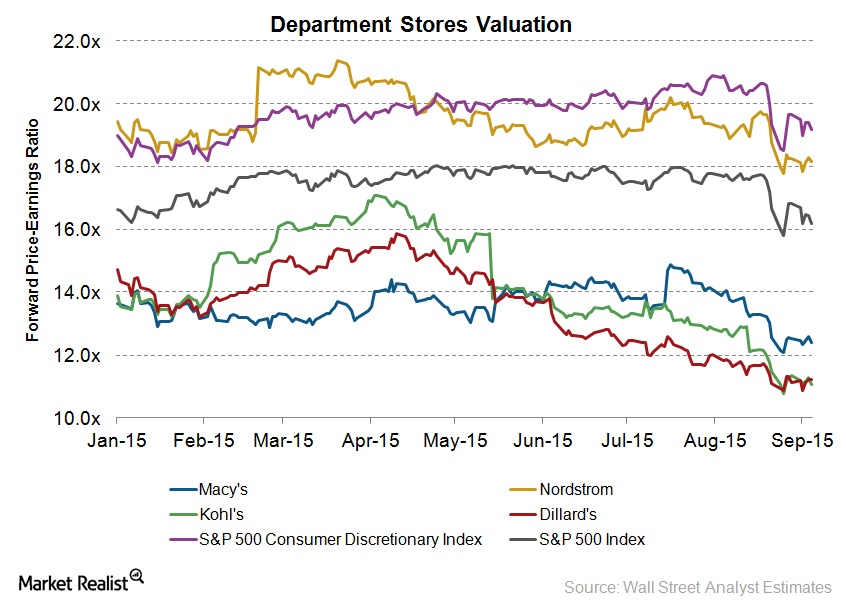

Key Department Store Stocks Underperform in the Market

As of September 4, department store stocks for Macy’s fell by 11.1% since the start of 2015. Despite 1H15 sales growth, Nordstrom’s stock also fell by 7%.

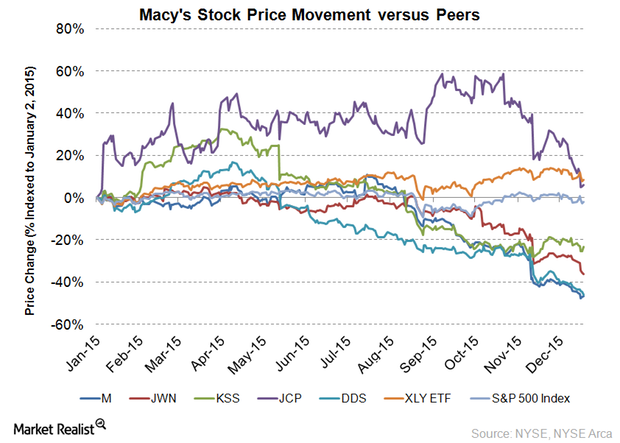

Macy’s Investors Disappointed in 2015: Stock Falls More Than 46%

Macy’s (M) stock price has fallen a whopping 46.7% this year. On December 21, 2015, Macy’s share price fell to $35.02. It touched its 52-week low of $34.50 on December 17.

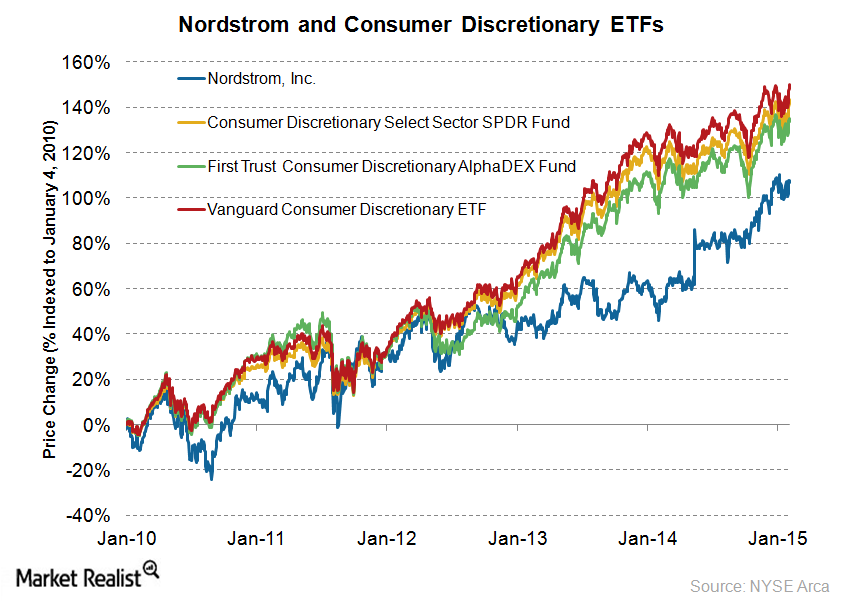

ETFs with holdings in Nordstrom

This article discusses ETFs with holdings in Nordstrom.

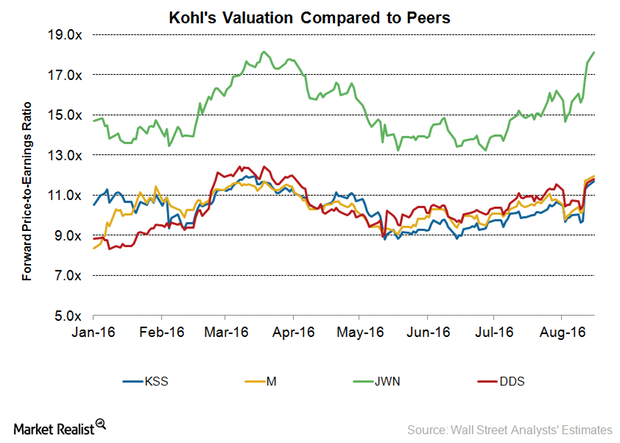

Kohl’s Valuation Surges after Fiscal 2Q16 Results

As of August 15, Kohl’s was trading at a 12-month forward PE (price-to-earnings) ratio of 11.7x.

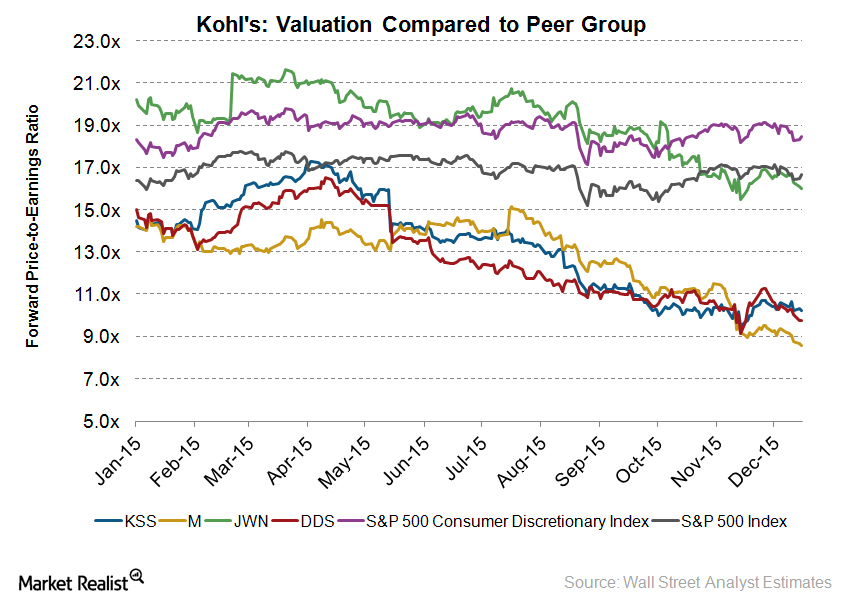

Sizing up Kohl’s Relative Valuation versus Its Peer Group

As of December 15, Kohl’s was trading at a forward PE multiple of 10.2x. Kohl’s is trading at a premium valuation compared to Macy’s and Dillard’s.

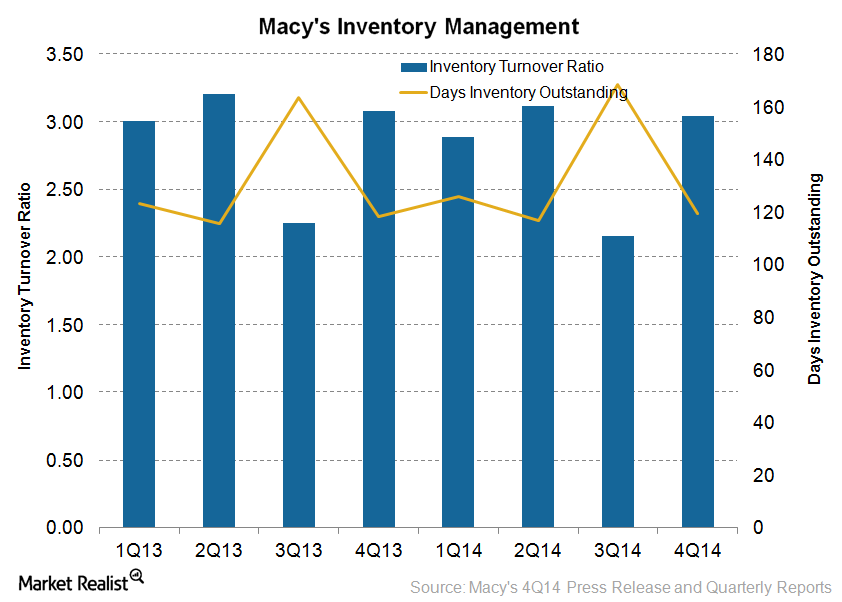

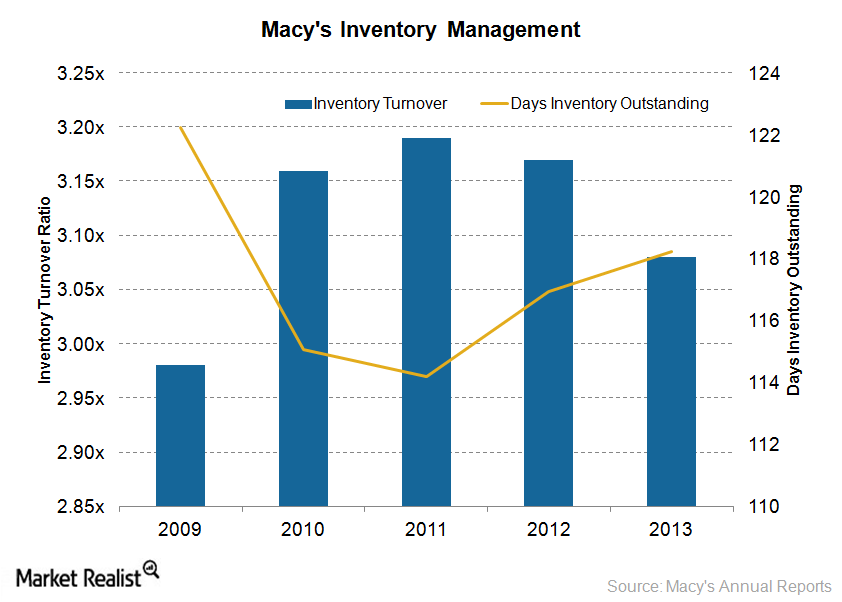

What Steps Has Macy’s Taken to Improve Inventory Management?

Department stores like Macy’s (M) are focusing on improving their inventory management so as to maintain the optimal level of inventory, bring down costs, and avoid stock-outs.

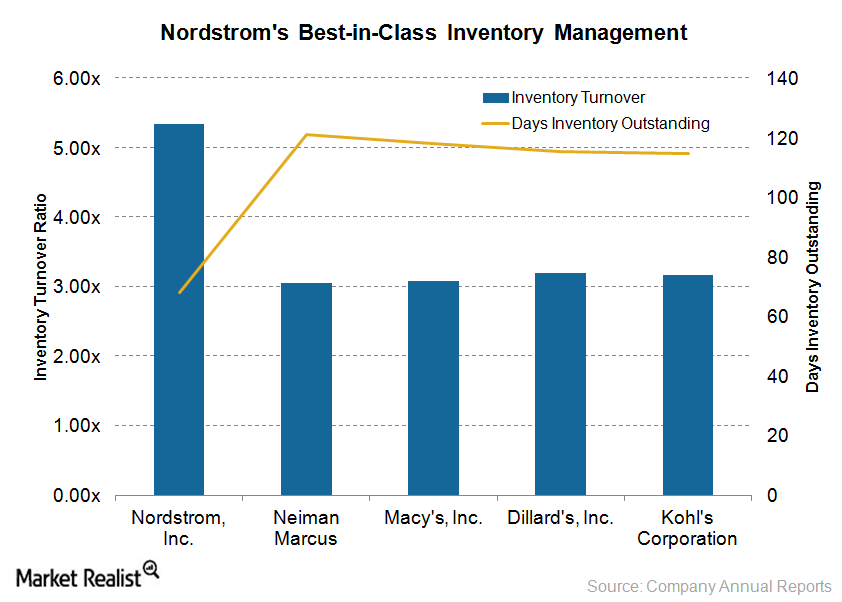

Nordstrom’s inventory management better than that of its peers

This article discusses Nordstrom’s inventory management in comparison to that of its industry peers.

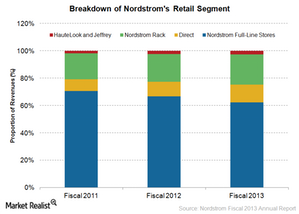

Understanding Nordstrom’s revenue streams

In fiscal 2013, the company’s Retail segment contributed 97% of Nordstrom’s revenues of $12.5 billion, while the Credit segment accounted for only 3%.

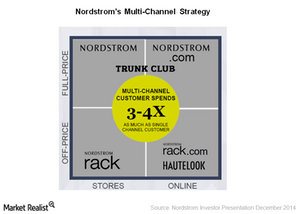

Nordstrom’s multichannel strategy, customer focus lead to success

Nordstrom’s multichannel strategy and best-in-class customer service have made the company famous.

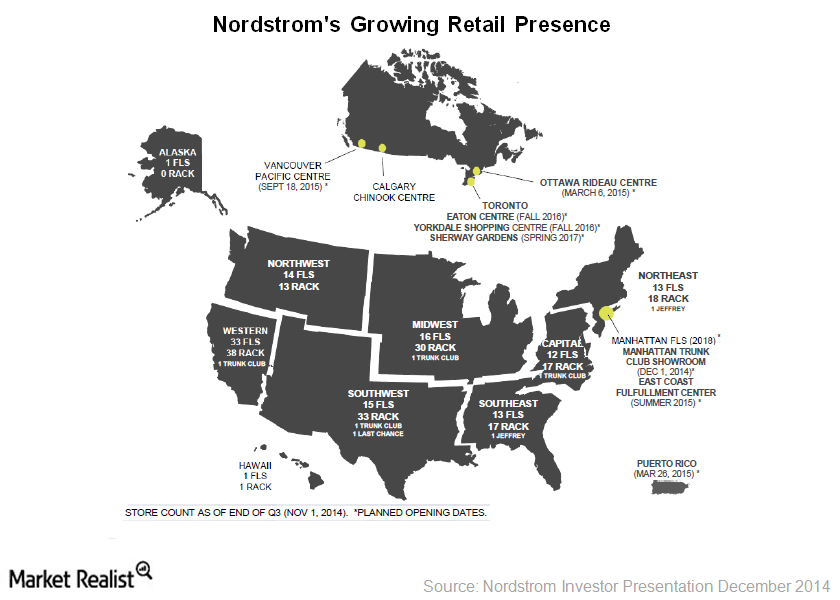

An overview of Nordstrom’s growth story

This article provides a brief overview of Nordstrom’s growth story.

Macy’s works on inventory management: Will it improve sales?

Macy’s is taking measures to improve inventory management, including its My Macy’s program that customizes merchandise according to local preferences.

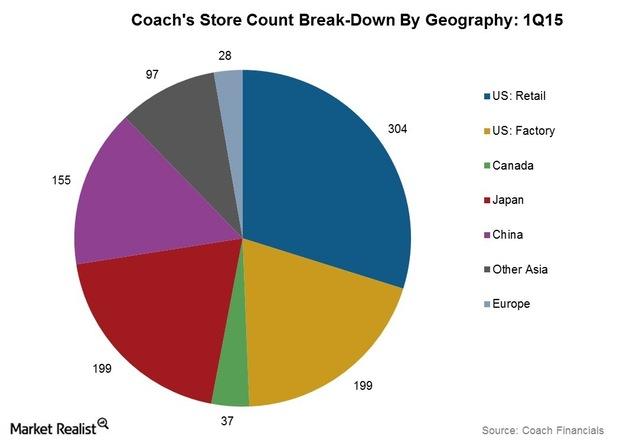

Selling Channels: How Coach Products Reach Customers

Coach, Inc. (COH) distributes products through wholesale and direct-to-customer channels. It runs wholesale shops-within-shops at major department stores.