Core Laboratories NV

Latest Core Laboratories NV News and Updates

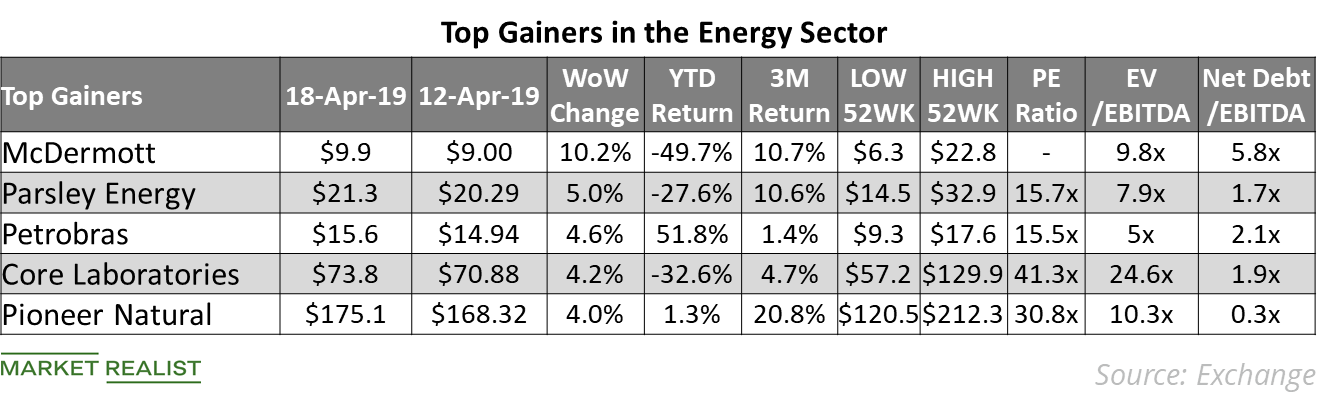

Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

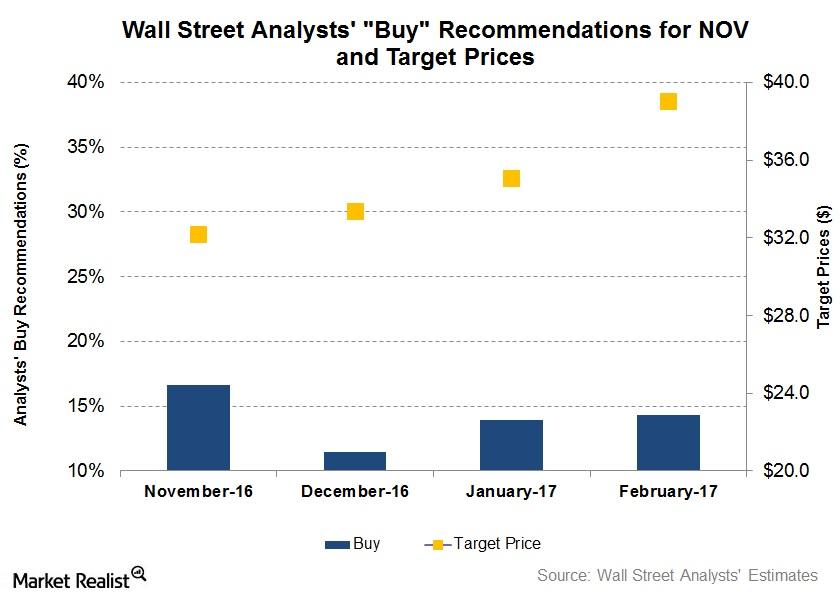

Wall Street Analysts’ Forecasts for National Oilwell Varco

On February 24, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy,” ~74% rated it as a “hold,” and 12% rated it as a “sell.”

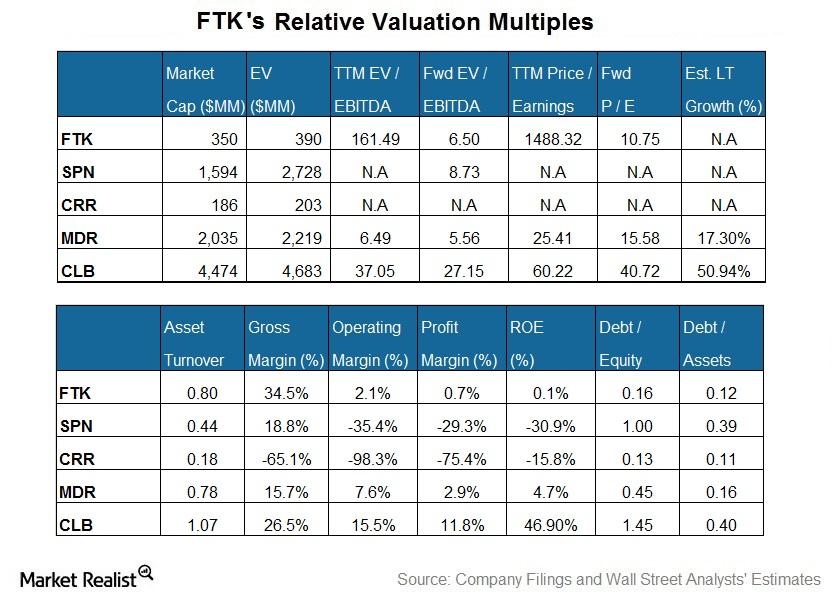

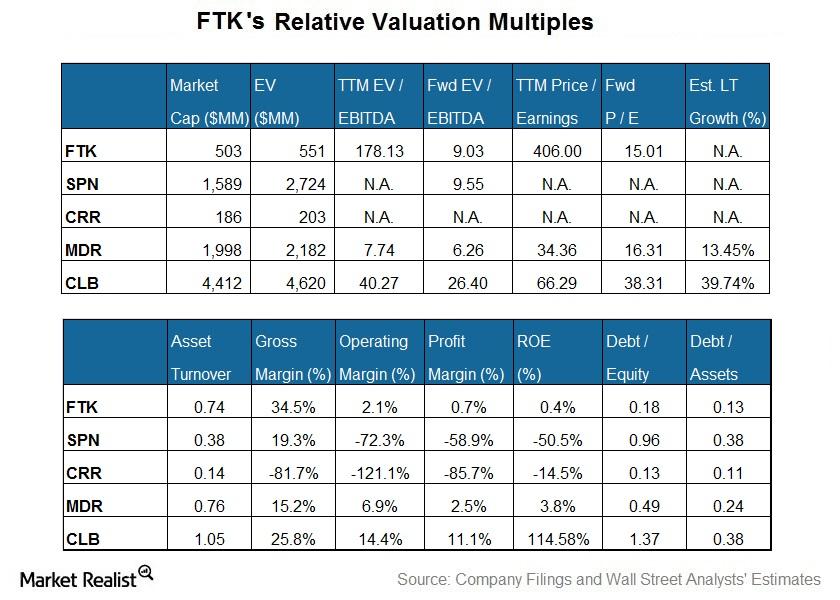

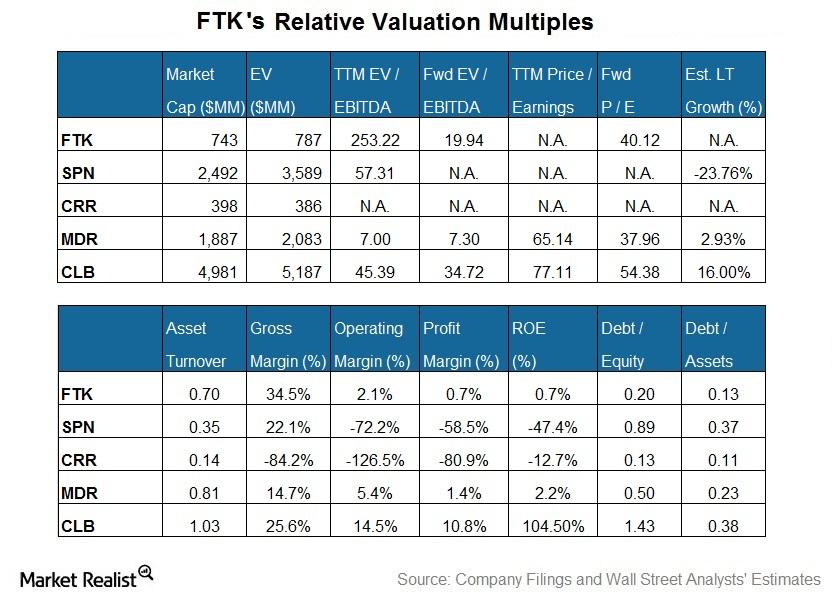

Flotek Industries’ Current Valuation versus Its Peers

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

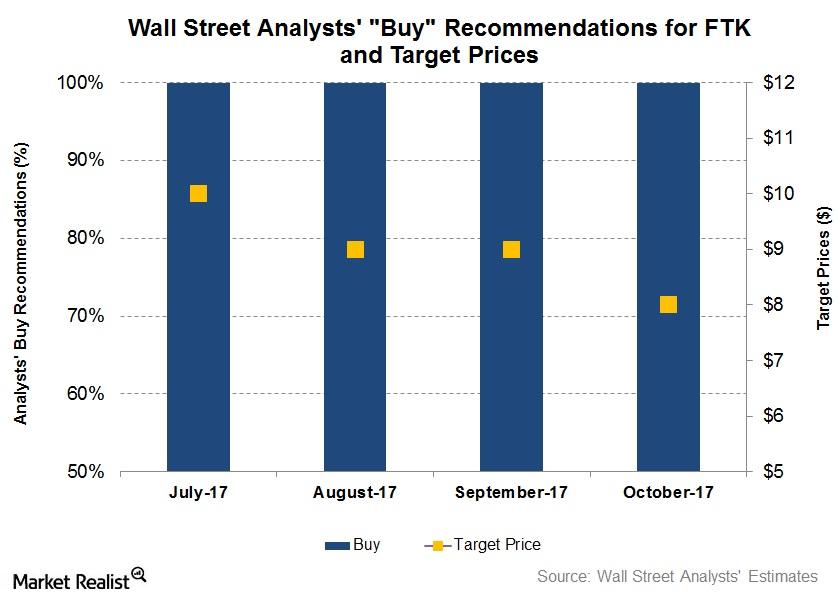

Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

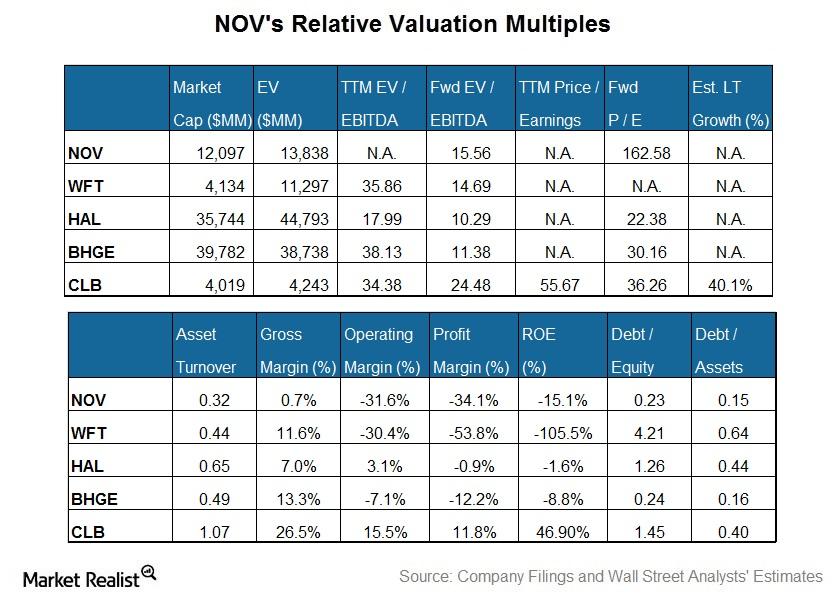

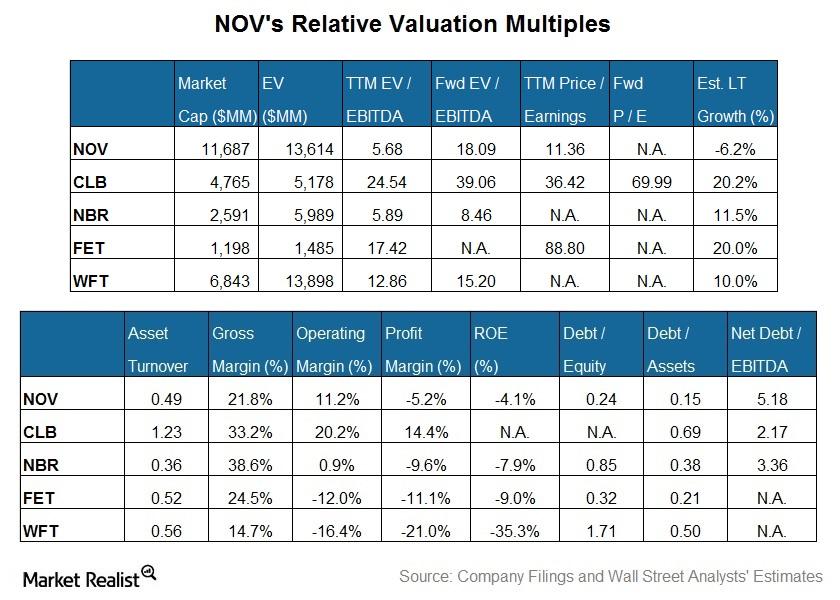

National Oilwell Varco’s Valuation Compared to Its Peers

National Oilwell’s valuation, expressed as the TTM PE (price-to-earnings) multiple, isn’t available due to its negative adjusted earnings.

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

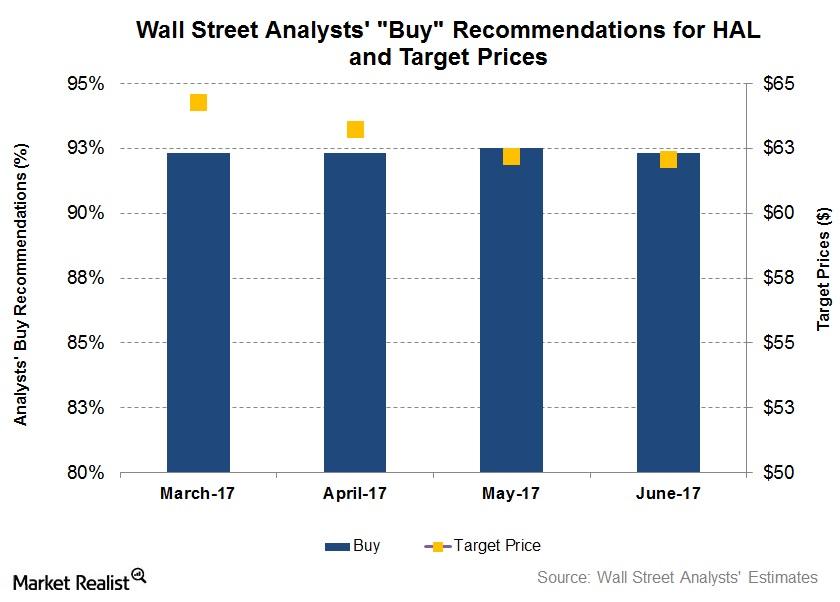

Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

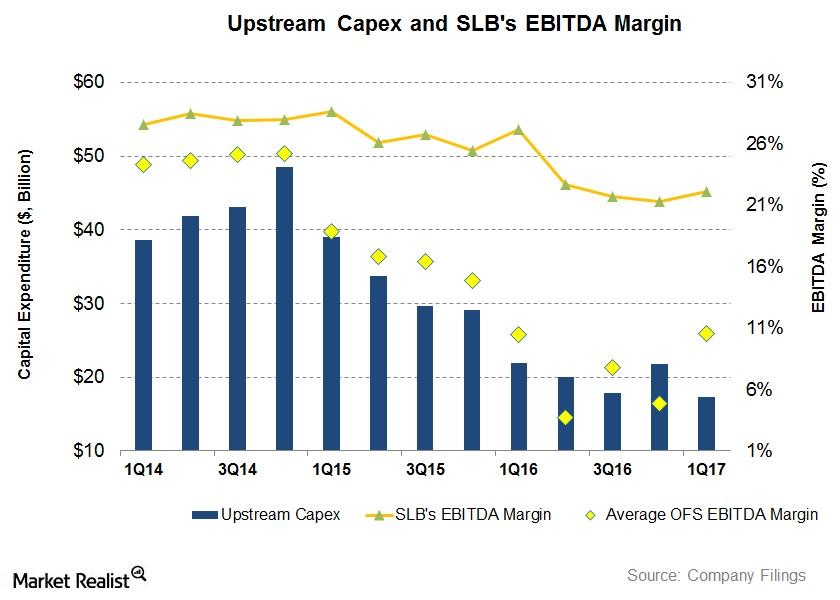

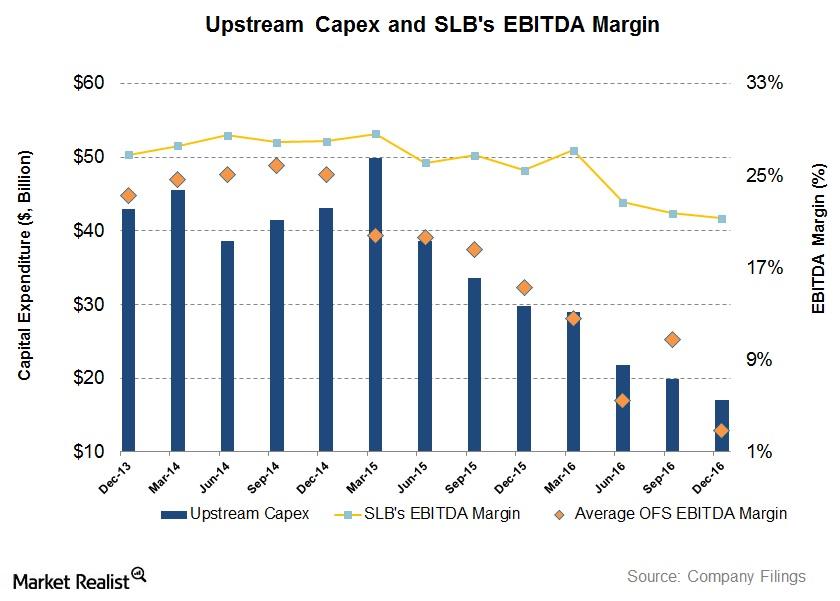

Upstream Operators’ Capex Could Impact Schlumberger’s Margin

Schlumberger’s EBITDA margin was impacted negatively as upstream companies slashed their budgets. From 1Q16 to 1Q17, Schlumberger’s EBITDA margin fell.

How Flotek Industries Is Valued versus Peer Stocks

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

Will Upstream Operators’ Capexes Affect SLB’s 1Q17 Margin?

In the past couple of years, some major US upstream and integrated companies have reduced their capital expenditures (capex) following crude oil’s sharp fall.

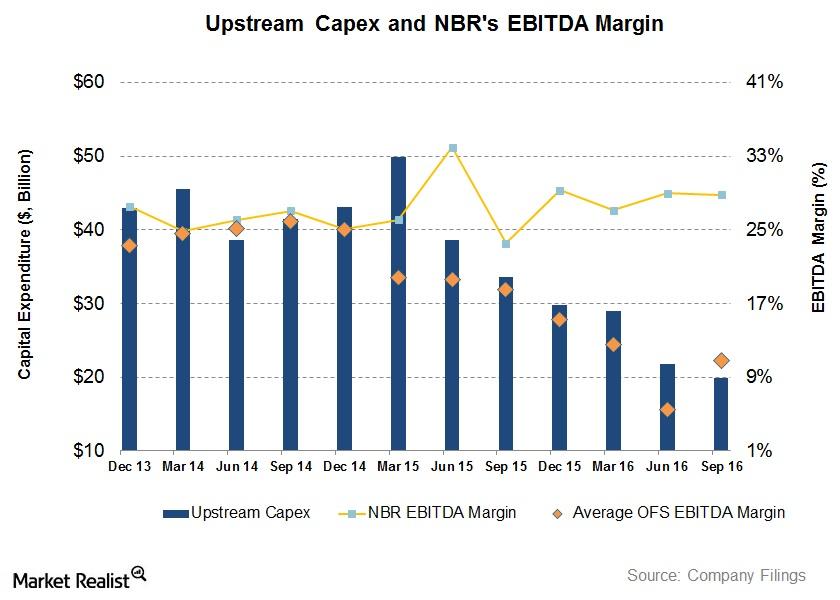

Will Upstream Operators’ Capex Affect Nabors’ 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline.

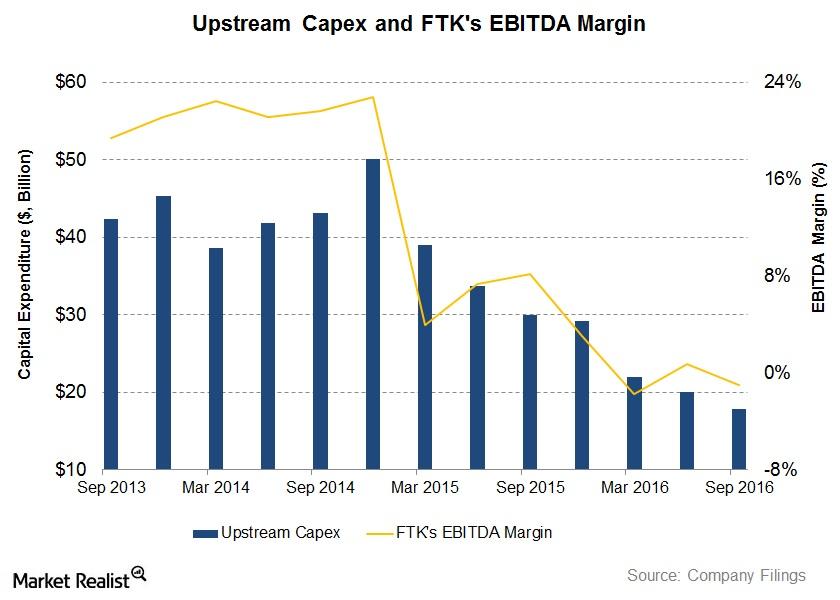

Will Upstream Operators’ Capex Affect Flotek’s 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline.

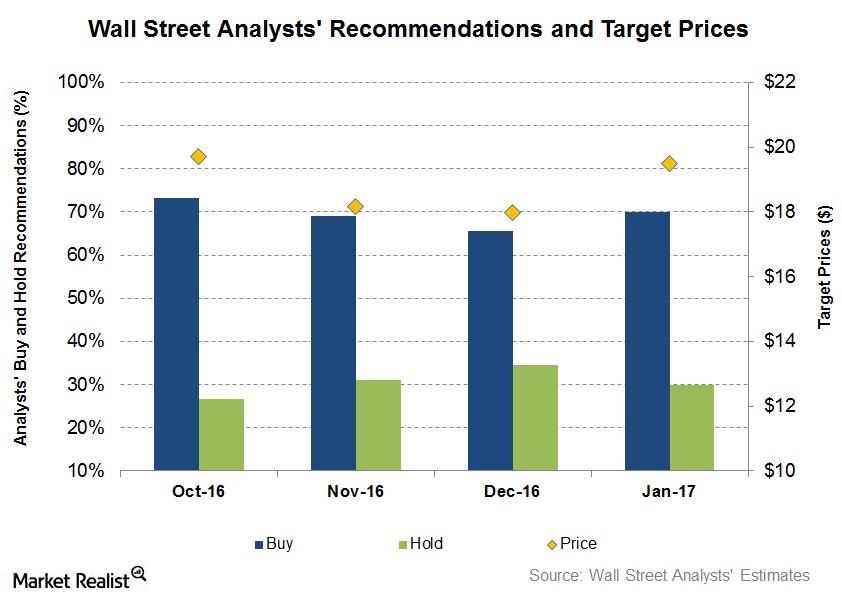

How Have Superior Energy’s Recommendations Changed before the 4Q16 Earnings?

On January 6, 2017, ~70% of the analysts tracking SPN recommended a “buy” or some equivalent for the stock, while ~30% of the analysts issued a “hold.”

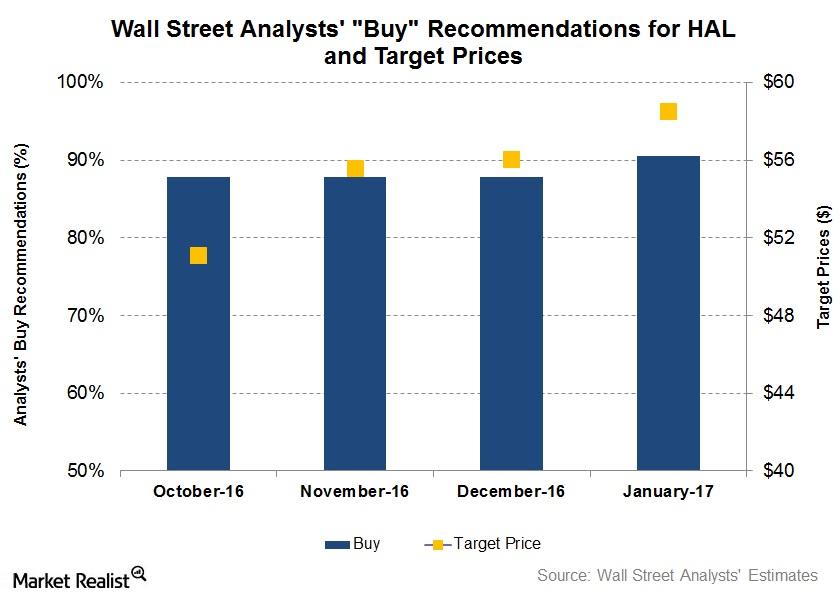

Wall Street’s Forecasts for Halliburton before Its 4Q16 Earnings

On January 3, 2017, 90% of the analysts tracking Halliburton (HAL) rated it a “buy” or some equivalent.

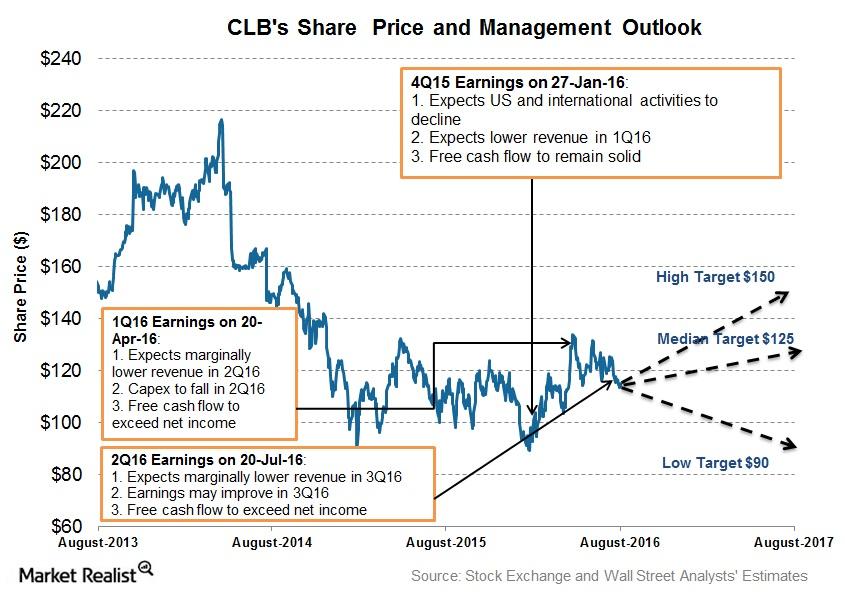

Inside Core Laboratories’ Management Projections for 3Q16

Core Laboratories expects onshore energy production to fall by the end of 2016 and net production of legacy deepwater projects to offset onshore declines.

What Is NOV’s Valuation Compared to Its Peers’?

NOV’s enterprise value, when scaled by trailing-12-month adjusted EBITDA, is lower than the peer average.

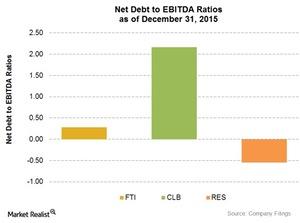

Analyzing the Net-Debt-to-EBITDA Ratios of 4 Major Mid-Cap OFS Companies

In fiscal 2015, RPC’s (RES) net-debt-to-EBITDA ratio stood at -0.54, down from the 0.34 it saw in 2014. The company’s long-term debt stood at zero in 2015.