Helmerich & Payne, Inc.

Latest Helmerich & Payne, Inc. News and Updates

Currency warfare: A ‘beggar-thy-neighbor’ situation

In a currency war, the “beggar-thy-neighbor” strategy is about increasing the demand for a nation’s exports at the expense of other countries’ export share.

Women CEOs: 5 Names You Should Know

Of all the Fortune 500 companies, only 5% have women CEOs. We rounded up five of the biggest names investors should know. Here’s why.

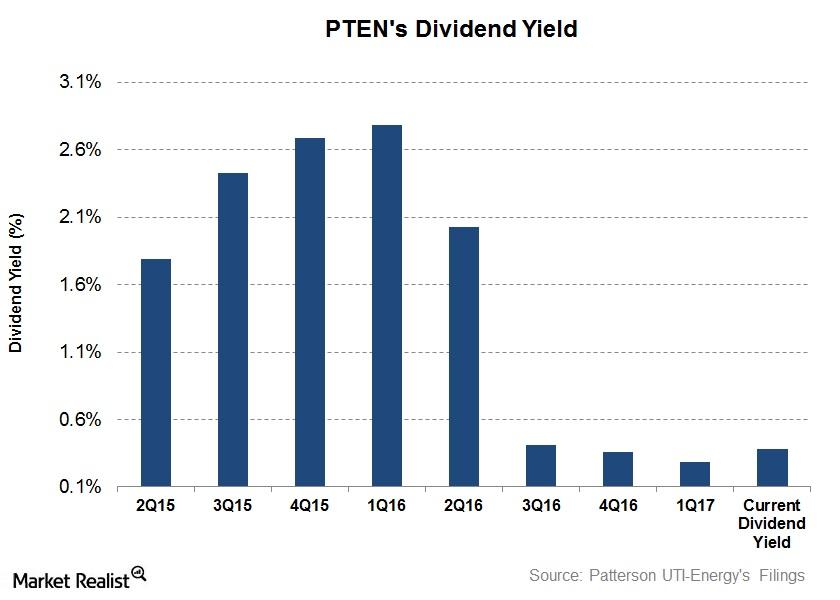

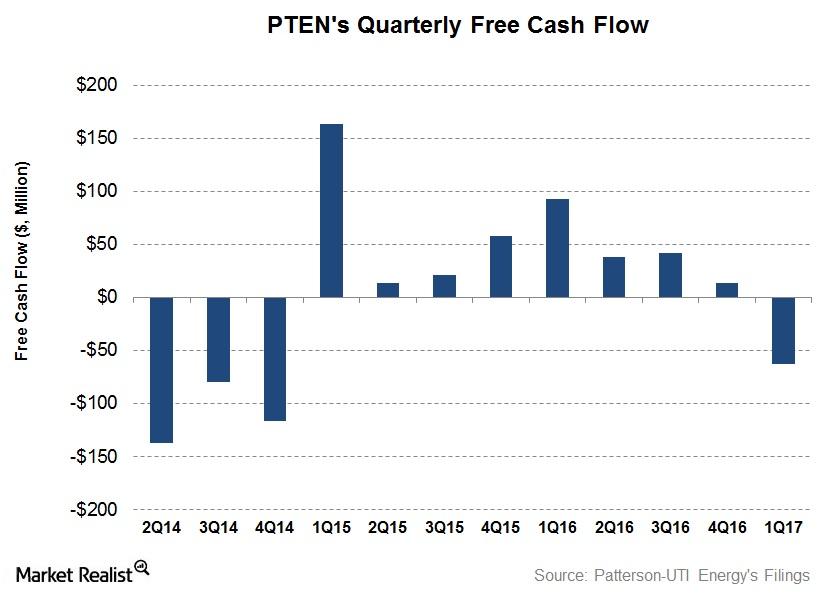

Patterson-UTI Energy’s Dividend Yield on June 2

Patterson-UTI Energy’s (PTEN) dividend yield fell to 0.29% on March 31, 2017. Since then, its dividend yield has risen to 0.38% as of June 2, 2017.

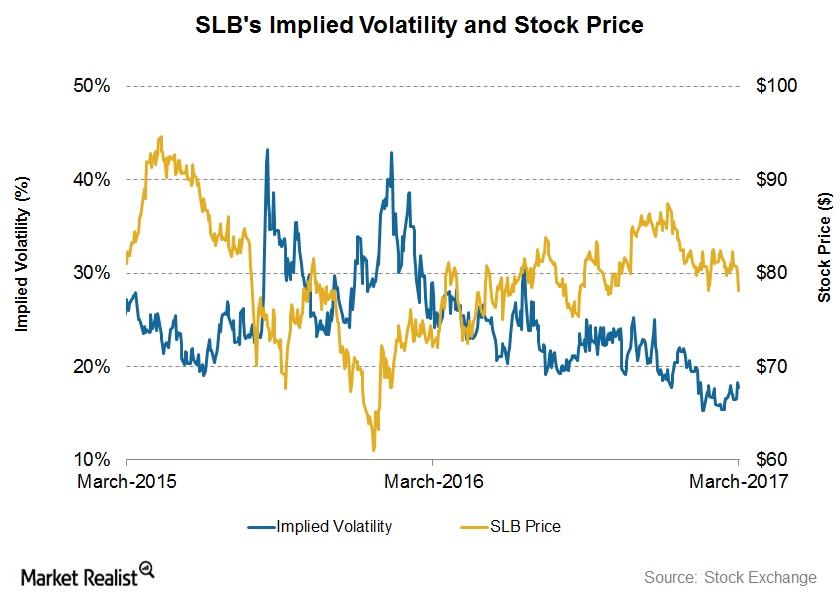

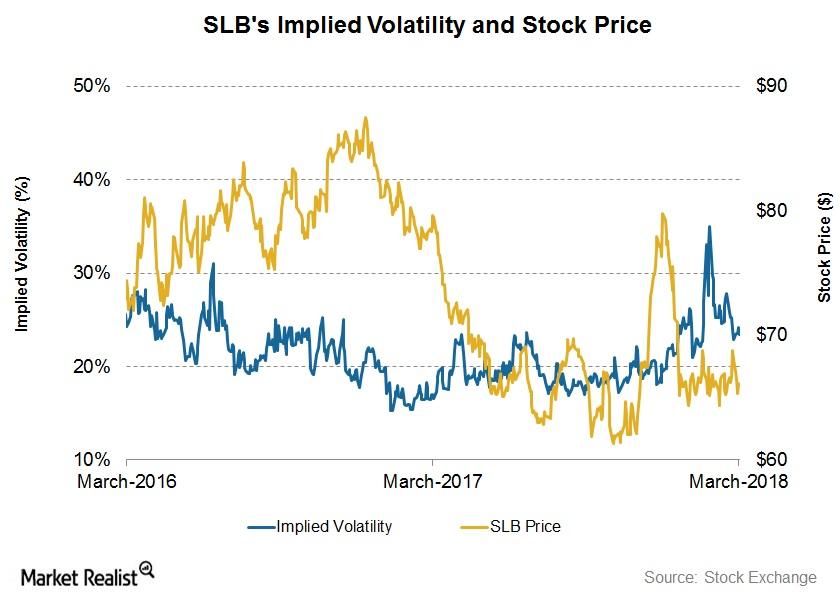

Schlumberger by Implication: Reading Implied Volatility

On March 10, 2017, Schlumberger’s (SLB) implied volatility was 17.7%, having fallen from 19% since its 4Q16 financial results were announced on January 20.

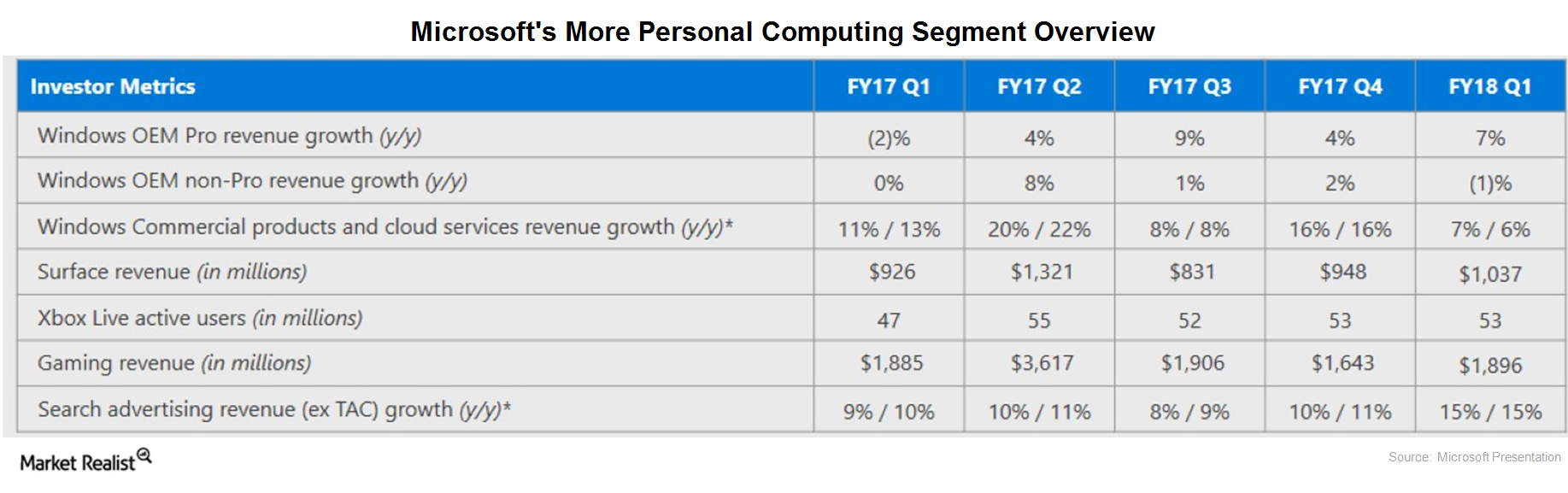

A Look at Microsoft’s More Personal Computing Segment in 1Q18

More Personal Computing revenue flat Previously, we discussed Microsoft’s (MSFT) Intelligent Cloud segment’s performance. In this part, we’ll look at how its MPC (More Personal Computing) segment performed in fiscal 1Q18. Microsoft’s MPC segment, as the name suggests, is highly dependent on the PC (personal computer) market, drawing close to ~50% of its total revenue […]

Will Huawei’s Hongmeng OS Topple Google Android on Mobile?

Huawei has unveiled a new OS, Hongmeng, after being placed on a US trade blacklist. The new OS is a direct replacement of Google’s Android.

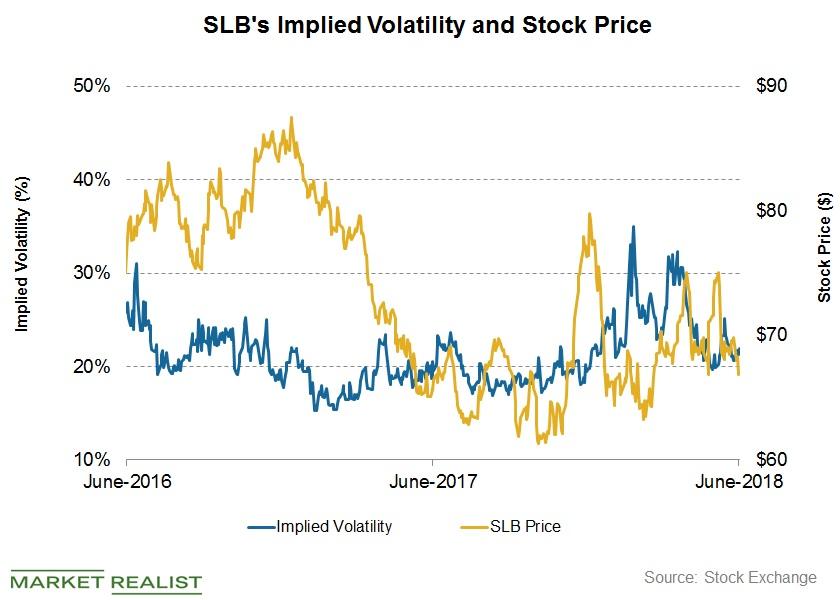

Schlumberger’s Stock Price Forecast this Week

Schlumberger’s (SLB) first-quarter financial results were released on April 20. Between April 20 and June 15, Schlumberger’s implied volatility fell from 24.1% to 22%.

What’s Schlumberger’s 7-Day Stock Price Forecast?

On January 19, 2018, Schlumberger’s (SLB) 4Q17 financial results were released.

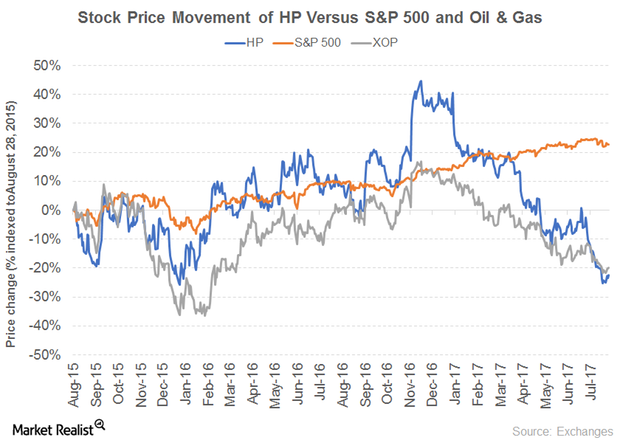

Decoding Helmerich & Payne’s Dividend Yield

What’s driving Helmerich & Payne’s high yield? Contract oil and gas well driller Helmerich & Payne (HP) recorded a sharp drop in its 2016 operating revenue due to declines in its US drilling, offshore, and international segments. Its revenue fell 19% in 2015, compared with 51% in 2016. Its operating income, as a result, ended […]

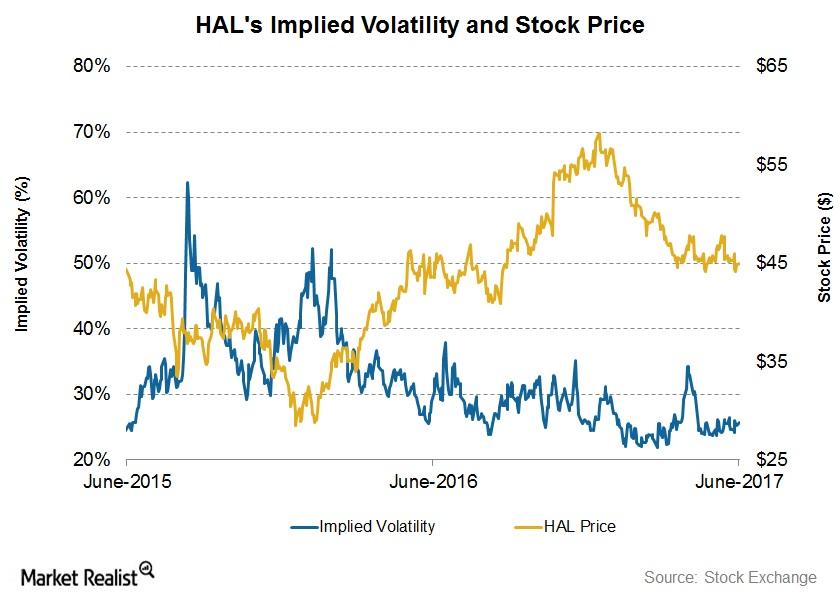

What Investors Can Expect from Halliburton

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

Why Microsoft Acquired Hexadite

In the week ended May 26, 2017, Microsoft (MSFT) announced the acquisition of Hexadite. Microsoft’s acquisition price for Hexadite is reported to be $100 million.

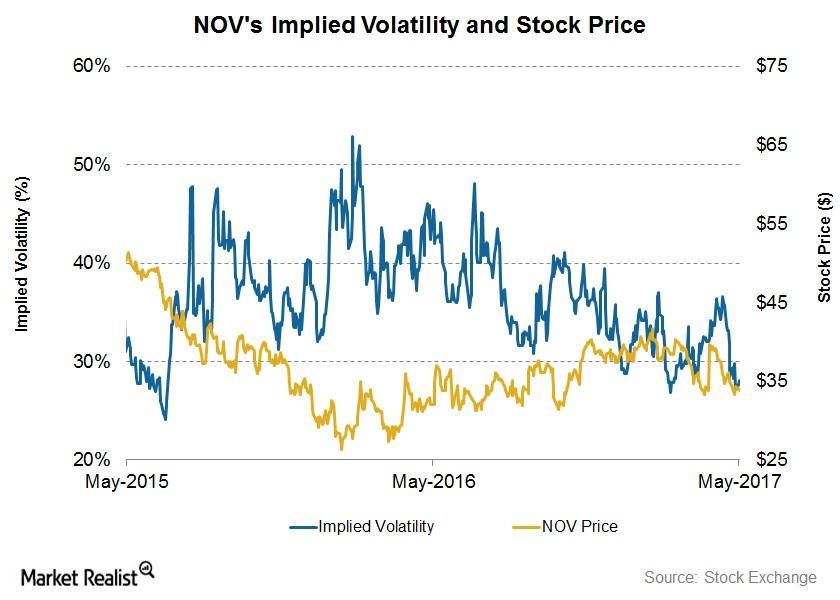

What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.

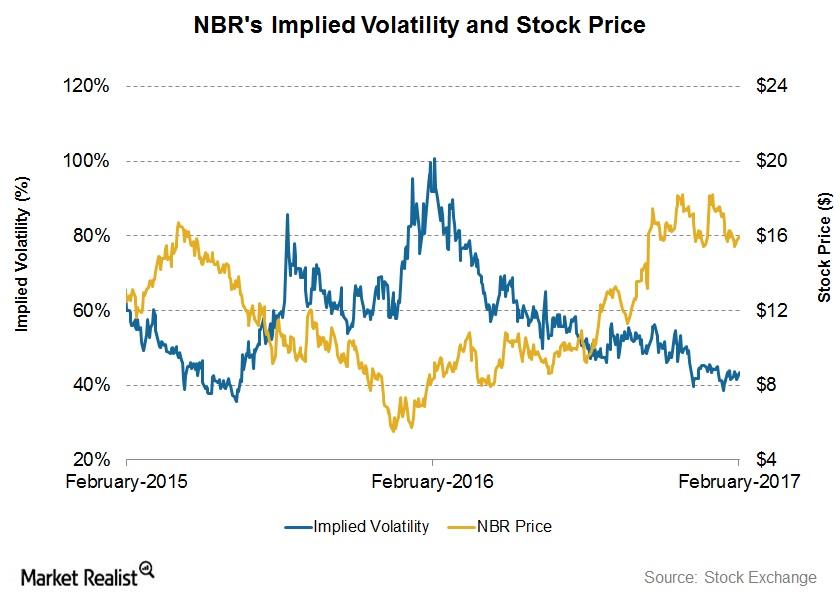

What Nabors Industries’ Implied Volatility Suggests

On February 13, 2017, Nabors Industries (NBR) had an implied volatility of 43%.

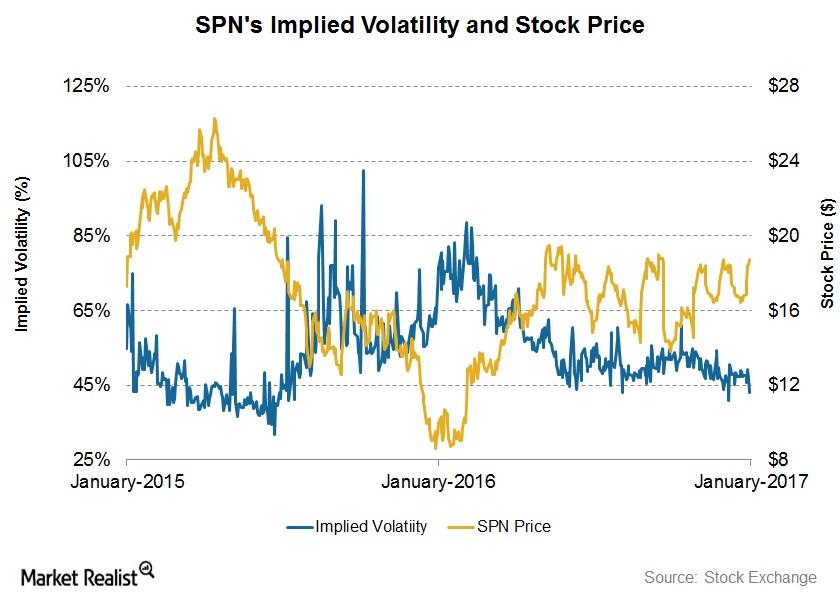

How Volatile Is Superior Energy Services in 1Q17?

On January 6, SPN had an implied volatility of ~43%. Since SPN’s 3Q16 financial results on October 24, 2016, its implied volatility has fallen from 54%.

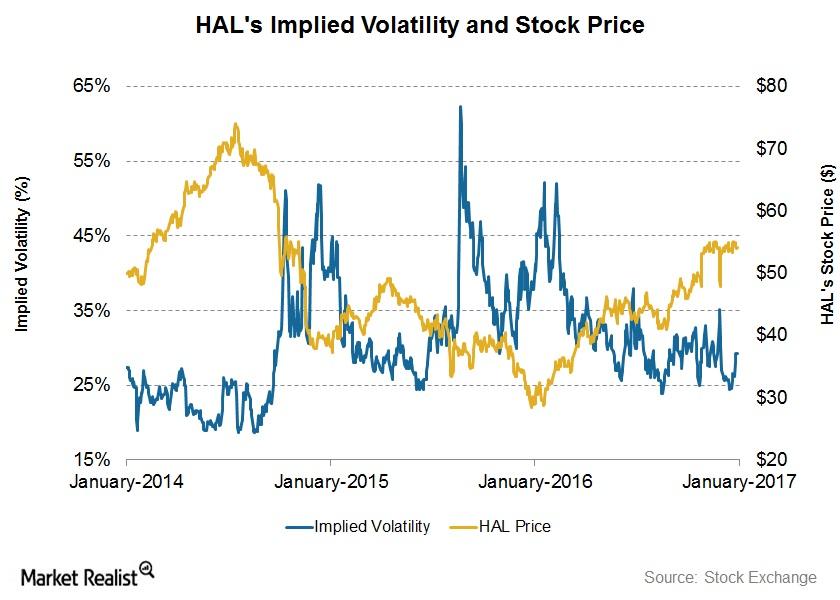

What Does Halliburton’s Implied Volatility Indicate?

On January 3, 2017, Halliburton (HAL) had implied volatility of ~29%. Since HAL’s 3Q16 financial results were announced on October 19, 2016, its implied volatility has remained nearly unchanged.

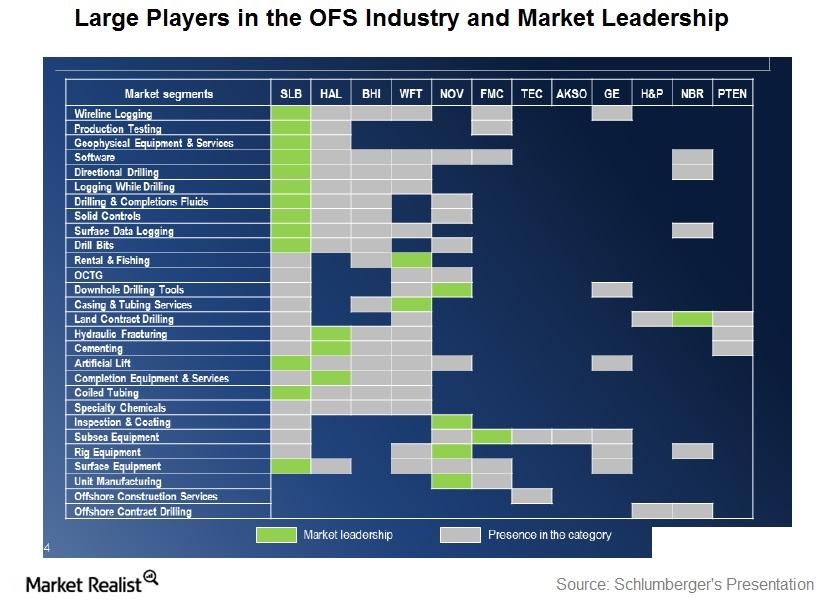

The Oilfield Services Industry: A Brief Introduction

The oilfield equipment and services industry refers to all products and services associated with the oil and gas exploration and production process, or the upstream energy industry.

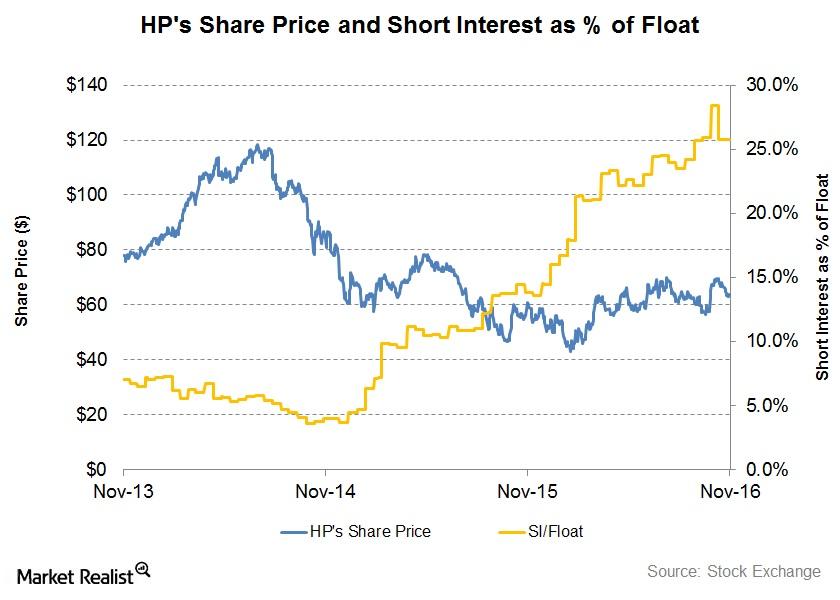

Has Helmerich & Payne’s Short Interest Decreased since Fiscal 3Q16?

Helmerich & Payne’s (HP) short interest as a percentage of its float was 25.7% on November 2, compared to 24.5% on June 30. Since the end of fiscal 3Q16, HP’s short interest has increased 5%.

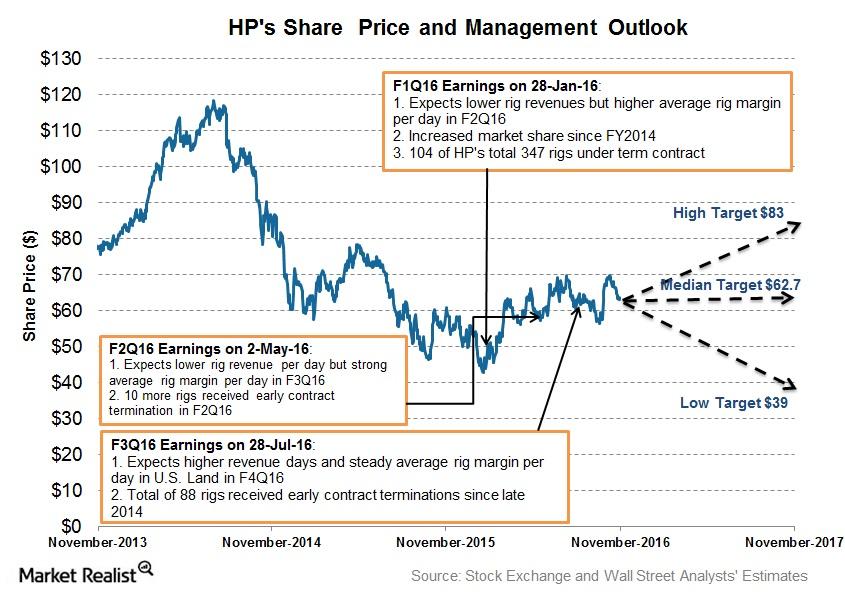

What Are Helmerich & Payne’s Management Estimates for Fiscal 4Q16?

In the US Land segment, Helmerich & Payne (HP) expects revenue days to see a 3% increase to 7% during fiscal 4Q16 compared to fiscal 3Q16.

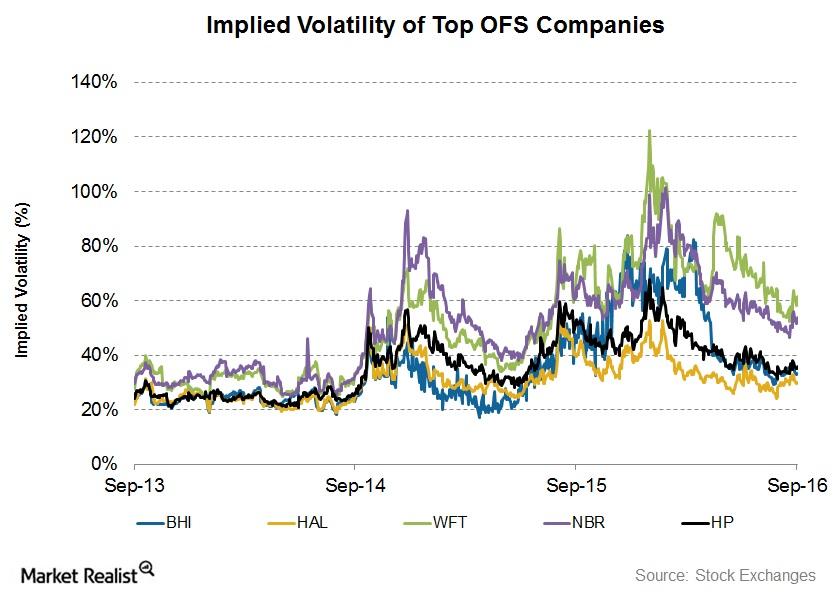

Implied Volatility: Analyzing the Top Oilfield Service Companies

On September 22, Halliburton’s implied volatility was ~28.5%. Since July 20, 2016, its implied volatility rose from ~27% to the current level.

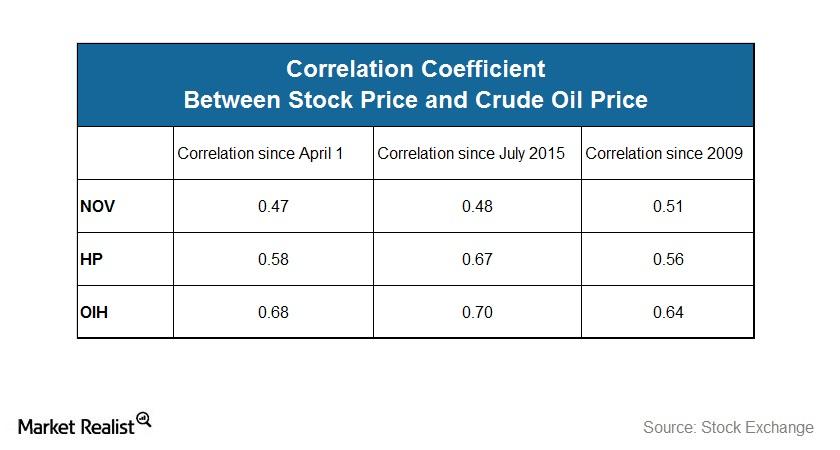

Has NOV’s Correlation with Crude Oil Decreased since 1Q16?

The correlation coefficient between National Oilwell Varco and crude oil’s price measures the statistical relationship between the two variables.

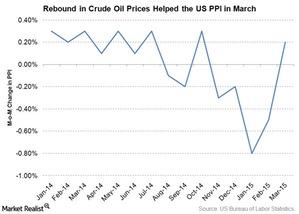

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.