Agilent Technologies Inc.

Latest Agilent Technologies Inc. News and Updates

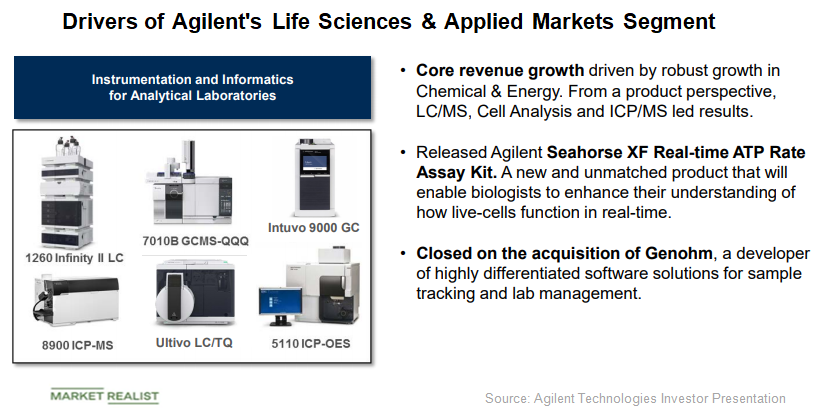

What’s Driving Agilent Technologies’ Segment Growth?

Agilent Technologies’ (A) Life Sciences and Applied Markets segment had revenues of $510 million in Q3 2017 compared to $540 million in Q3 2018.

Agilent Technologies: Its Acquisition Spree in 2018

Agilent Technologies (A) has been on an acquisition spree in 2018 with major acquisitions made until the third quarter.

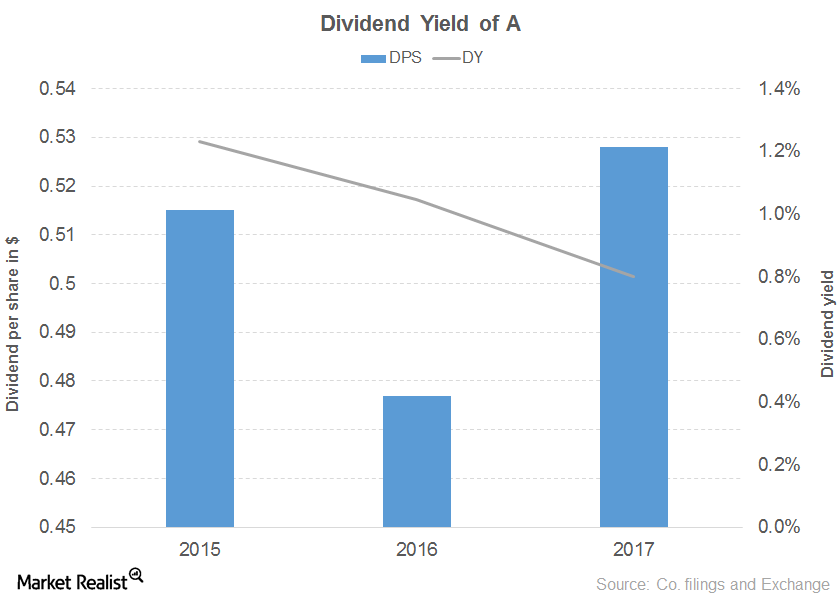

Agilent Technologies’ Downward Sloping Dividend Yield Curve

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much.

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

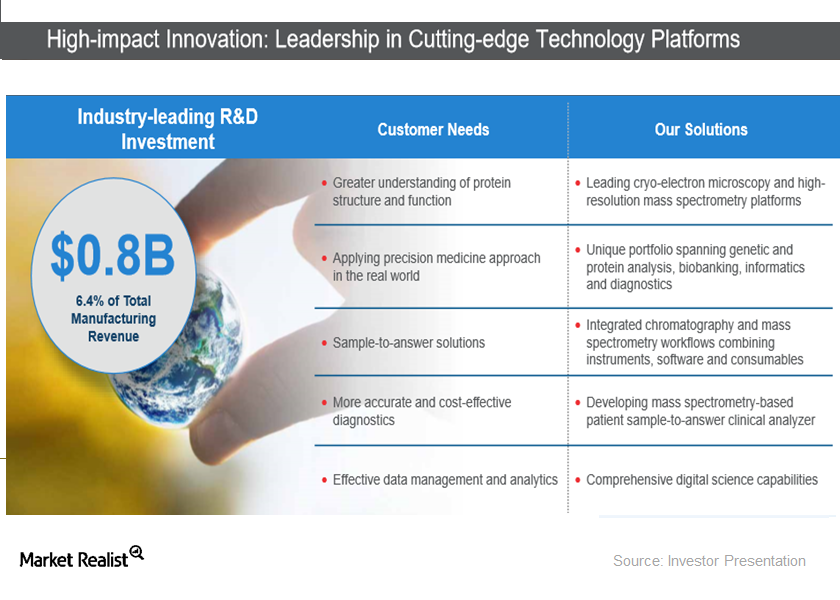

Understanding Thermo Fisher’s Growth Strategy

Thermo Fisher Scientific (TMO) has always focused on innovation as a key growth strategy.

Thermo Fisher Scientific’s Key Growth Strategy

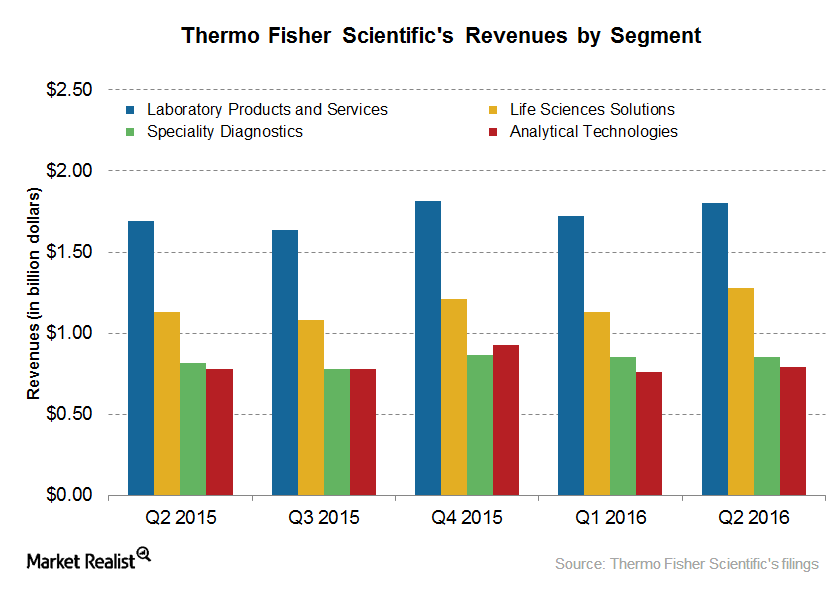

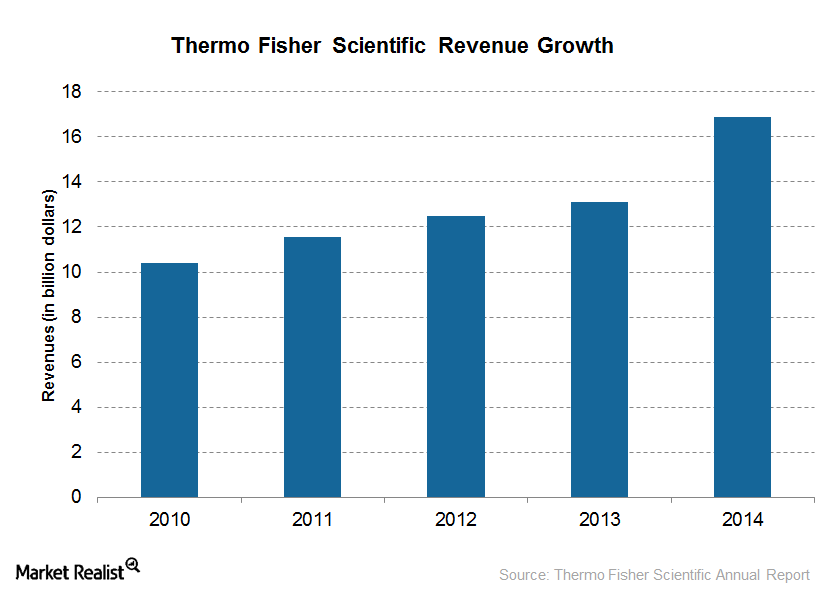

Thermo Fisher Scientific reported ~$4.5 billion in revenues in 2Q16, representing YoY (year-over-year) growth of ~6%.

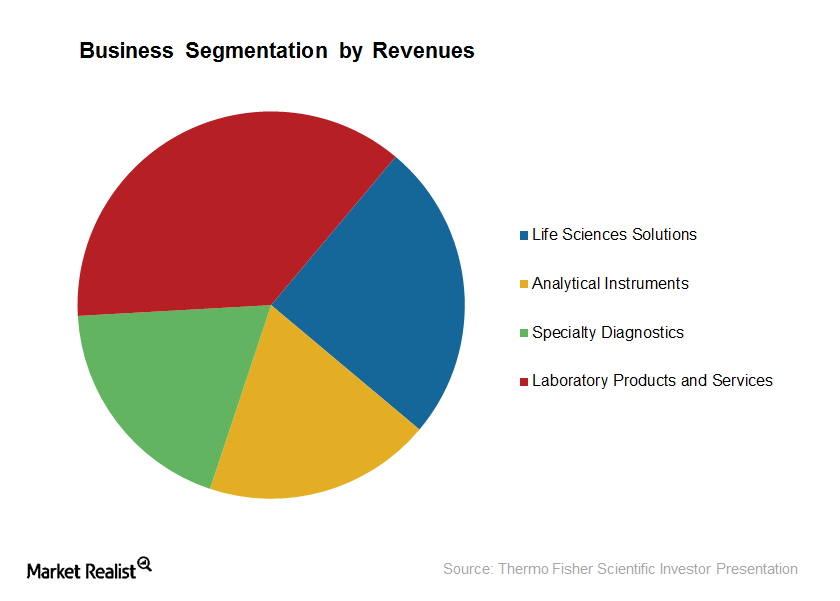

An Overview of Thermo Fisher Scientific’s Business Model

Thermo Fisher Scientific (TMO) has made a number of acquisitions over the years, resulting in the expansion of the company’s product portfolio with the inclusion of a number of premium brands.

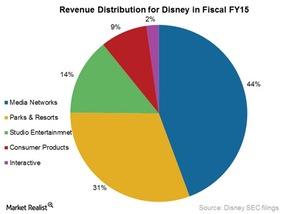

Disney’s Business Segments: Expectations for Fiscal 2016

Disney’s Media Networks segment was the biggest contributor to its revenue at 44% with segment revenues of $23.3 billion in fiscal 2015.

Thermo Fisher Scientific’s Analytical Instruments Business Segment

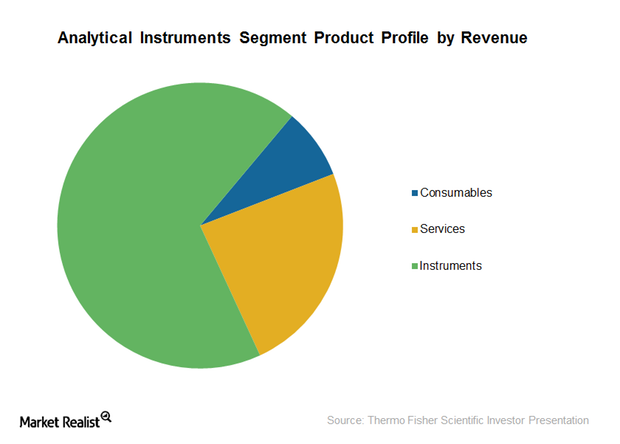

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

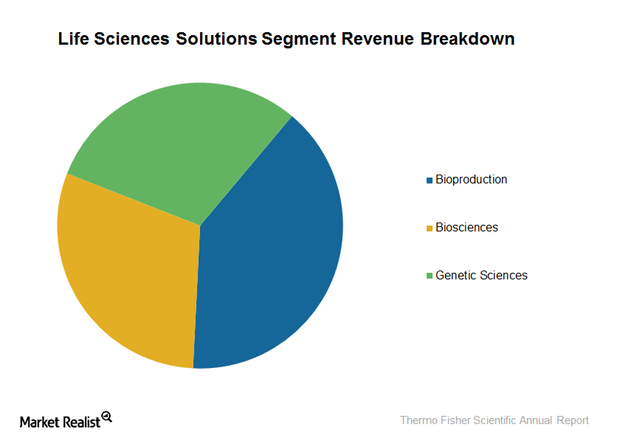

The Life Sciences Solutions Segment of Thermo Fisher Scientific

Thermo Fisher Scientific’s Life Sciences Solutions segment earned revenues of ~$4.2 billion in 2014, representing organic growth of around 4%.

Thermo Fisher Scientific: A Leading Medical Technology Company

Thermo Fisher Scientific (TMO) is one of the leading medical technology companies in the world, providing a broad portfolio of laboratory equipment and services.

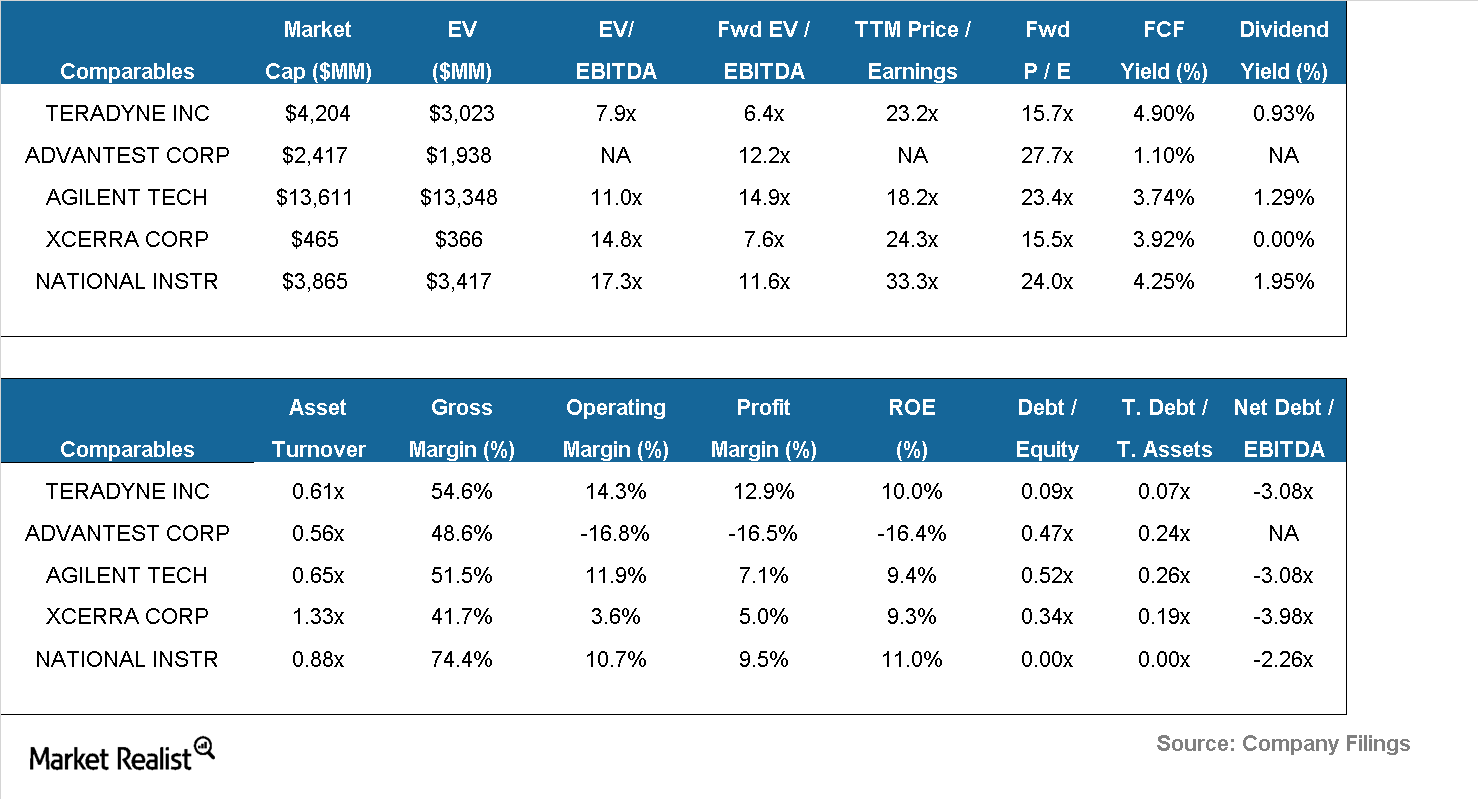

Is Teradyne fairly valued relative to its peers?

Presently, ten analysts have given Teradyne a buy rating, and four have issued a neutral rating, for a consensus target price of $22.17.

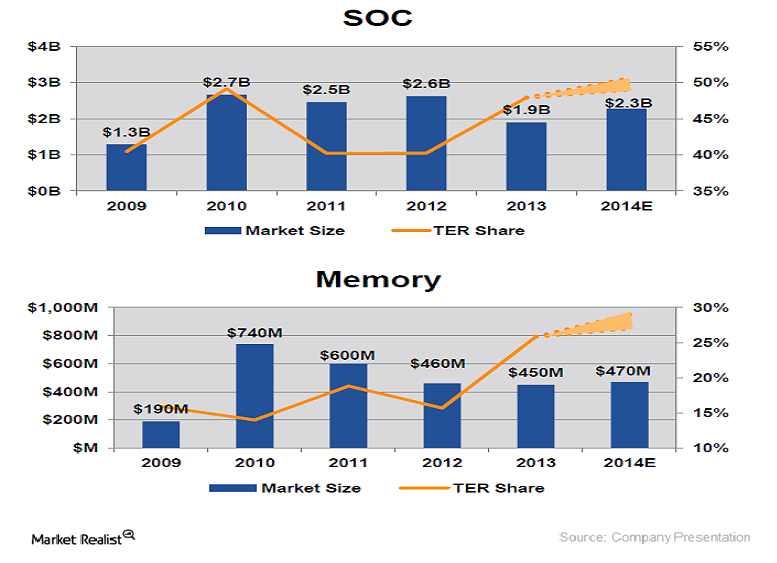

Teradyne boasts encouraging market share gains

Teradyne has about 26% share of the $470-million memory testing market. The company expects to gain 3 to 5 points of share this year.