Exelon Corp

Latest Exelon Corp News and Updates

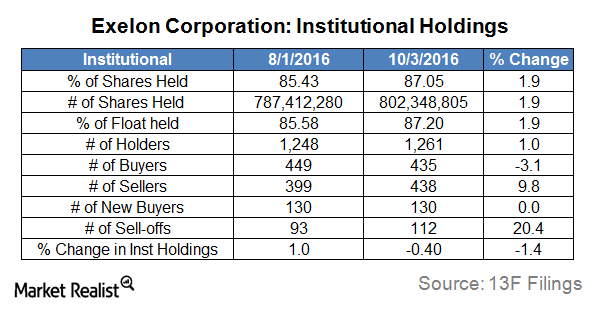

A Look at Institutional Investors’ Holdings in Exelon

In the past couple of months, institutions have increased their positions in Exelon by nearly 2%, from 85.6% to 87.2%, as of October 3, 2016.

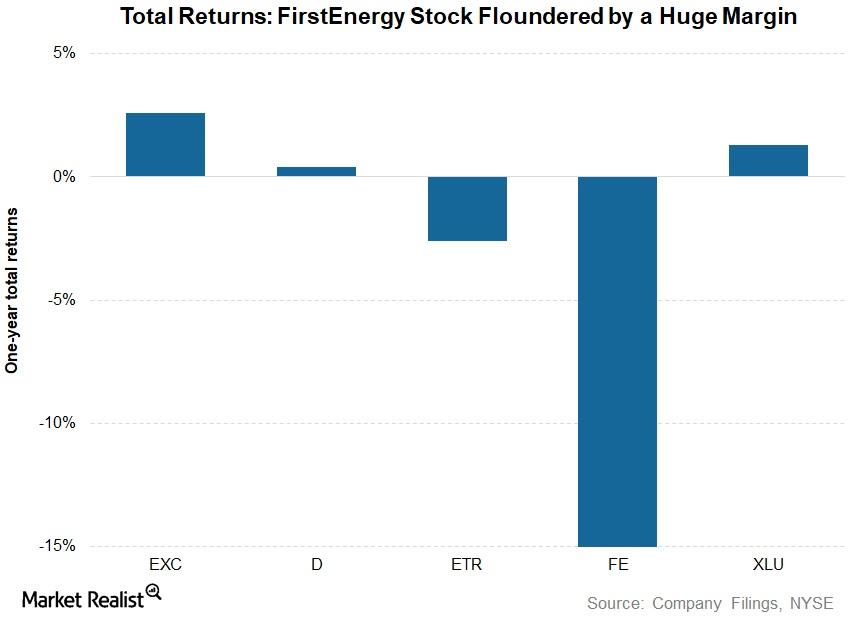

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.

A brief overview of Exelon’s power operations

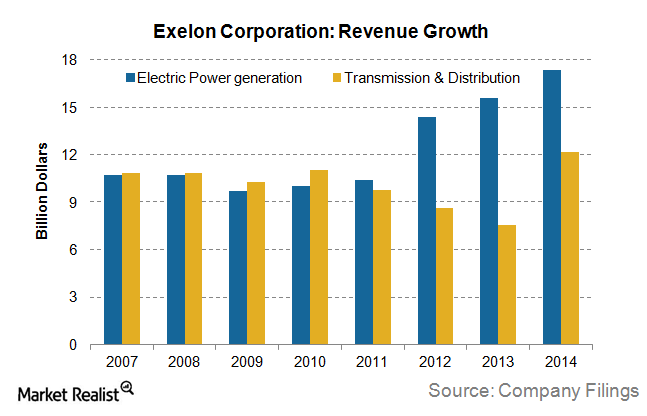

Power generation is a significant segment for Exelon, generating more than 60% of its total revenue. The energy delivery business provides the other 40% of the company’s revenues.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

XLU’s Chart Indicators and Short Interest

Currently, the Utilities Select Sector SPDR ETF (XLU) is trading at $58.2 after hitting an all-time high of $58.7 last week.

How FirstEnergy Stock Ranks against Peers

FirstEnergy (FE) has been one of the top-performing stocks among the S&P 500 Utilities Index (XLU) this year.

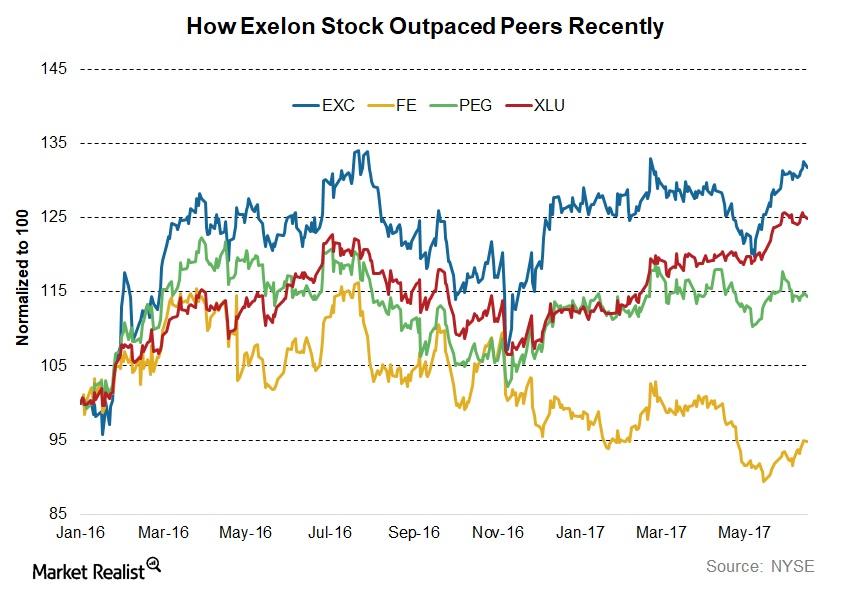

EXC, FE, and PEG: Are Hybrid Utilities Really Worth the Risk?

US utilities including giants like Duke Energy (DUK) and Southern Company (SO) have done fairly well in the last few months compared to broader markets.

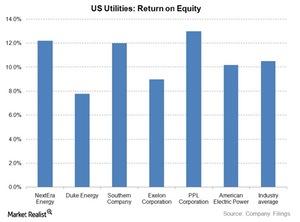

A Look at US Utilities’ Return on Equity

Duke Energy’s (DUK) adjusted return on equity stayed below 8% due to volatile earnings from international operations. This ROE was on the lower side of the industry average.

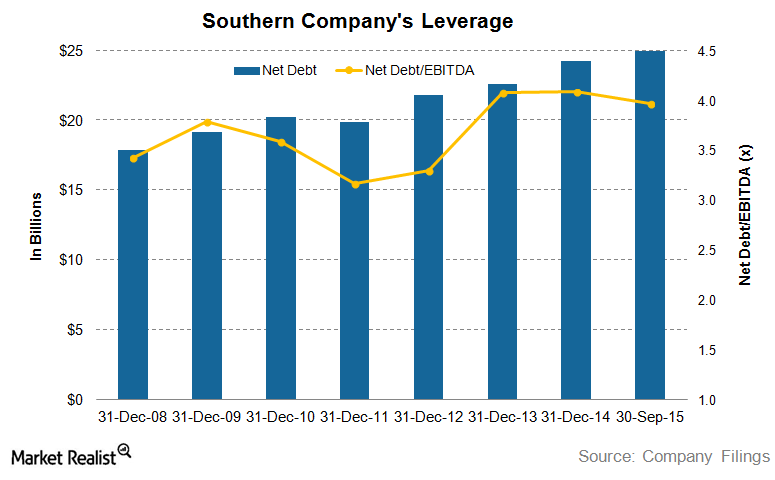

Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

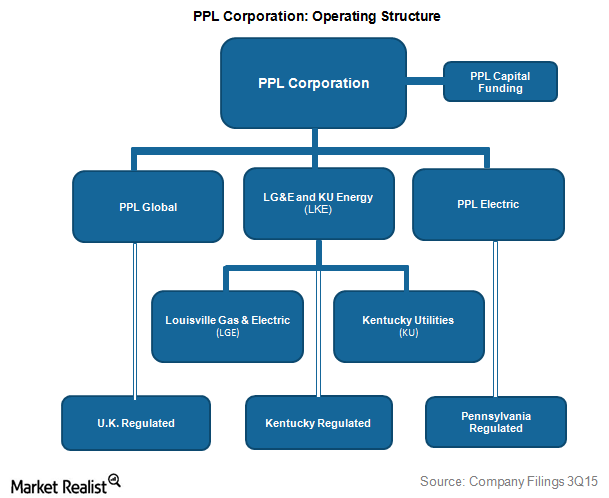

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

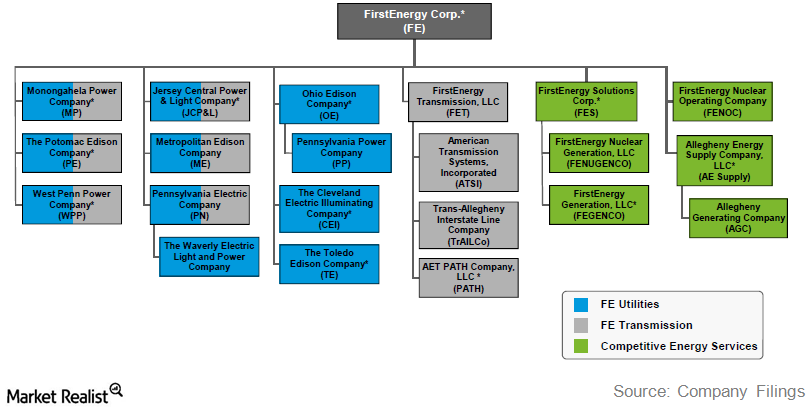

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

How Exelon’s Hybrid Business Model Provides Balanced Revenues

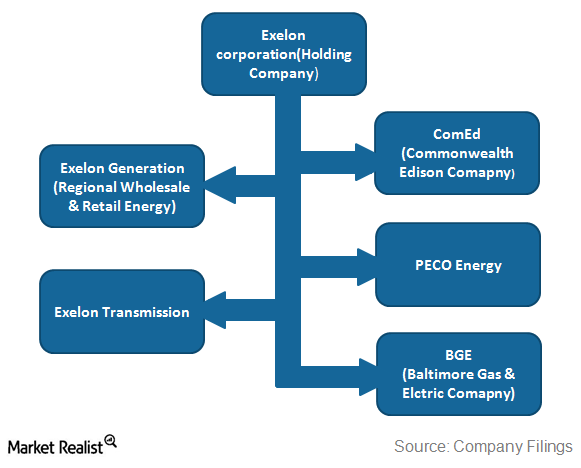

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.Energy & Utilities Must-know: The top US electric utility companies

The top electric utility companies in the U.S. include Duke Energy, Exelon Corporation, Southern Company, NextEra Energy, and Dominion Resources. These companies are largest in terms of market cap.