EOG Resources Inc

Latest EOG Resources Inc News and Updates

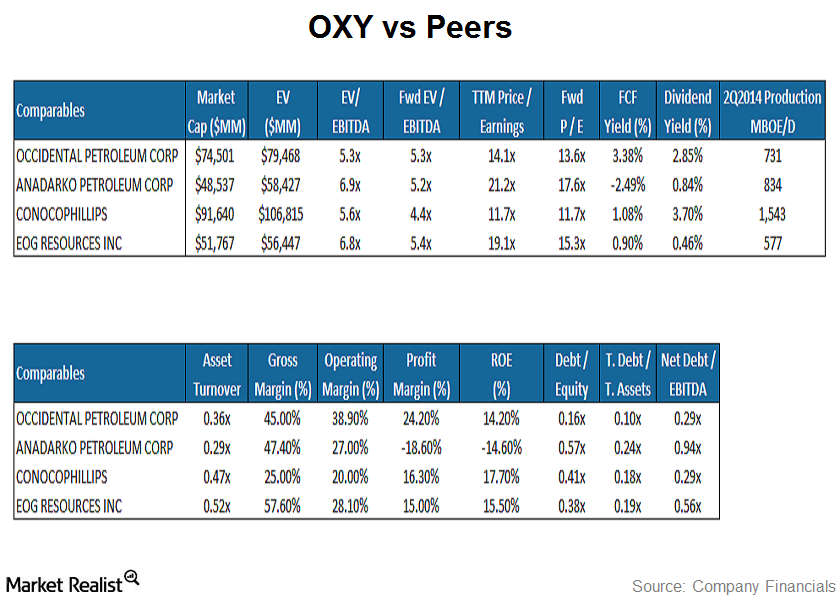

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

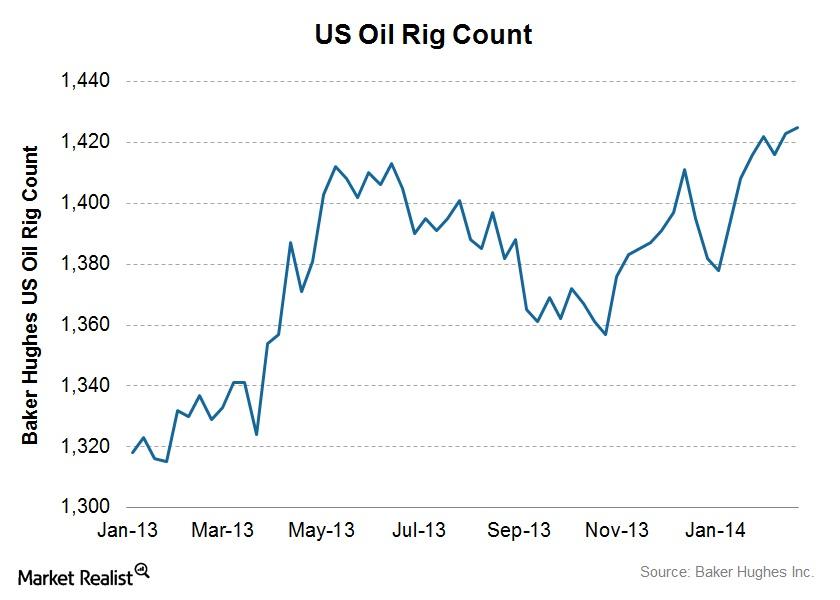

US oil rig counts continue to rally, reaching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.

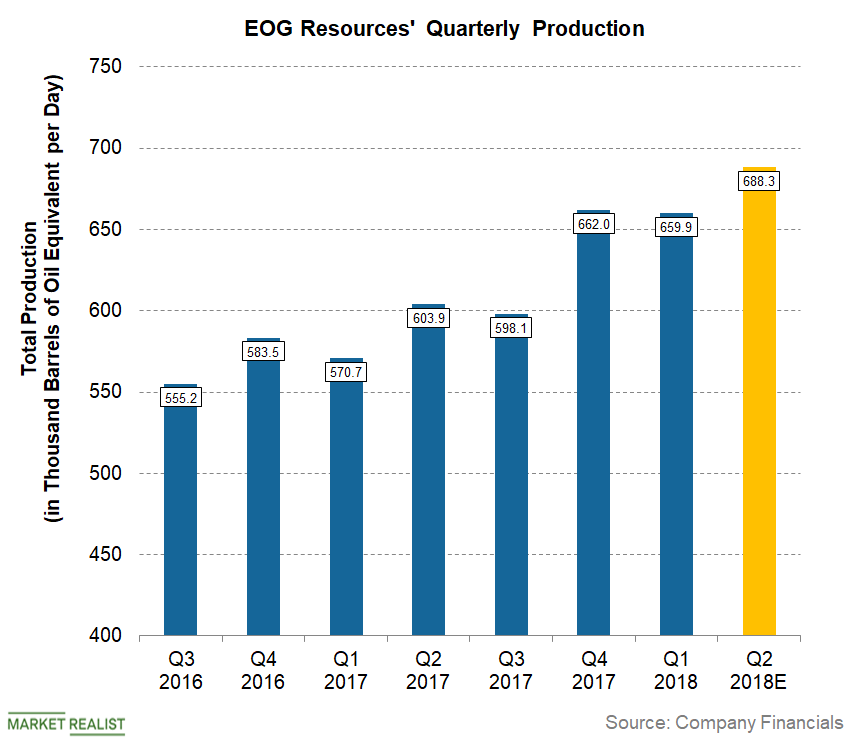

Understanding EOG Resources’ Q2 2018 Production Guidance

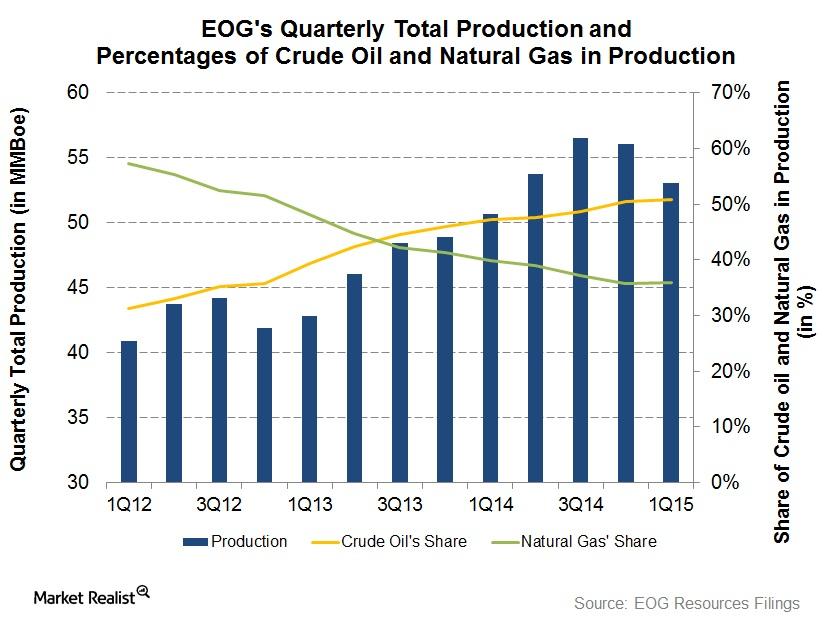

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

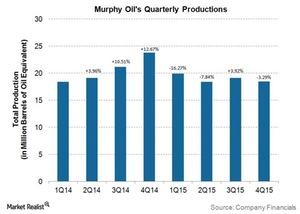

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

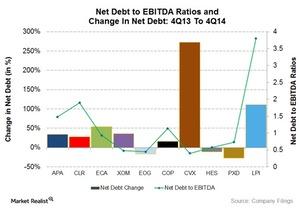

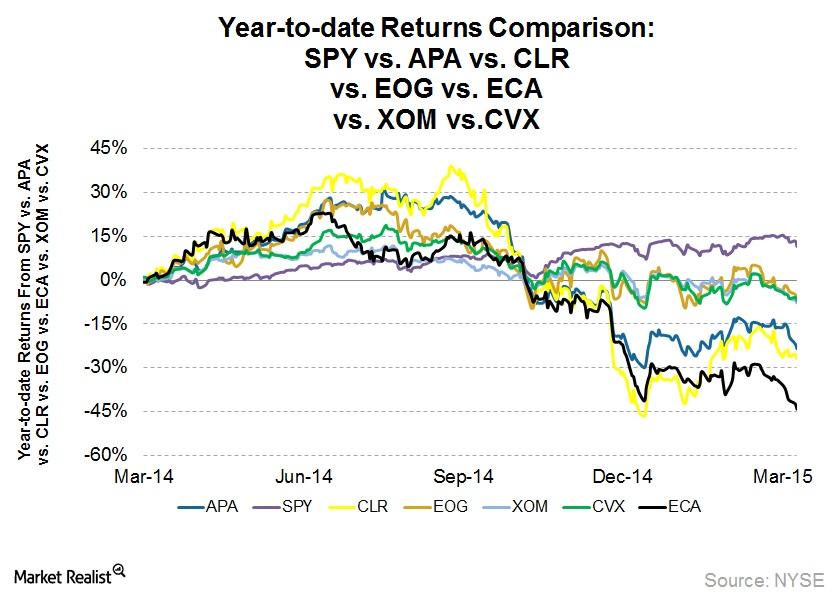

Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

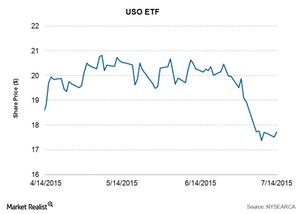

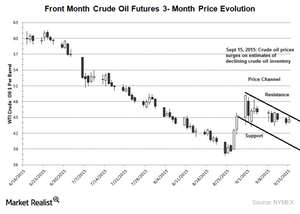

Crude Oil Prices Rally despite the Iran Nuclear Accord

NYMEX-traded WTI (West Texas Intermediate) crude oil futures contracts for August delivery rose by 1.10% and settled at $53.04 per barrel on July 14, 2015.

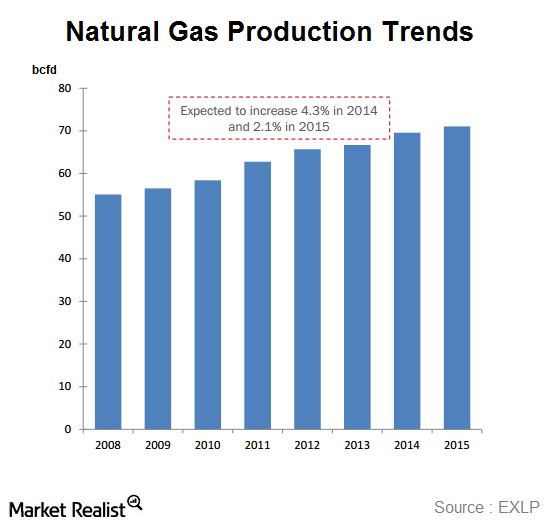

An overview of the natural gas compression industry

Natural gas compression is essential for transporting natural gas. Compression is used several times during the natural gas production and transportation cycle.

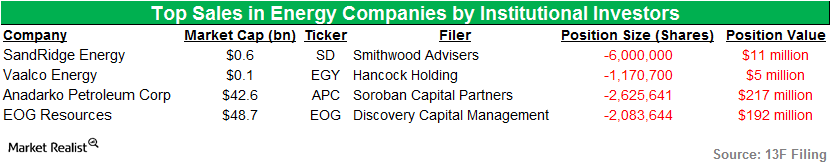

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

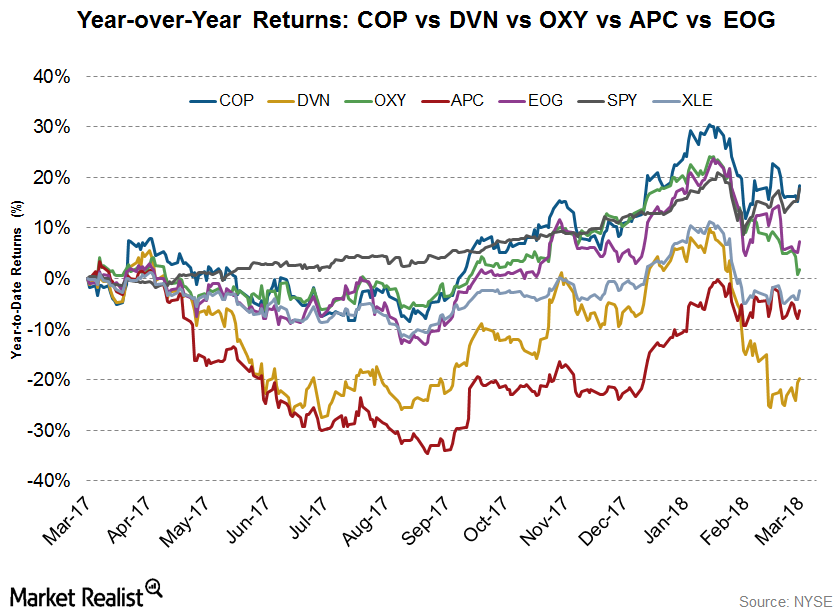

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

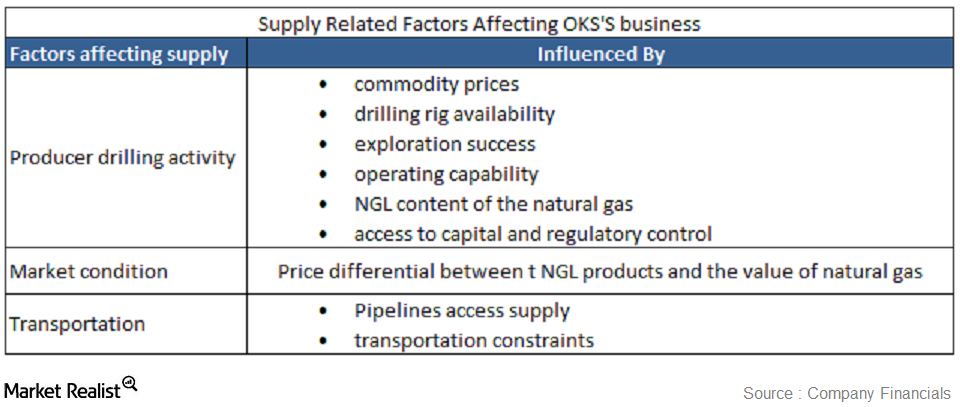

Must-know: Supply-related factors that affect ONEOK Partners

Natural gas, crude oil, and NGL (or natural gas liquid) supply is affected by several factors that could be supply related or demand related.

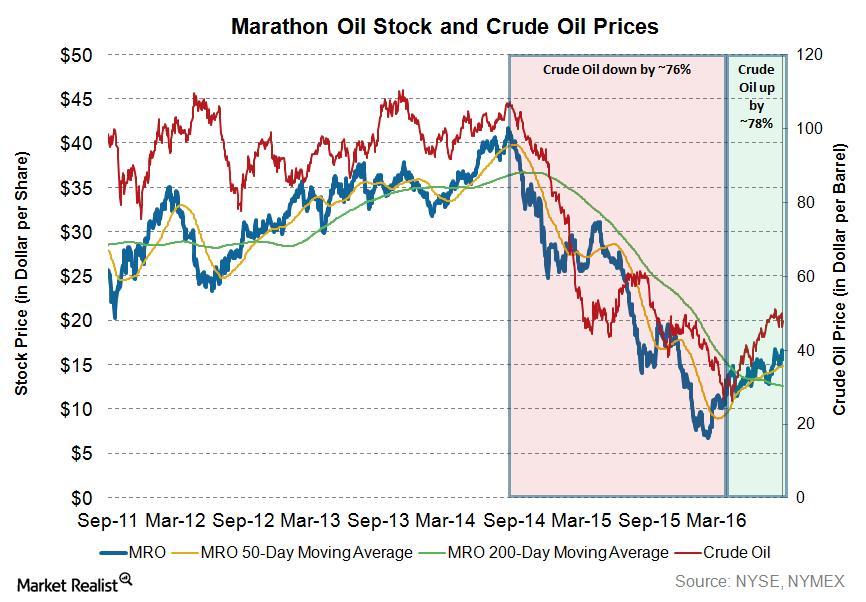

How the Decline in Crude Oil Prices Affected Marathon Oil

Although crude oil prices have rallied ~78% from their lows in February 2016, crude is still trading ~57% lower than its high two years ago.

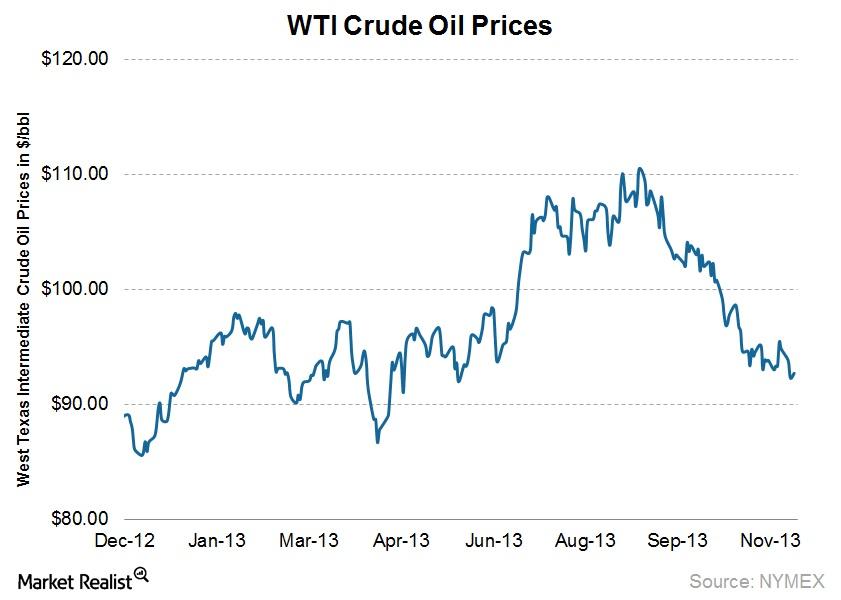

Why WTI crude oil prices are down over 15% in 3 months

WTI crude oil prices continued to slide as U.S. crude inventories continued to grow, with domestic production surging.

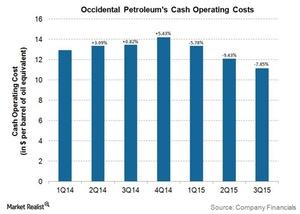

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

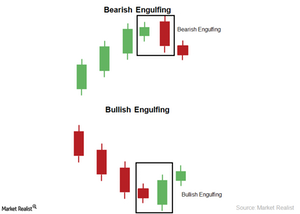

The Bearish Engulfing and Bullish Engulfing Candlestick Pattern

The Bullish Engulfing candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is small and bearish. The second candle is long and bullish.Financials Technical indicators and the Relative Strength Index

The Real Strength Index (or RSI) is a measure of a stock’s overbought and oversold position. The commonly used RSI is a 14-day RSI. It refers to the 14-day stock price that’s used to calculate the RSI.Financials Double top and double bottom patterns in technical analysis

The double top pattern forms in the uptrend. In this pattern, two consecutive peaks are formed. The peaks both have roughly the same price level.

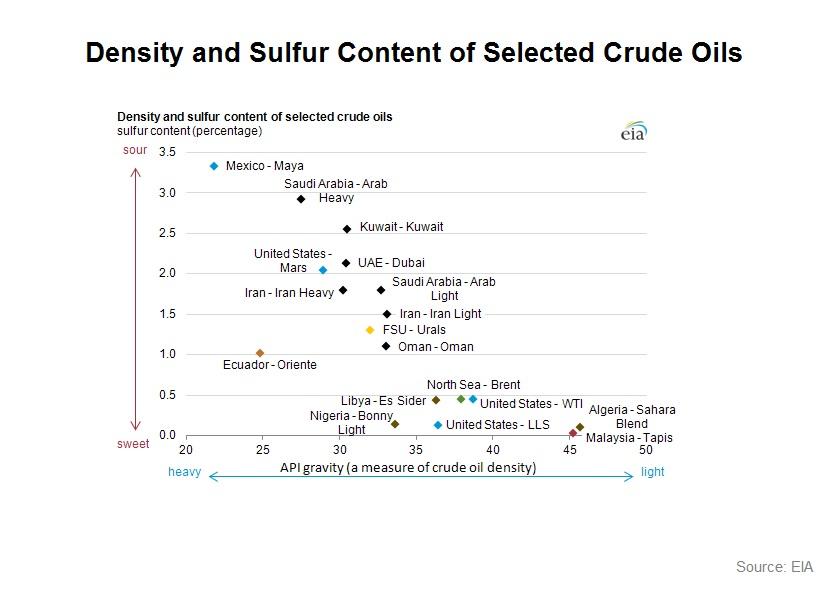

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.Energy & Utilities What are the advantages of technical analysis?

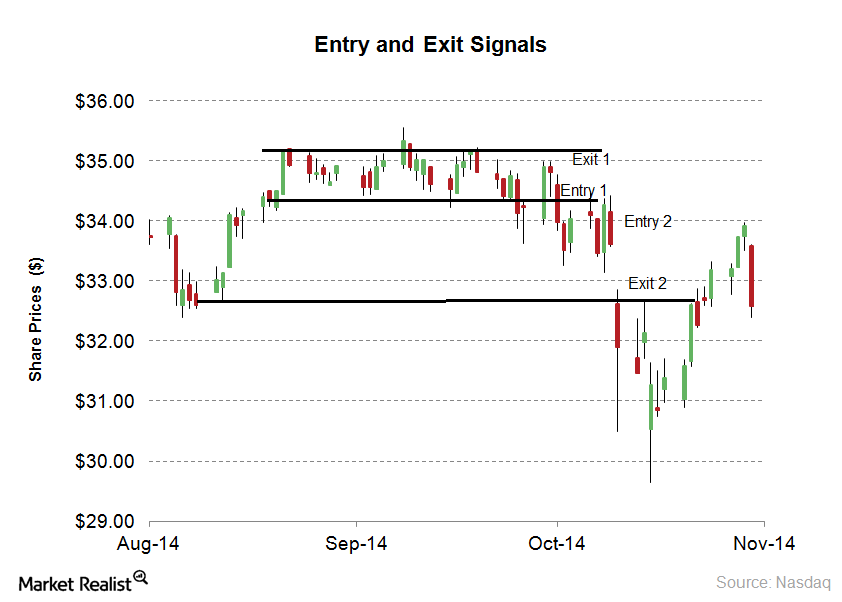

Entry and exit strategy is recommended for short and long-term trading in technical analysis. Fundamental analysis is used for the long-term entry and exit point.

What are the disadvantages of technical analysis?

Technical analysis is used to forecast stocks. All of the technical indicators give possible entry and exit points. The forecasting accuracy isn’t 100%. This is one of disadvantages of technical analysis.

Why it’s important to know the crude oil extraction process

Before learning the costs components of crude oil extraction, let’s take a look at how producers extract crude oil from the ground.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

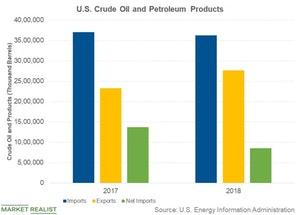

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

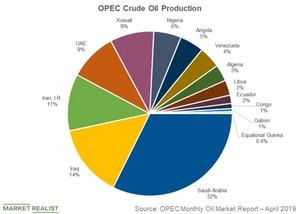

OPEC’s Role in World Oil Production

OPEC (the Organisation of the Petroleum Exporting Countries) aims to “coordinate and unify the petroleum policies of its Member Countries.”

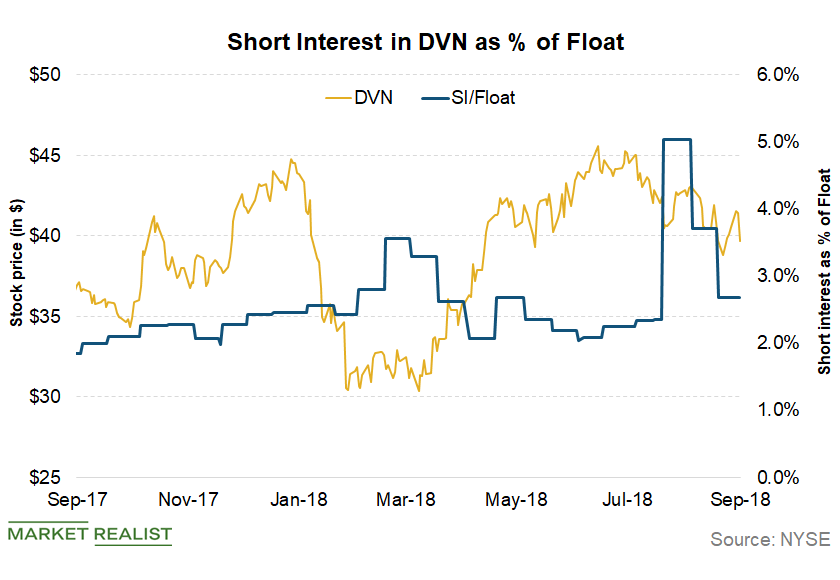

What Devon Energy’s Technical Indicators Tell Us

Devon Energy (DVN) continues to trade below its short-term (50-day) moving average.

Capital World Investors Sold a Major Position in NBL in Q2

So far in this series, we’ve looked at institutional investments in five major oil-weighted E&P (exploration and production) stocks: ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD).

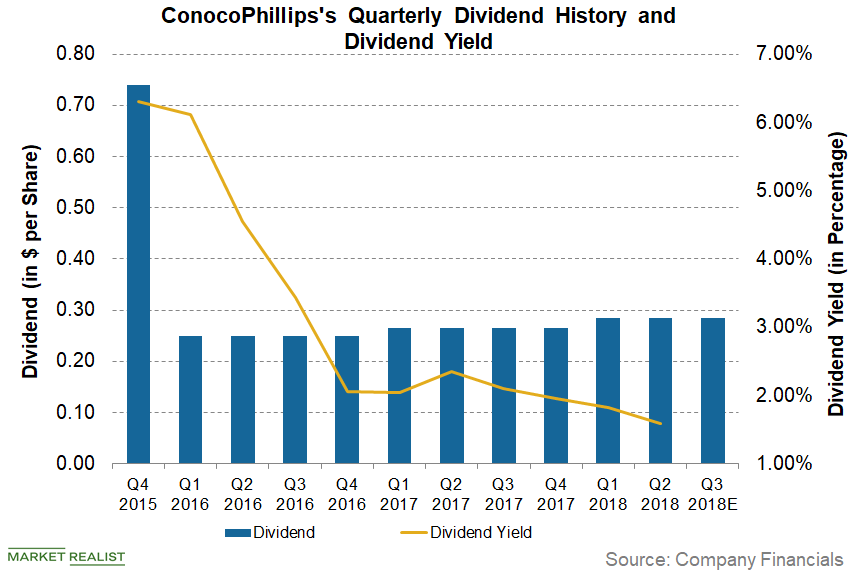

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

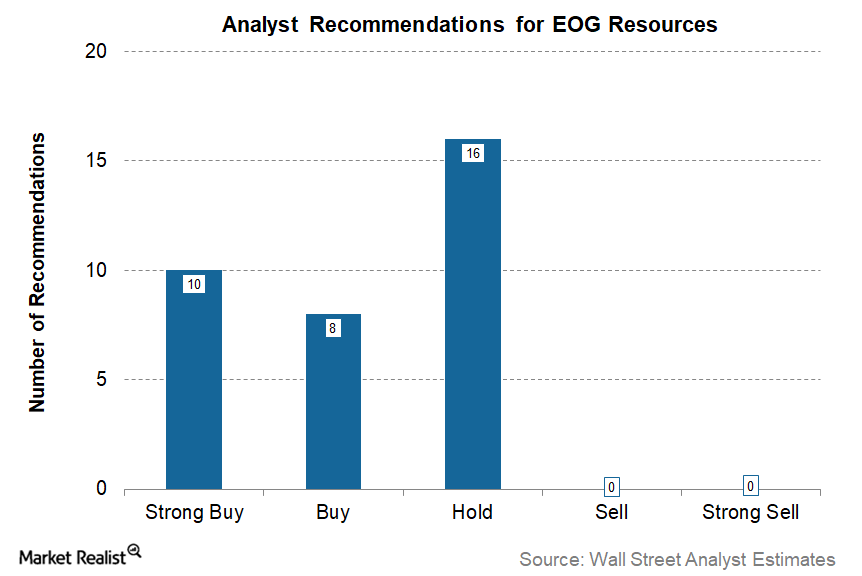

EOG Resources: Post-Earnings Wall Street Ratings

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

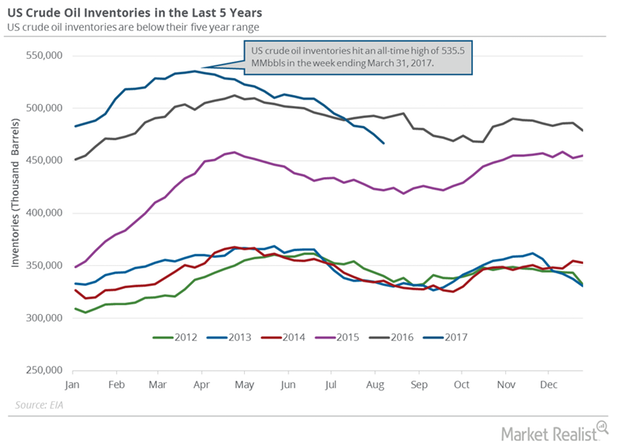

US Crude Oil Inventories: Biggest Draw since September 2016

The EIA reported that US crude oil inventories fell by 8.9 MMbbls or 1.8% to 466.4 MMbbls on August 4–11, 2017—the biggest draw since September 2016.

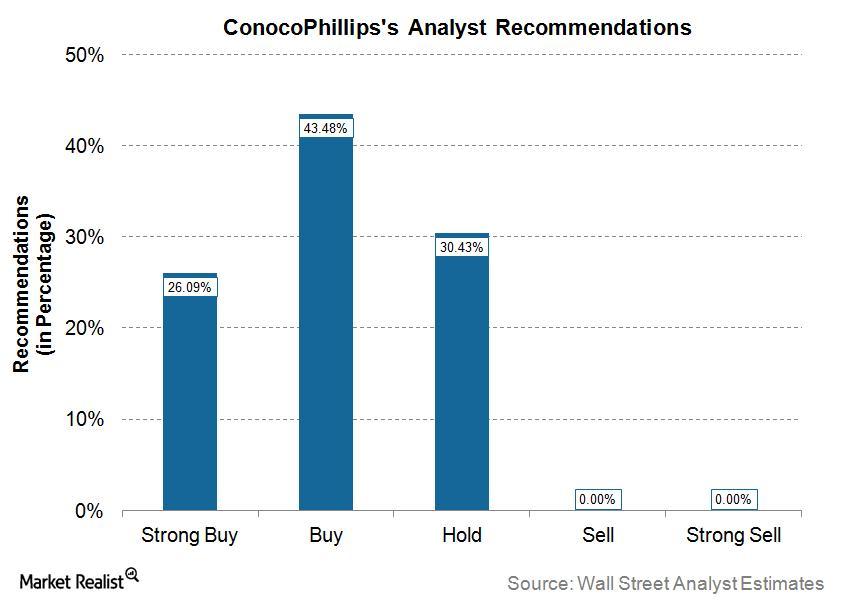

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

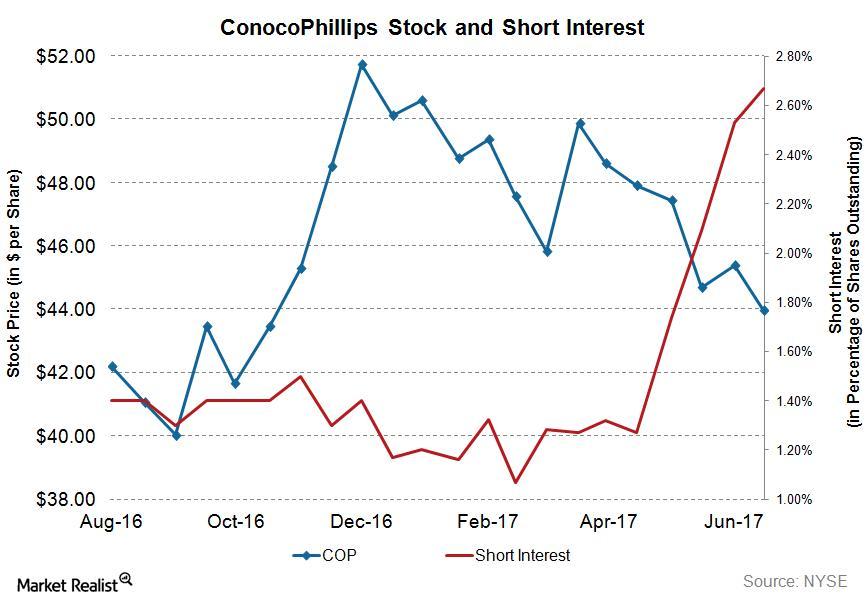

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

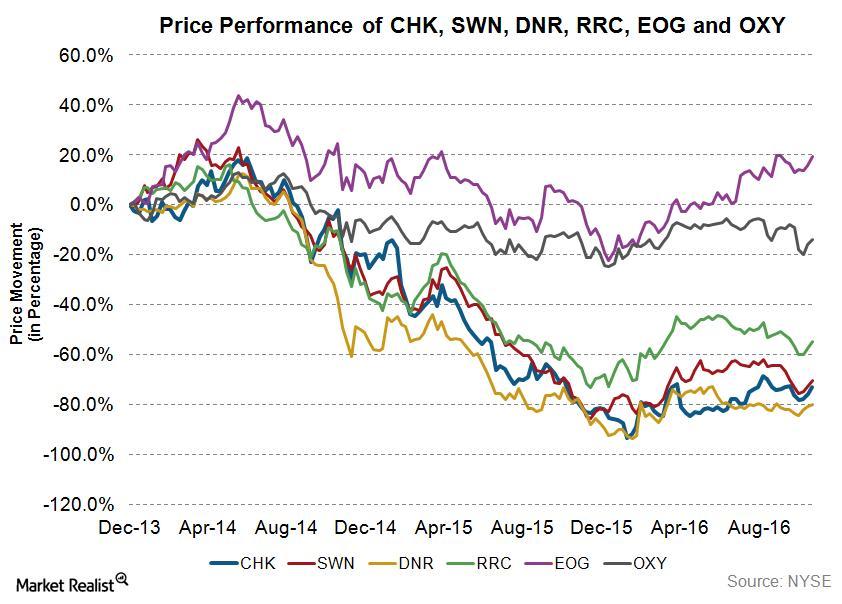

Are Companies That Have Done Acquisitions Outperforming?

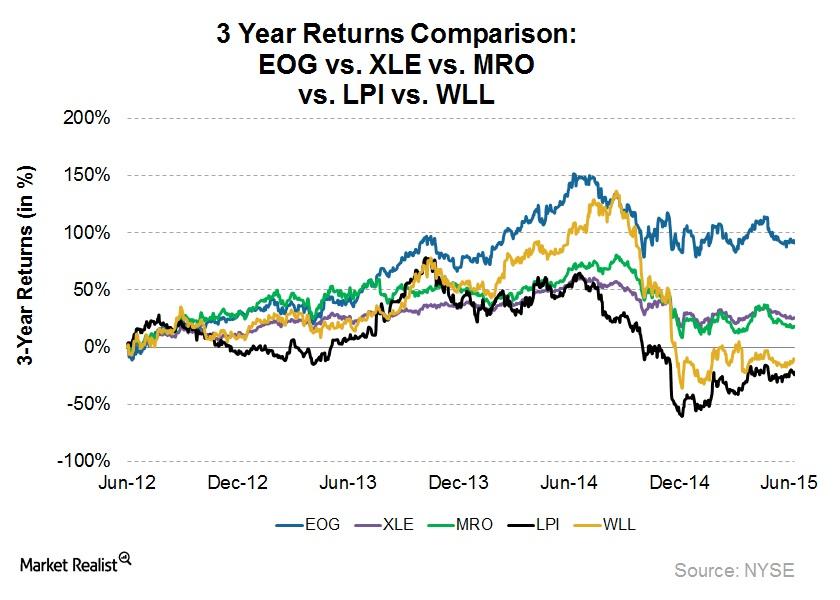

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

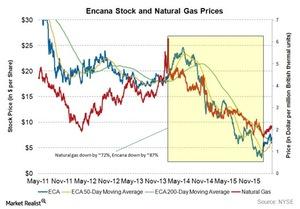

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

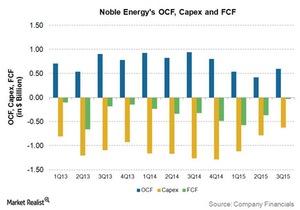

A Look at Noble Energy’s Free Cash Flow Trends

Noble Energy reported negative but improving free cash flows in 2015.

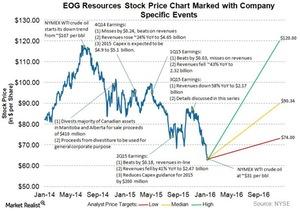

EOG Resources Failed to Hold above Its 200-Day Moving Average

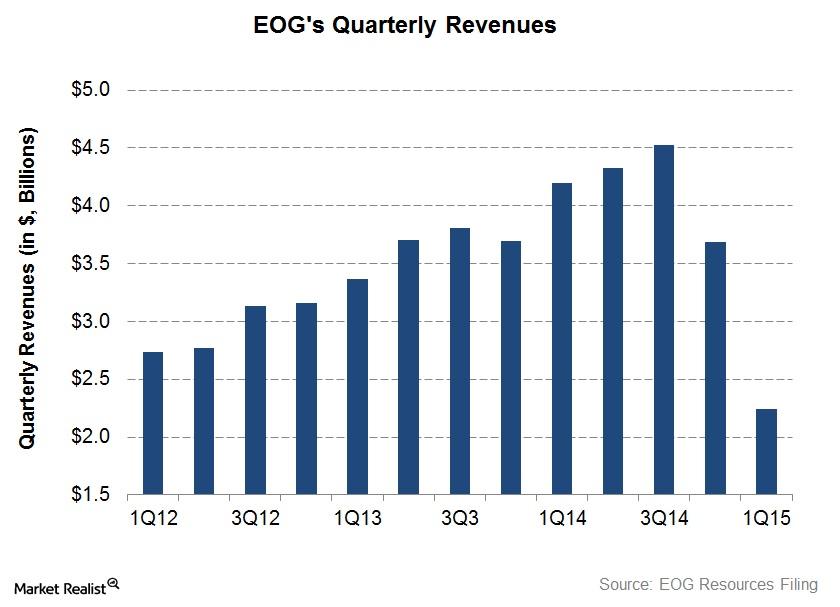

In 3Q15, excluding the one-time items, EOG reported a profit of $0.02 per share, $0.32 better than the analyst consensus for a loss of $0.30 per share. Its revenues fell ~58% year-over-year to ~$2.17 billion.

Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

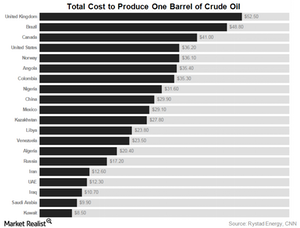

Crude Oil’s Total Cost of Production Impacts Major Oil Producers

OPEC members Nigeria, Libya, and Venezuela have the highest total cost of producing crude oil at $31.6 per barrel, $23.80 per barrel, and $23.50 per barrel.

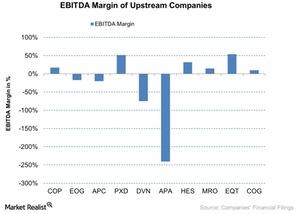

Operating Margins for Upstream Companies Rose

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%.

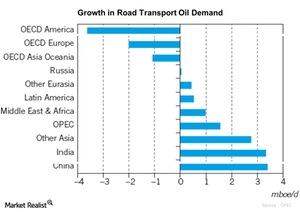

Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

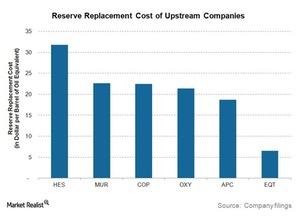

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.

Why EOG Resources Is among the Best Upstream Stocks

EOG Resources (EOG) has generated above-par returns over a three-year period. EOG returned 91.8% in the last three years, mainly due to its strong performance.

EOG Resources: Growing Revenue Is Battered by the Crude Oil Slump

EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14.

EOG Production Adjusts to Weak Energy Prices

On the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

Falling oil prices affect energy upstream and integrated companies

Falling oil prices have started to affect energy upstream companies’ revenues. These companies have resorted to cutting costs and focusing on cash flow.

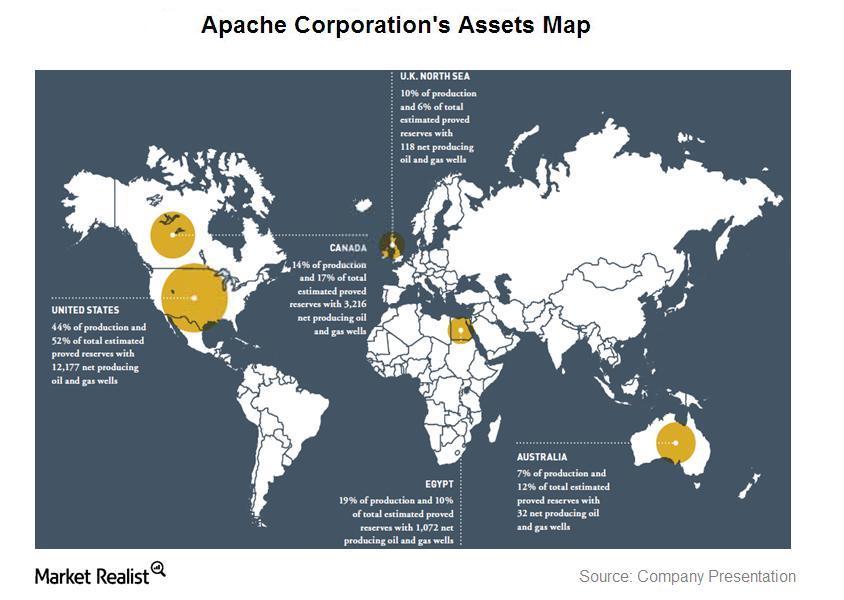

An overview of Apache Corporation’s oil and gas asset sales

Apache Corporation is planning asset sales of certain of its oil and gas operations. The company is focused on building onshore acreage instead.

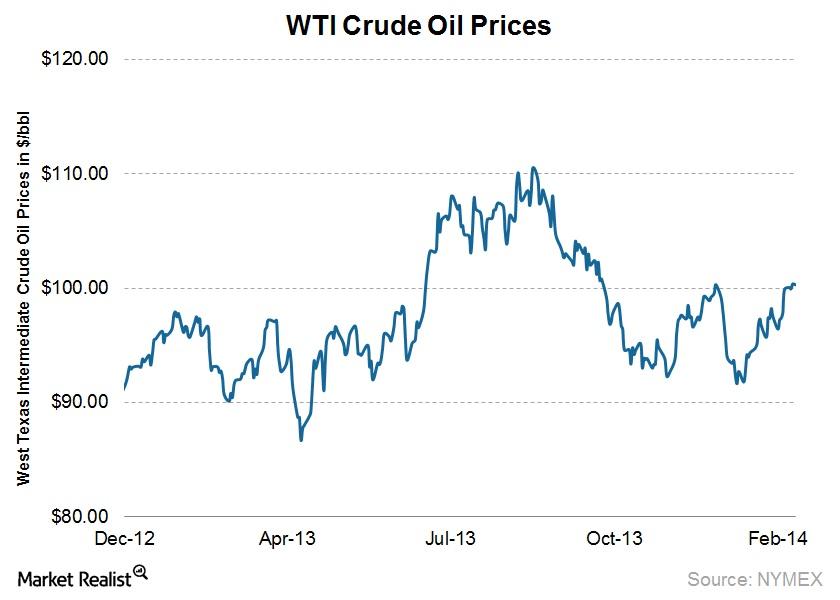

WTI crude prices break $100 per barrel for the 1st time in 2014

WTI traded flat last week, but firstly traded up $100 per barrel since December 27. This past week’s upward movement in prices was a short-term positive for the sector.