BTC iShares Core MSCI Emerging Markets ETF

Latest BTC iShares Core MSCI Emerging Markets ETF News and Updates

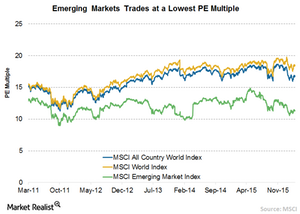

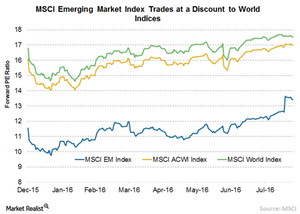

Why Emerging Markets Are Trading at a Discount to Developed Markets

With the recent fall, some of these emerging markets have certainly become very cheap compared to most of the developed markets.

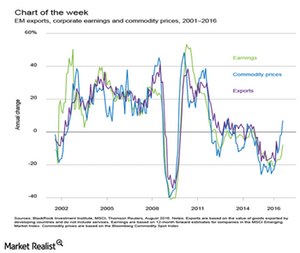

Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

Can Malaysia’s Improved Retail Sales Support Economic Growth in 2017?

Retail sales in Malaysia rose 13.9% YoY (year-over-year) in June 2017, compared with its 13.6% gain in May 2017.

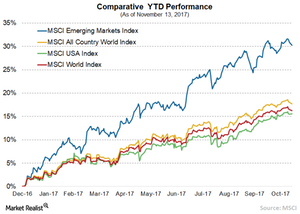

Why Emerging Markets Are Rallying

There are a lot of reasons behind the sharp rally in EMs (SCHE). The prominent reason is that the GDP growth in many of these nations has improved in the last few quarters partially on the back of the rise in commodity prices like copper and oil.

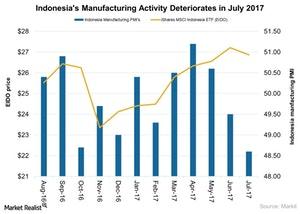

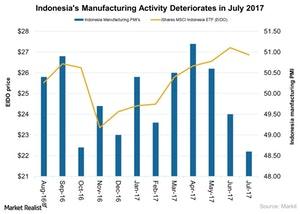

Why Indonesia’s Manufacturing Activity Fell

Manufacturing activity in Indonesia In July 2017, manufacturing activity in Indonesia (EIDO) fell at the fastest pace in 19 months, mainly due to sharp decline in its output. Indonesia’S (EEM) manufacturing PMI (purchasing managers’ index) fell to 48.6, compared with 49.5 in June 2017, according to an IHS Markit report. New orders also fell in July […]

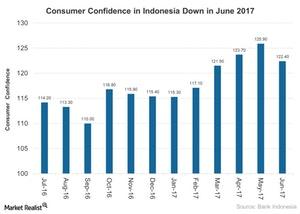

Why Indonesia’s Consumer Confidence Was Down in June 2017

Consumer confidence in Indonesia (EIDO) fell to 122.4 in June 2017 from an all-time high of 125.9 in May 2017.

Manufacturing Activity in Indonesia Contracted in July 2017

Manufacturing activity in Indonesia (EEM) in July 2017 fell at its fastest pace in the last 19 months mainly due to the sharp decline in its output.

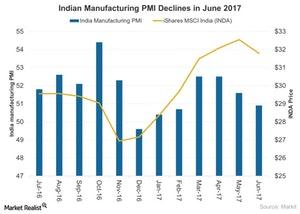

Why Manufacturing Activity in India Fell in June 2017

Uncertainty related to India’s new goods and services tax, which was implemented on July 1, 2017, seemed to affect India’s manufacturing activity in June 2017.

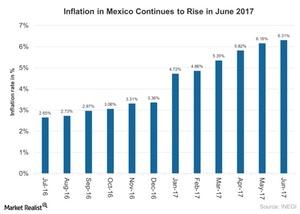

Did Inflation Pose a Huge Concern for Mexico in June 2017?

Consumer prices in Mexico (EEM) surged 6.31% year-over-year (or YoY) in June 2017, compared to their 6.16% rise YoY in May.

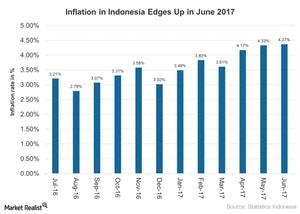

Indonesia Inflation Was Close to the Target in June 2017

Consumer prices in Indonesia (EEM) rose 4.4% on a YoY (year-over-year) basis in June 2017—compared to a 4.3% rise in May 2017.

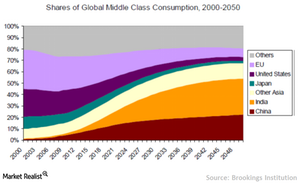

Rethink Your Emerging Market Story

In the previous articles of this series, we discussed population and economic growth as the two major drivers leading to a rise in emerging markets (EMQQ).

Why Investors Are Upbeat about Emerging Markets

The sharp rise in global liquidity conditions has been channeled mainly into emerging market (EEM) economies.

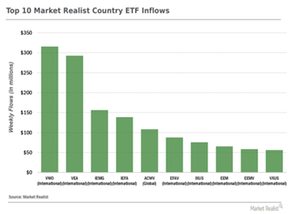

Country ETFs: Double Down on Emerging Markets?

The upside reversal in emerging market equity ETFs has become one of the most remarkable investment themes in 2016. Investors don’t want to miss out.

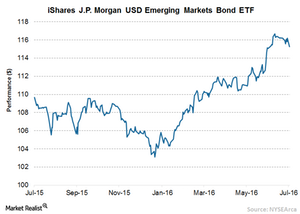

Intense Search for Yield Leads to Emerging Market Debt

Under the current uncertain economic circumstances, investors flocked to emerging market debts in search of higher yields.

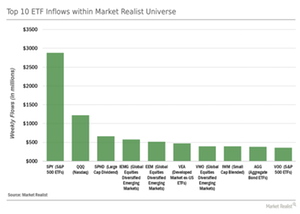

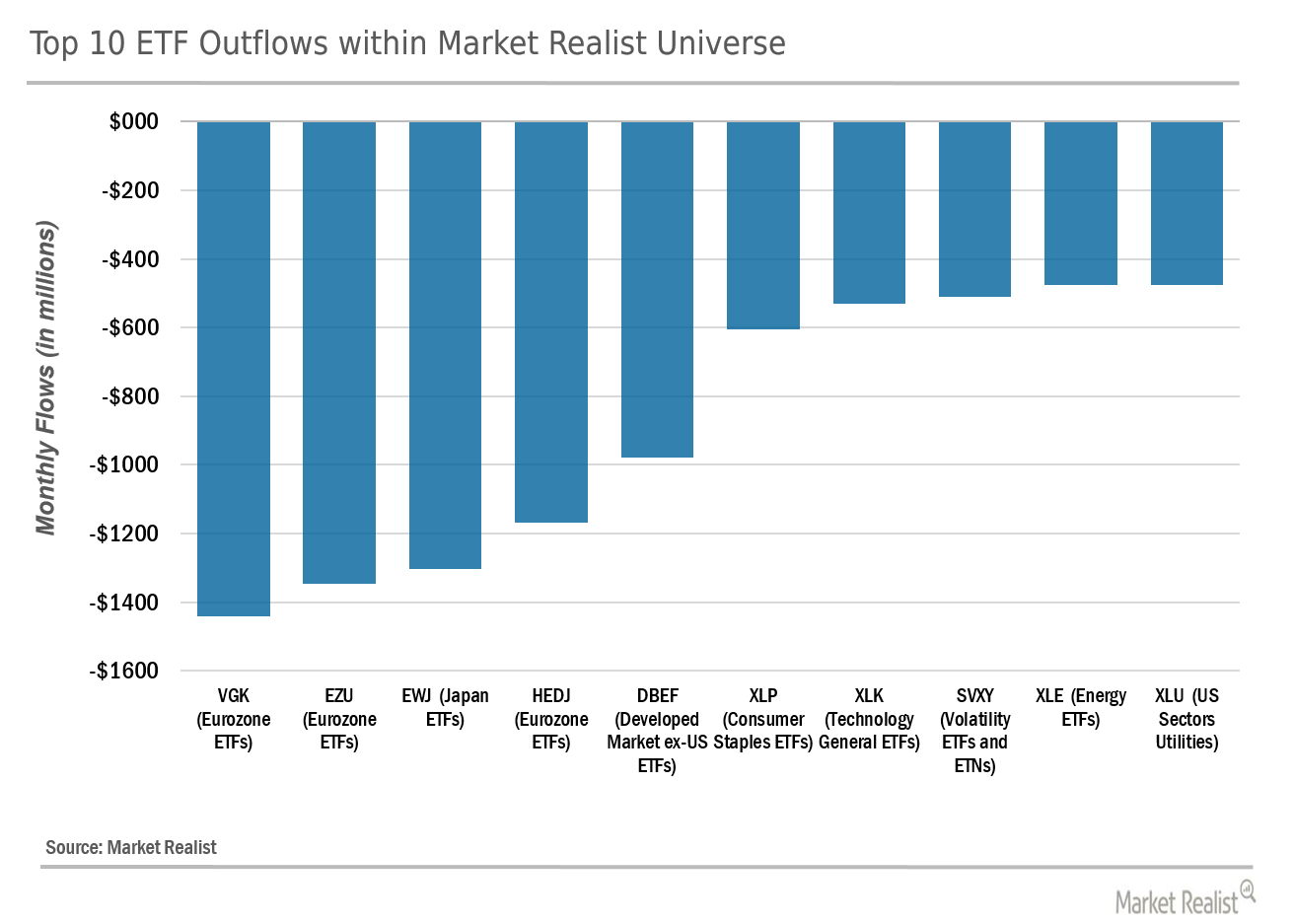

Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

ETF Flows in 30 Seconds: 5 Things That Matter

Last week‘s ETF fund flows showed the beginning of a remarkable shift in investor behavior and asset allocation.