Burger King Worldwide Inc

Latest Burger King Worldwide Inc News and Updates

Thousands Get Blank Burger King Receipt Emails After “Internal Processing Error”

Did you get a blank Burger King receipt email? You aren't alone. The fast-food chain has emailed thousands of people a blank receipt. Read more here.

Burger King's Whopper Will Cost $0.37 This Weekend—Here's the Catch

Burger King is celebrating the 64th anniversary of the Whopper by offering the burger for only 37 cents this weekend, but the offer isn’t open to everyone.

Burger King Partners With Robinhood for Crypto Giveaway

Burger King will give away cryptocurrencies to its loyalty rewards members through a partnership with Robinhood.Consumer Must-know: Chipotle Mexican Grill’s food costs

CMG reported $372 million in food costs in 3Q14. Food costs accounted for 34.3% of the revenue. It was an increase of 70 basis points year-over-year (or YoY).Consumer Why Yum! Brands’ division in China is important

Yum! Brands’ (YUM) division in China includes its business in mainland China. It’s the combined revenues from all the brands—KFC, Pizza Hut, East Dawning, and the Little Sheep.

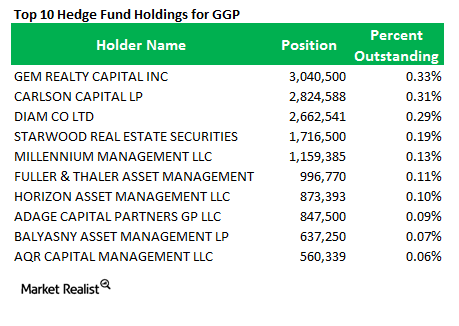

Why did Ackman’s Pershing Square exit General Growth Properties?

Last week, Pershing Square exited its entire stake in General Growth Properties.Consumer Analyzing Burger King’s shifting business model focus in 2Q14

Franchise revenues include royalties and franchise fees. Royalties are calculated as a percentage of franchise restaurant revenues, which are driven by same-store sales.Consumer Why Tim Hortons introduced a mobile app and loyalty cards

Along with introducing new products like those we discussed in the previous part of this series, Tim Hortons (THI) is also testing different revenue channels and payment methods.Consumer Must-know: Yum! Brands’ segments by business models

For six months ending June 2014, China’s division reported revenue of $3 billion, or 52% of Yum! revenues. China only represents 15% of the more than 40,000 Yum! restaurant units.Consumer Why McDonald’s same-store sales declined

McDonald’s (MCD) revenues declined 4.5% YoY. Revenues in the restaurant industry are mainly driven by same-store sales and unit growth. The global same-stores sales were down to -3.3% YoY.

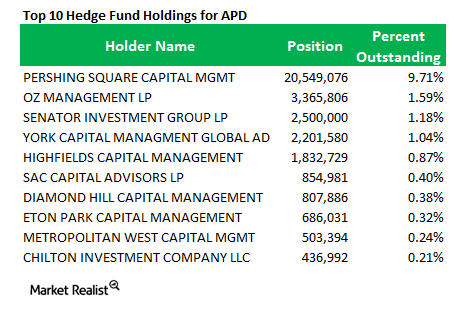

Why Pershing Square increased its stake in Air Products and Chemicals

Pershing Square increased its position in Air Products and Chemicals, Inc. from 21.31% in 3Q 2013 to 27.91% in 4Q 2013.Consumer Domino’s management guidance on food costs, capex, and more

Management anticipates the effective tax rate to be in the range of 37% to 38% for the “foreseeable future.” Corporate tax rates in the U.S. are high, and force some companies to move their headquarters to countries offering lower tax rates.

Downward trend: McDonald’s November Same-Store Sales

McDonald’s November same-store sales indicate a continued slide in all segments. Tensions between Russia and Ukraine are partially to blame.Consumer Why Burger King is improving its traffic through product innovation

Burger King (BKW) introduced premium products internationally that should complement its menu. It launched a Hashbrown Whopper in Korea, a Barbecue Bacon Whopper in the U.S., and a Mexican Whopper in Spain.Consumer Why fuel prices affect restaurants

Higher fuel costs put pressure on operating costs, and can squeeze profit margins. The demand side also takes a hit. When gas prices are high, consumers tend to economize on transit by eliminating unnecessary trips.

Starbucks Gets Help From Its Rewards Program

One of the ways a customer can become a My Starbucks Rewards member is by using the My Starbucks Rewards card. The card is available at the checkout counter.

McDonald’s List Of Initiatives That Will Bring A Turnaround

McDonald’s list of initiatives includes simplifying its menu and possibly offering locally relevant menu items. This could be quite a gamble.Company & Industry Overviews Pilgrim’s Pride Corporation’s three customer categories

Pilgrim’s customer base is spread across 100 countries, including the US and Mexico, which together contributed ~92% of the company’s revenues as of 2013 year-end.Company & Industry Overviews What is a limited-service restaurant?

Limited-service restaurants can be classified into fast food or quick service, fast-casual restaurants, pizza restaurants, and cafés.Consumer Why Burger King’s restaurant visit program is so important

Burger King (BKW) opened a net of 131 new restaurants in the second quarter, making for a total net new restaurant count of 682 restaurants in the past 12 months.Consumer Must-know: Key metrics in McDonalds’ quarterly earnings

McDonald’s reported flat global comparable sales and negative comparable guest count for 2Q14, which is concerning from a long-term income growth perspective.

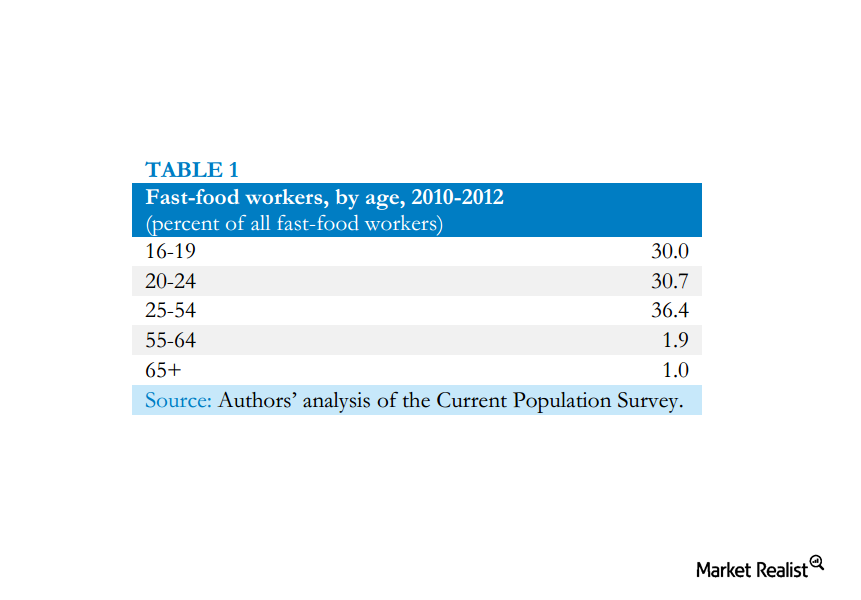

Must-know: Majority of fast food workers “not” above 25 years old

Why the unionization of all fast food workers, which would increase the bargaining power of employees and possibly lead to higher wages, in quite unlikely.

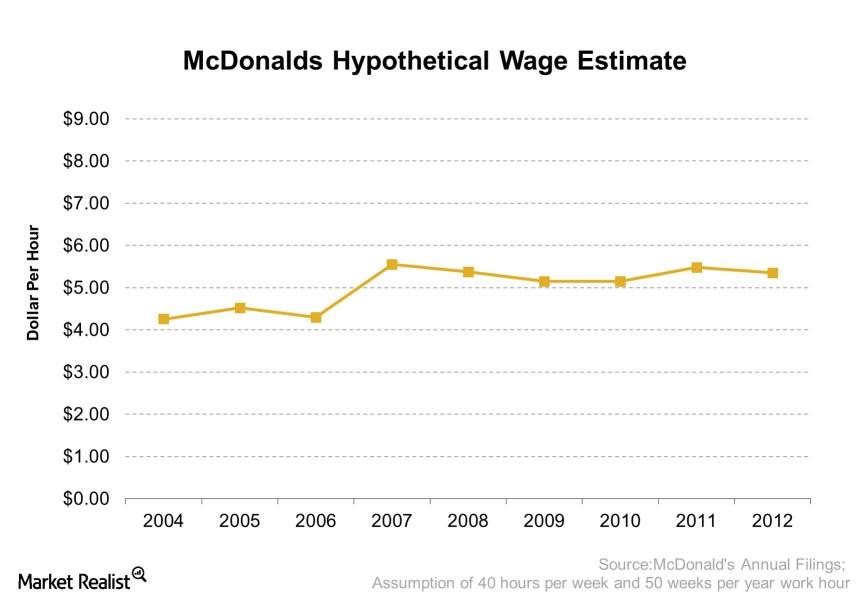

Why do most workers at McDonald’s work part-time?

Part-time work is most likely an industry-wide characteristic within the food retail business.