Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

Nov. 20 2020, Updated 3:46 p.m. ET

Energy stocks

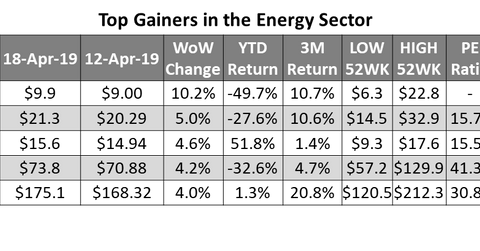

In the week ending on April 18, oilfield service stock McDermott International (MDR) rose the most among the stocks in the energy space. The stocks are included in the following ETFs:

A few foreign-headquartered integrated energy companies listed in the United States, including Imperial Oil (IMO) and China Petroleum & Chemical (SNP), are also on our list of energy stocks.

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29. Based on analysts’ consensus estimates, the company might report an adjusted net income of $0.07 per diluted share compared to an adjusted loss of $1.55 per share in the previous quarter. On April 16, McDermott International’s stock prices rose 12.5%. In a press release on April 15, the company said, “MDR and its joint venture partner, Chiyoda International Corporation, a U.S.-based wholly-owned subsidiary of Chiyoda Corporation, Japan, today announced that Train 1 of the Cameron LNG project in Hackberry, La., has reached the final commissioning stage.”

Other strong performers

Core Laboratories (CLB) had the fourth-highest increase in the energy space. On April 24, Core Laboratories is scheduled to announce its first-quarter earnings results. The company might report a whopping ~60% upside compared to the fourth quarter of 2018—based on analysts’ consensus estimates.

Parsley Energy (PE) and Pioneer Natural Resources (PXD) were the second and fifth-largest gainers among energy stocks in the last five trading sessions. Chevron and Anadarko Petroleum’s deal on April 12 expands Chevron’s presence in the Permian Basin. The deal might have pushed these upstream stocks higher. Pioneer Natural Resources and Parsley Energy are among the top eight oil and gas producers in the Permian Basin. Early in May, these two upstream stocks are scheduled to report their first-quarter earnings results, which might have kept investors’ confidence higher in these stocks.

Petrobras (PBR) was the third-largest gainer among energy stocks last week.