AGNC Investment Corp

Latest AGNC Investment Corp News and Updates

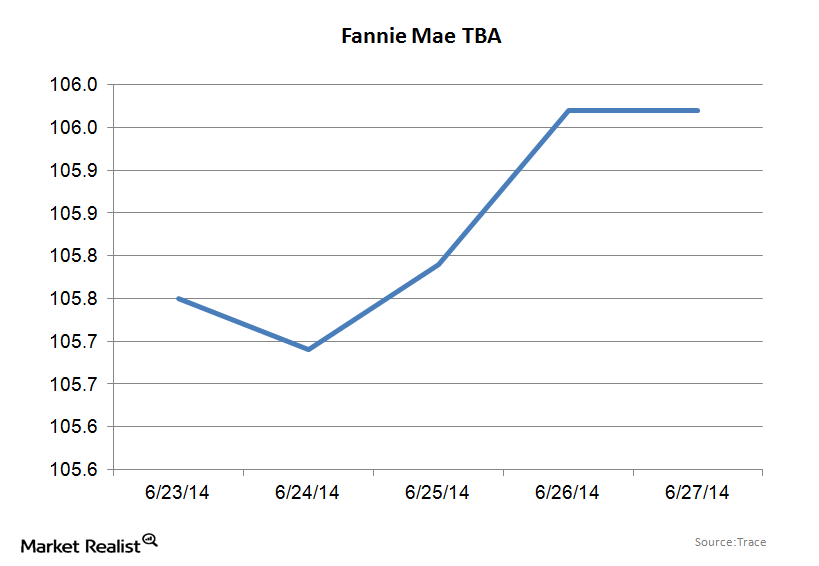

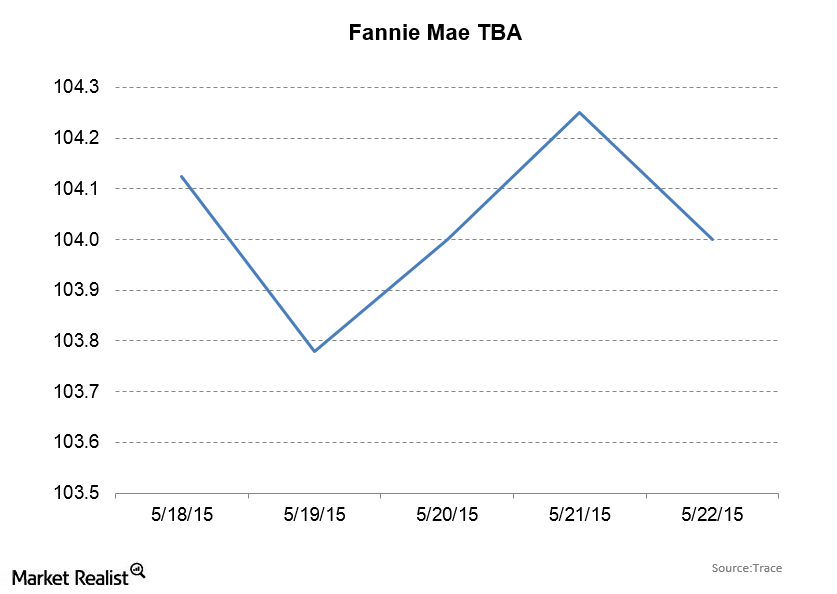

Why Fannie Mae securities rallied with bonds about 1/4

The main action driving TBAs specifically seems to be out of Washington, between the Fed purchases and the government’s policies to drive origination.

Fannie Mae TBAs Rise with the Bond Market

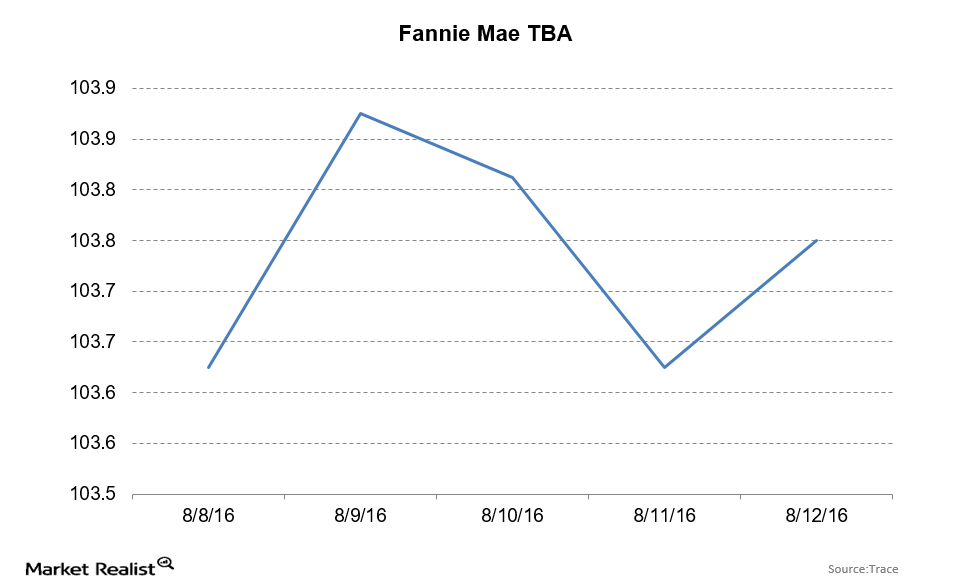

For the week ending August 12, 2016, Fannie Mae TBAs ended at 103 24/32—up 4 ticks for the week. The ten-year bond yield fell by 8 basis points to 1.51%.

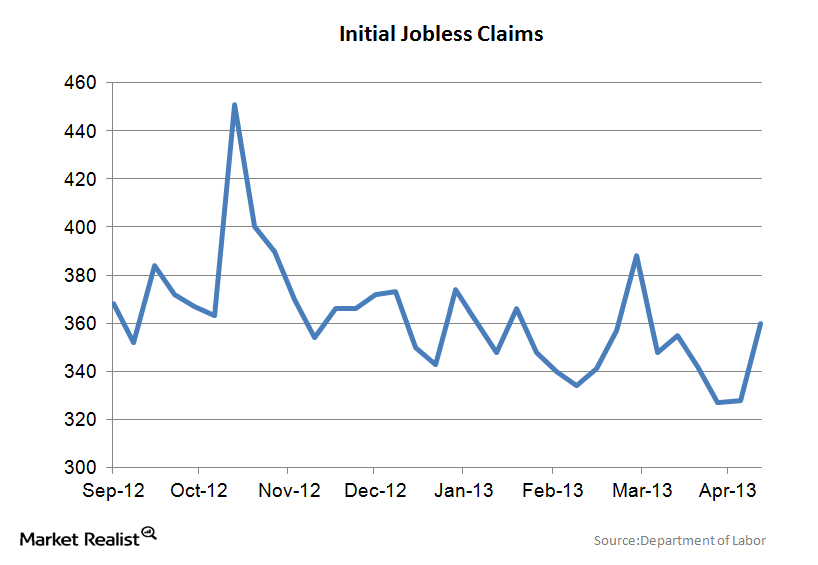

Initial jobless claims jump

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like […]

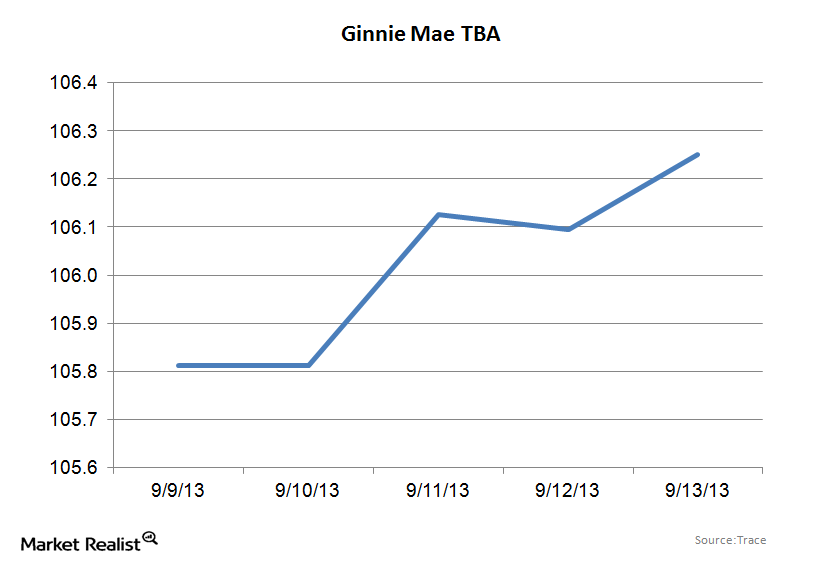

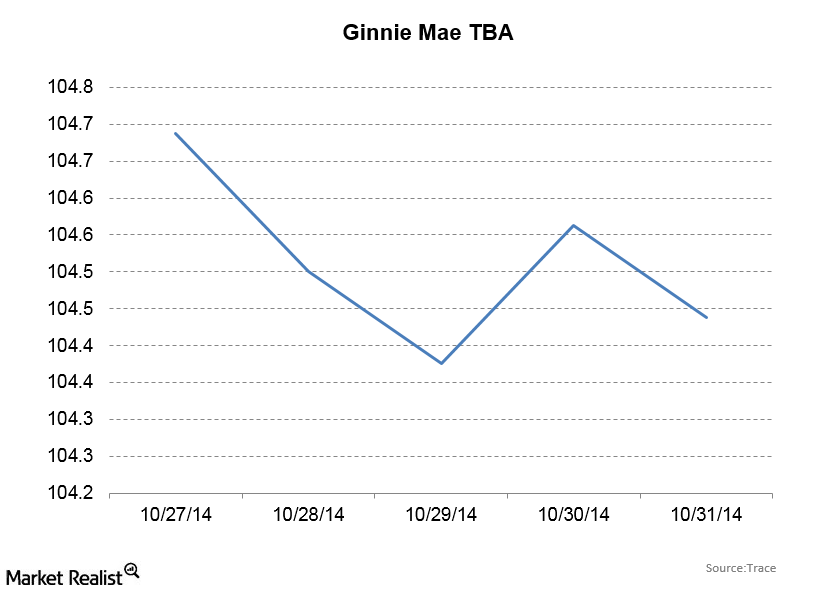

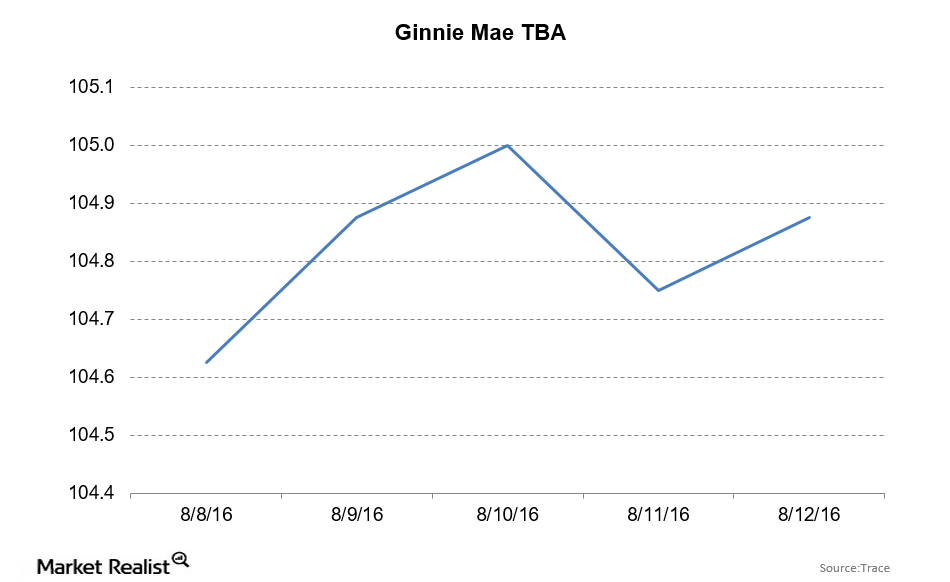

Ginnie Mae TBAs rally before the Fed meeting

Mortgage-backed securities are the starting point for all mortgage market pricing and the investment of choice for mortgage REITs When the Federal Reserve talks about buying mortgage-backed securities, it’s referring to the To-Be-Announced (also know as the TBA) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product […]

The End Of Quantitative Easing Could Make Mortgage REITs Vulnerable

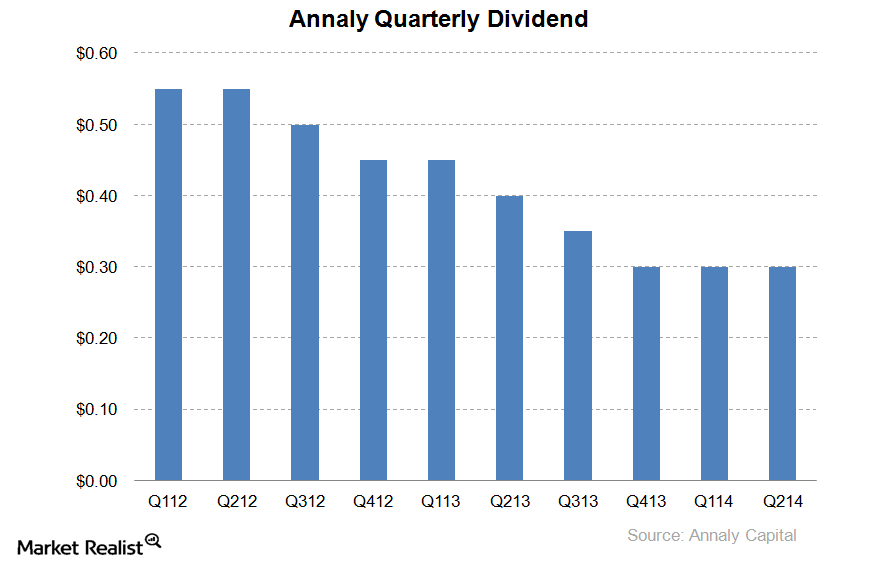

Big agency REITs like Annaly (NLY) and American Capital Agency (AGNC) took the chance to deleverage their balance sheets after the warning in the spring of 2013.

Ginnie Mae securities shake off the end of quantitative easing

The ten-year bond sold off, with yields increasing from 2.27% to 2.34%. Ginnie Mae TBAs bucked the trend, rising from 104 20/32 to 104 25/32.

Mortgage servicing rights increase in value as interest rates rise

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be […]

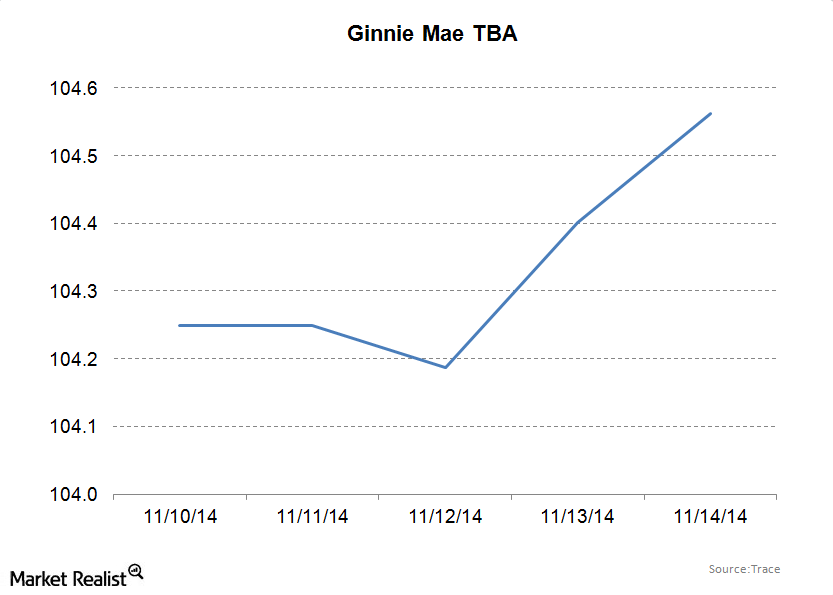

Ginnie Mae Securities Buck The Recent Trend And Rally

Ginnie Mae and the to-be-announced market The Fannie Mae to-be-announced (or TBA) market represents the usual conforming loan—the plain Fannie Mae 30-year mortgage. Meanwhile, Ginnie Mae TBAs are where government loans go—such as the federal housing administration (or FHA) and veterans affairs (or VA) loans. The biggest difference between a Fannie Mae mortgage-backed security (or […]

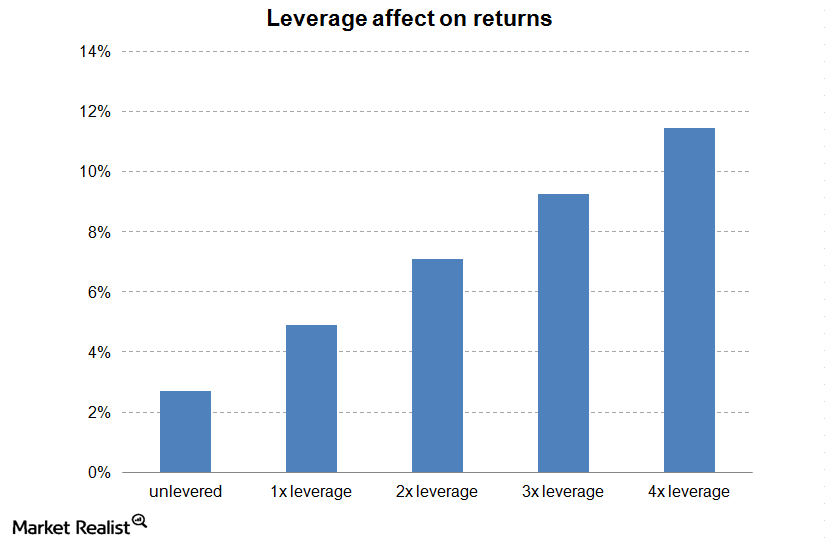

Leverage and mortgage REITs – Part 2

Leverage and Mortgage REITs – Part 1 How a mortgage REIT typically does it Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement […]

Primer on mortgage backed securities, Part 5

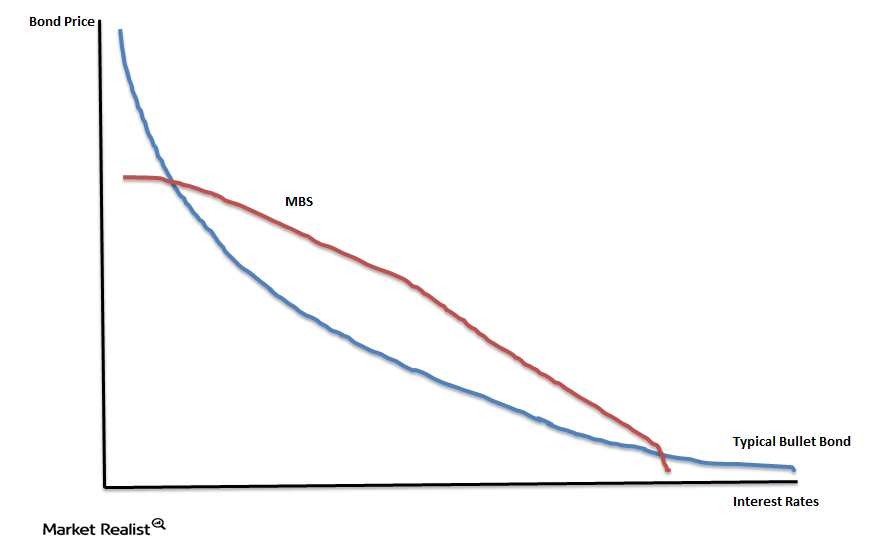

Continued from Primer on mortgage backed securities, Part 4. Prepayment risk Prepayment risk and interest rate risk go hand-in-hand. The main difference between a mortgage backed security and a government bond is that with a government bond, you know exactly when you will get your principal and interest payments. If you purchase a 7-year Treasury […]

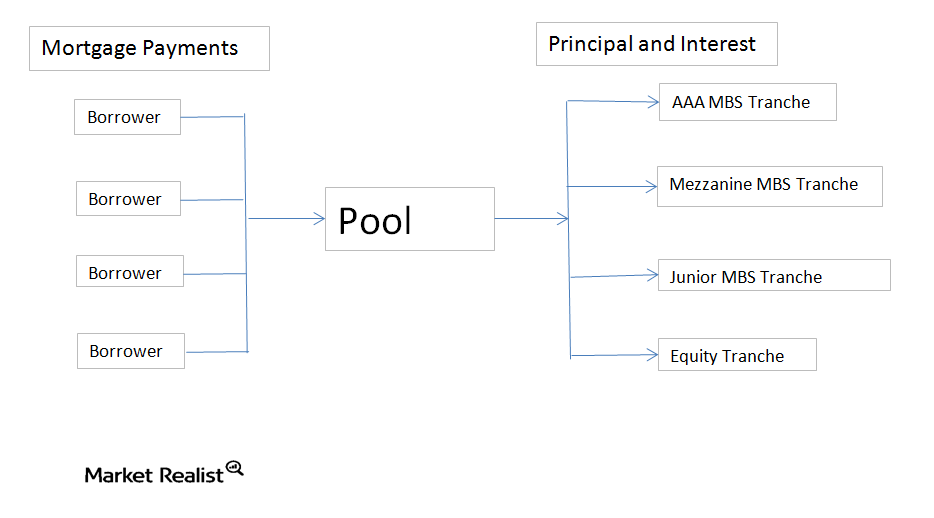

Primer on mortgage backed securities, Part 1

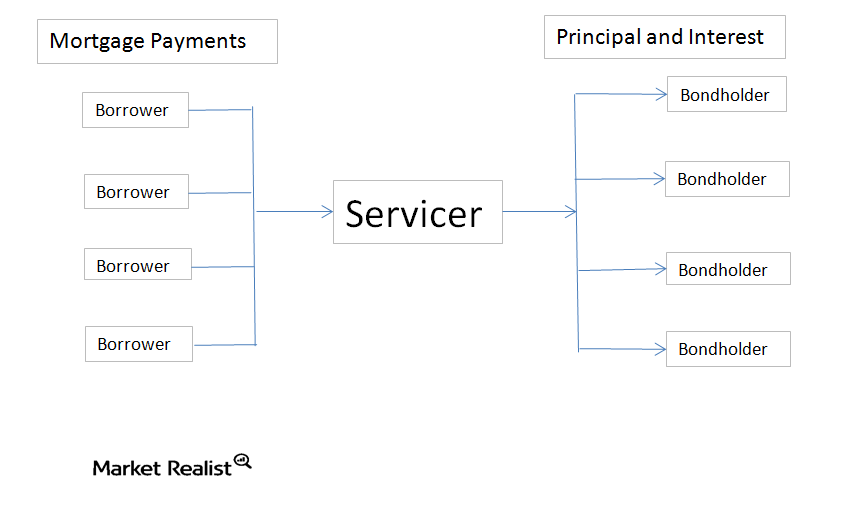

What are mortgage backed securities? Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order […]

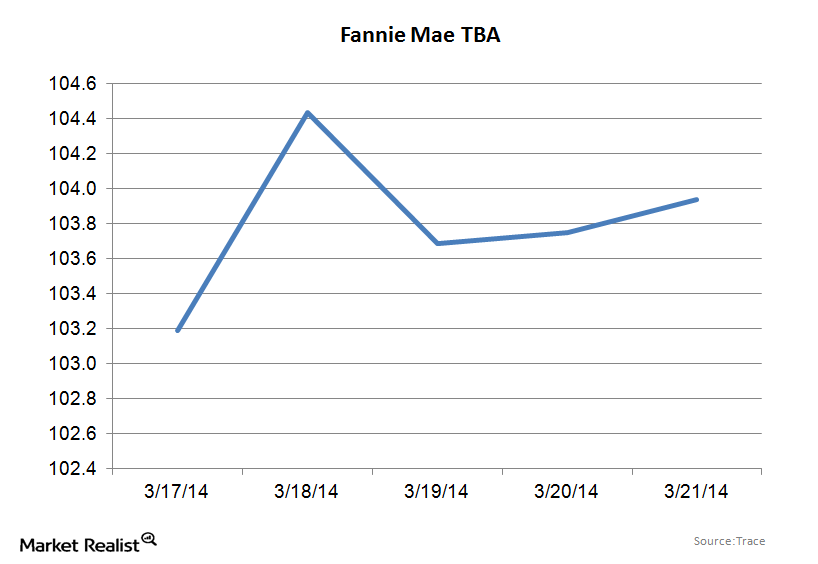

Fannie Mae TBA securities shrug off the March FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.

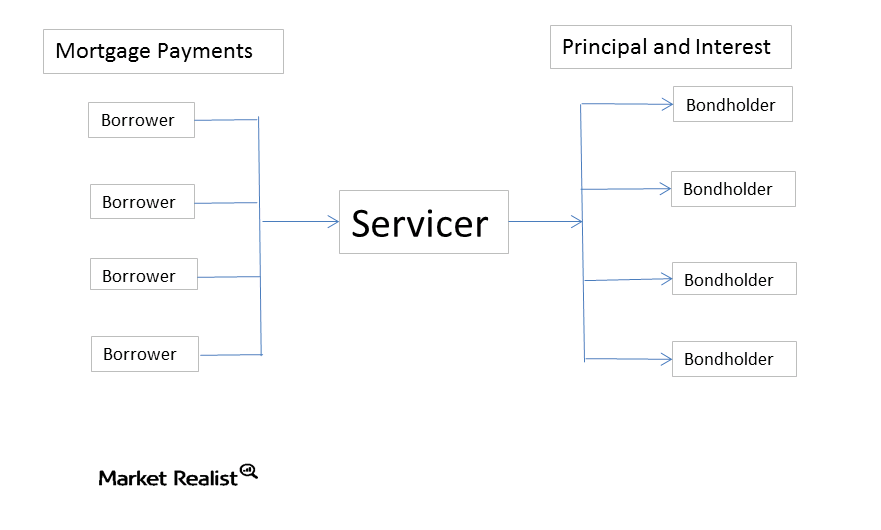

Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]

Ginnie Mae TBAs Rise with the Bond Market

The ten-year bond yield fell by 8 basis points to 1.51% for the week ending August 12, 2016. Ginnie Mae TBAs rose by 4 ticks and closed at 104 28/32.

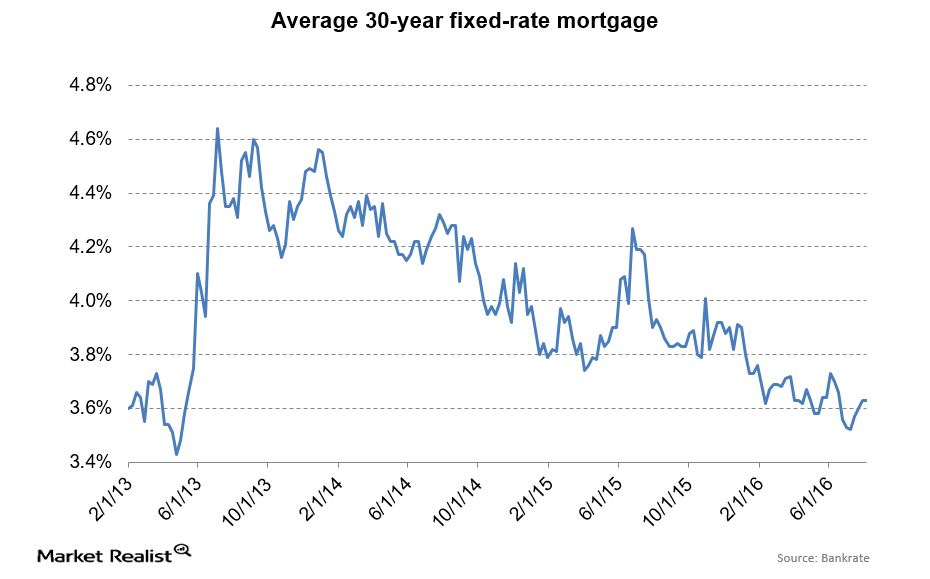

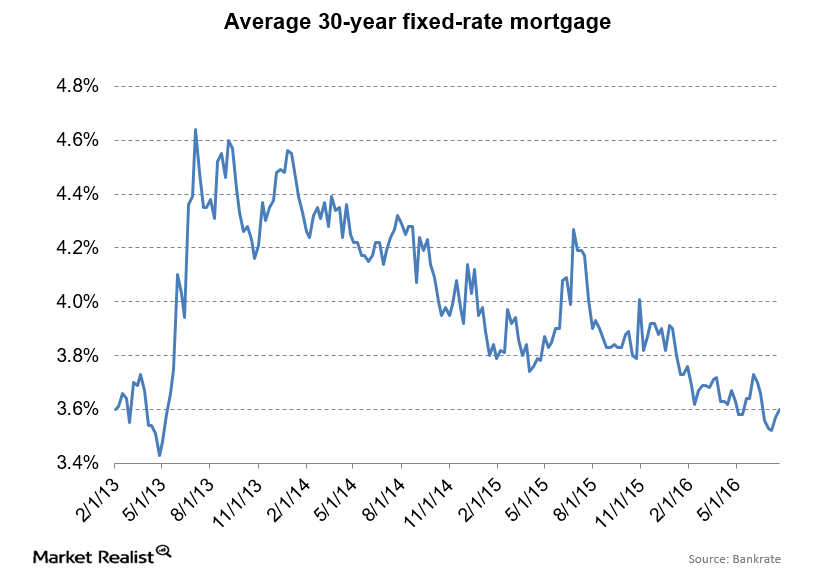

Mortgage Rates Didn’t Move despite a Volatile Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen in the past month, while mortgage rates have been steady.

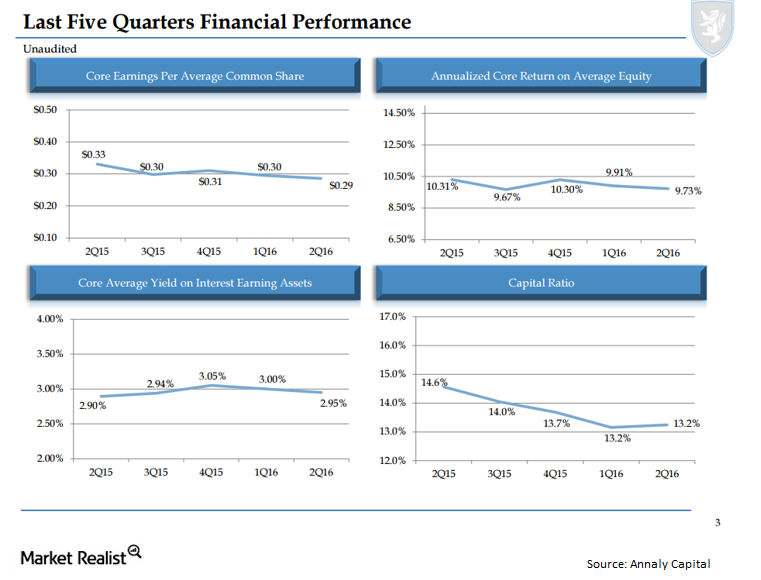

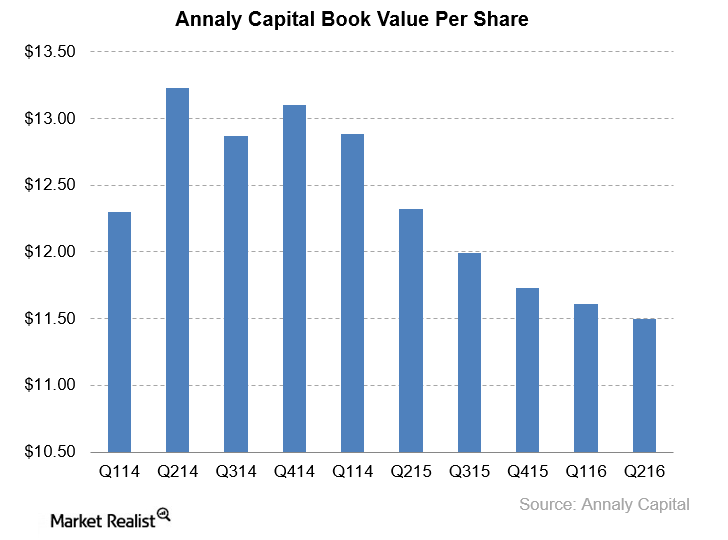

What’s Annaly Capital’s Take on the Bond Market’s Volatility?

Annaly positioned itself to reduce its interest rate risk and increase its credit risk. Since 2009, global bond markets have risen in value by about $17 trillion.

How’s Annaly Capitalizing on Commercial Real Estate?

By investing in commercial real estate, Annaly Capital is increasing its returns. At the same time, it’s taking on credit risk.

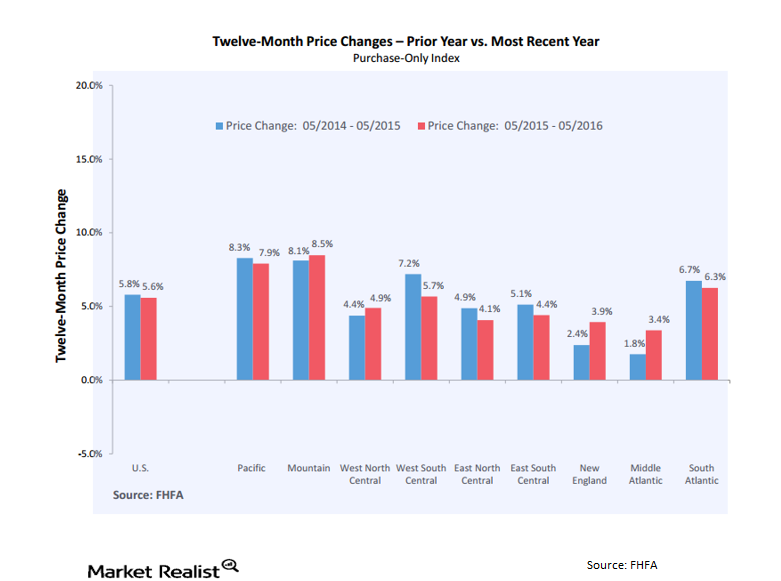

Real Estate Market Hot in the West, Cold in the Northeast

Home prices in the Pacific and Mountain states have outperformed prices in the rest of the country over the past two years.

Mortgage Rates Rise with the Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen over the past month, while mortgage rates have been steady.

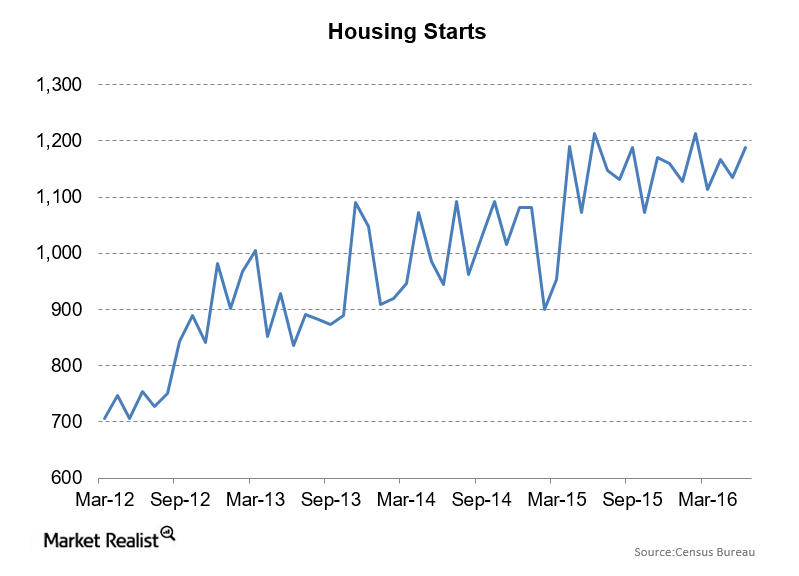

Why Do Housing Starts Remain Muted?

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

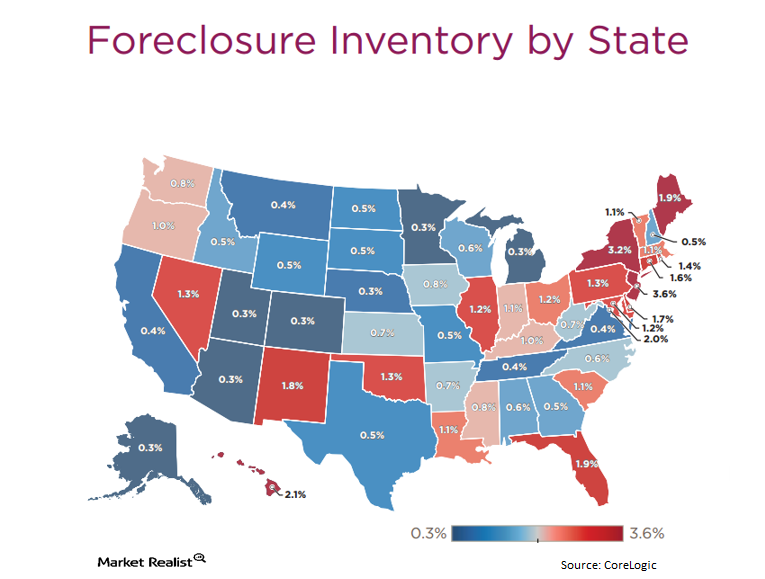

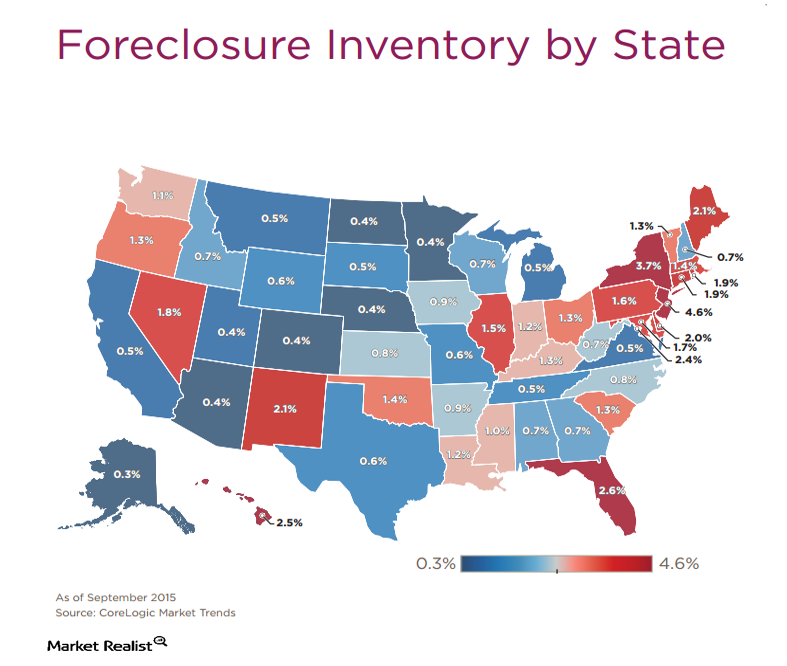

Why Are State Foreclosure Laws Important?

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process.

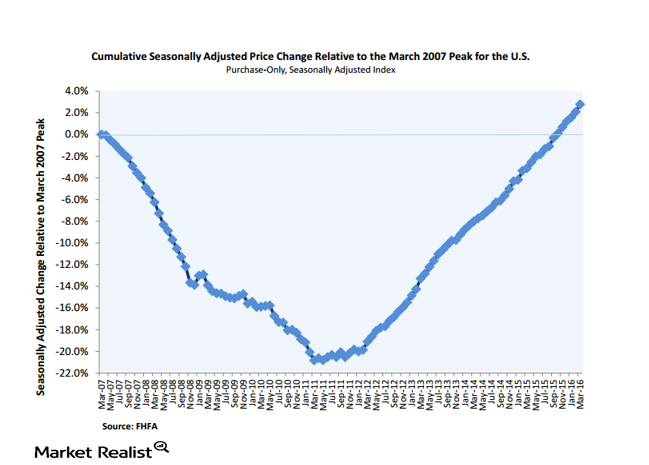

Why Is the Median Income to Median Home Price Ratio Elevated?

The recent 5.5% year-over-year gain for home prices has put the FHFA House Price Index about 3% above its April 2007 level.

Why Home Price Appreciation Differs from State to State

In the judicial states, particularly New York, New Jersey, and Connecticut, we’re seeing much lower home price appreciation.

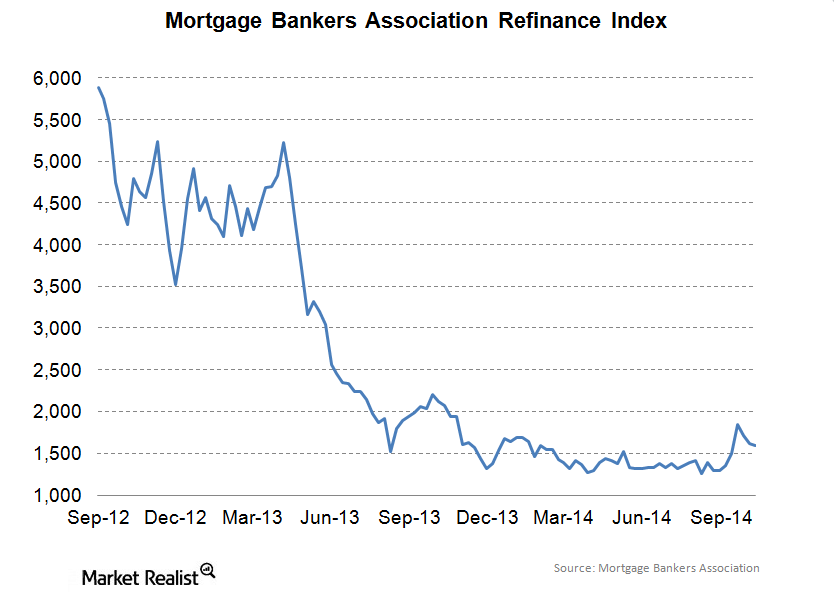

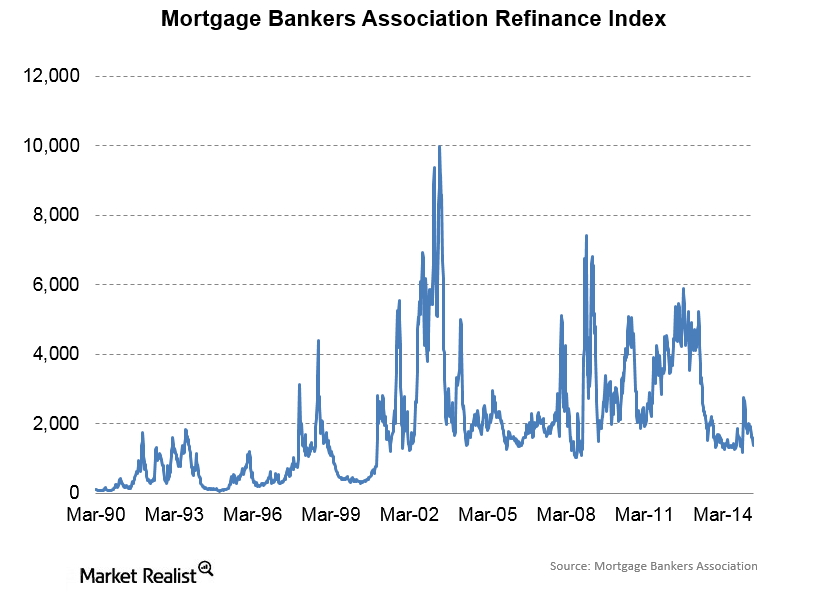

Mortgage Refinances Are Hit by Prepayment Burnout

Refinancing activity affects prepayment speeds. Prepayment speeds occur because homeowners are allowed to pay off their mortgages early and without penalty.

REIT Outlook: Fannie Mae Securities Close at 104 1/32

Fannie Mae TBAs started the week at 104 15/32 and gave up 7/16 to close at 104 1/32. The ten-year bond yield increased by 7 basis points.

Annaly CEO Wellington Denahan shares her vision for the future

On the company’s conference call to analysts and investors, Annaly CEO Wellington Denahan addressed the current interest rate environment and where she saw the company heading in the future.

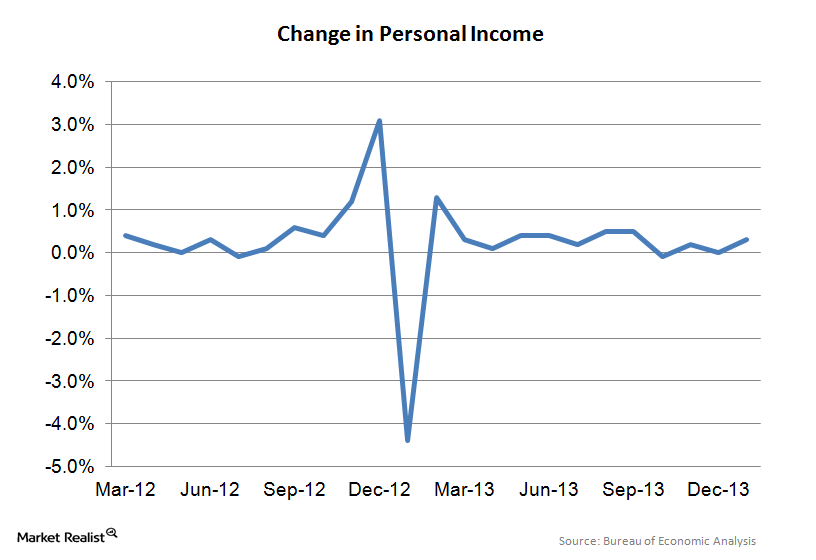

Important releases for homebuilder and REIT investors this week

While last week was a huge one for the builders, we still have a lot of important data this week, with the Case-Shiller Real Estate Index, New Home Sales, as well as the Personal Spending and Income data.