American Electric Power Company Inc.

Latest American Electric Power Company Inc. News and Updates

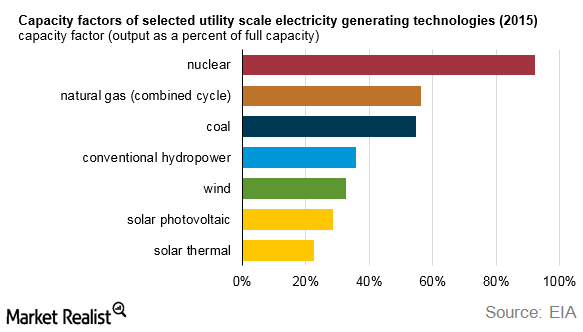

Energy Sources: Capacity Factor and Capacity Additions

Capacity additions in wind power have been quite volatile over the past few years due to uncertainty over tax incentive policies.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.

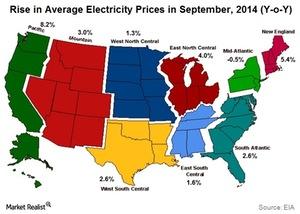

New England and the Pacific are great regions to produce power

The US is divided into nine divisions. The Pacific and New England divisions had the highest year-over-year, or YoY, growth in electricity prices in September 2014.

Is Joe Biden’s Green New Deal Really Feasible?

Joe Biden has proposed a climate change framework that aims to zero down on carbon emissions and create millions of new jobs by 2050.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

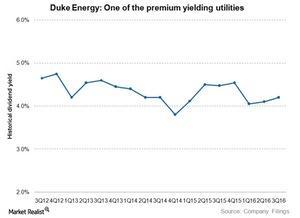

Why Does Duke Energy Yield Better Than the Industry Average?

Duke Energy is one of the highest-yielding S&P 500 Utilities stocks. Its large regulated operations fetch stable earnings and offer stable dividends.

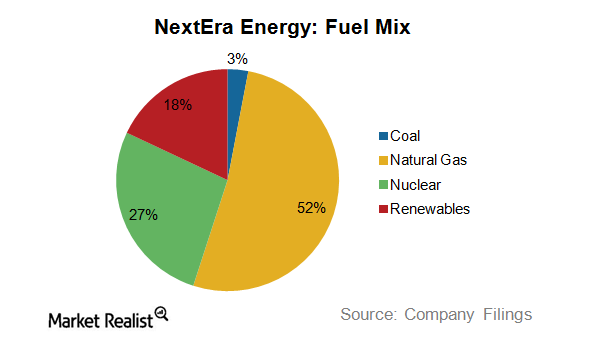

NextEra Energy Seeks Capacity Addition Using Renewables

NEE is further expanding its renewables footprint. In 9M15, it added 225 megawatts of wind capacity and 115 megawatts of solar generation capacity.

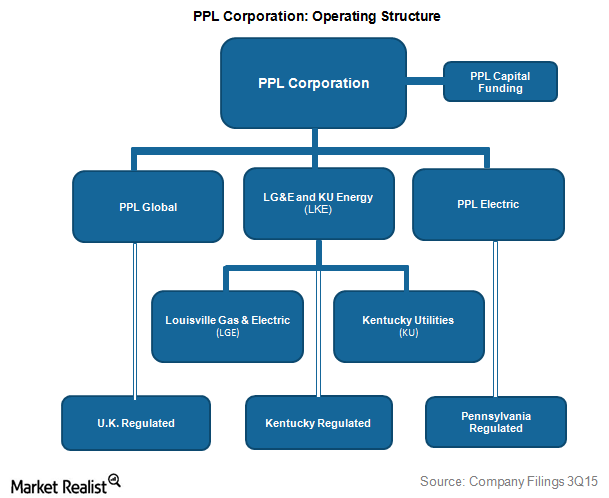

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

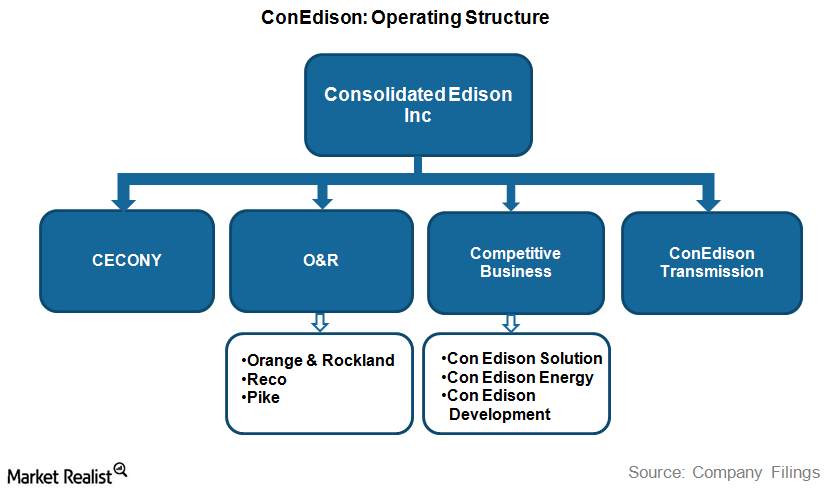

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

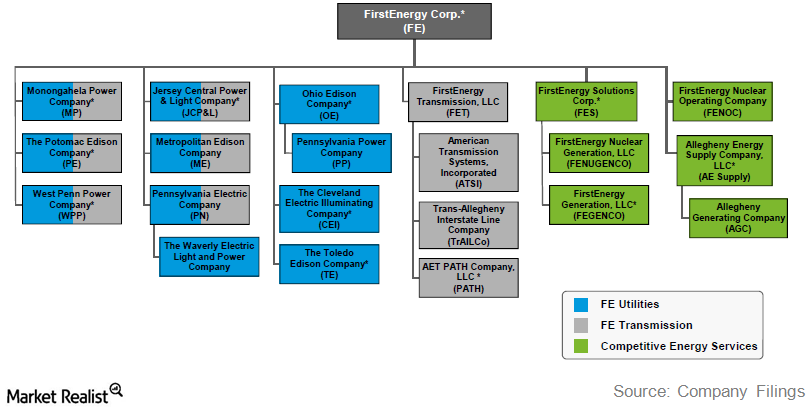

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

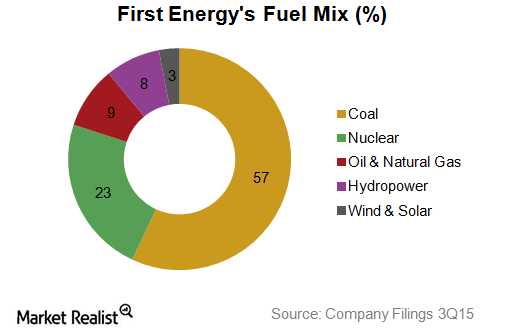

FirstEnergy Relies Heavily on Coal for Power Generation

FirstEnergy generates power from a diverse mix of primary energy sources but is primarily dependent on coal, which accounts for 57% of its power generation.

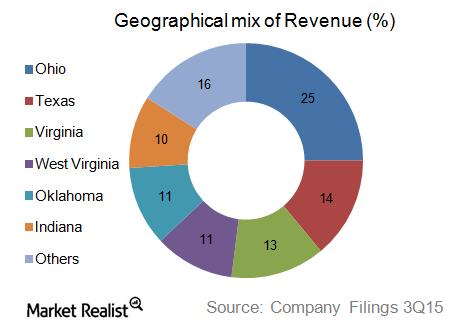

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

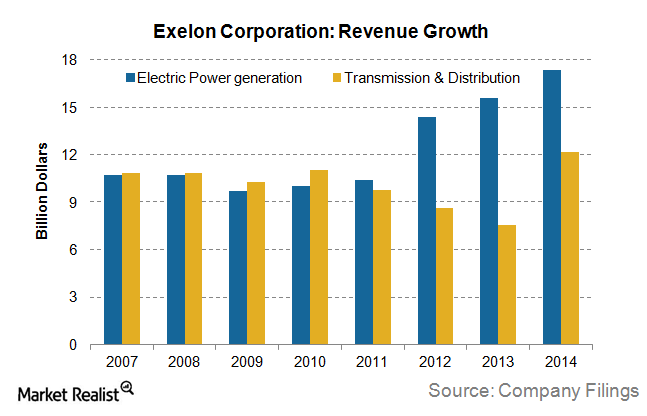

Analyzing Exelon’s Key Revenue Drivers

Demand growth for electricity in the last decade has been sluggish due to increasingly energy-efficient devices and equipment.

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.

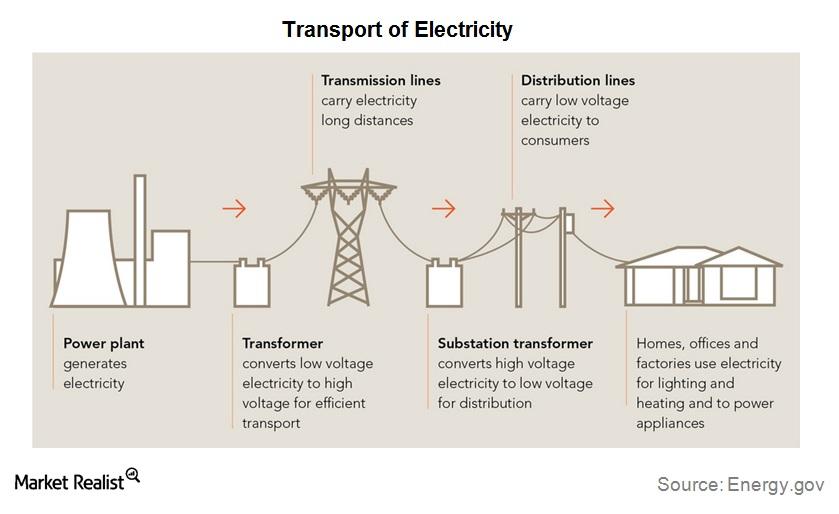

Must-know: The supply chain delivers electricity

The industry’s supply chain consists of three broad categories—generation, transmission, and distribution. Power generation requires a fuel source—for example, coal, nuclear, natural gas, or wind—and a power plant to convert the fuel source into electricity.