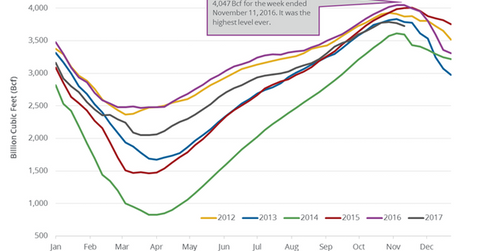

US Natural Gas Inventories Have Fallen 8% from Last Year

The EIA estimated that US natural gas inventories fell by 46 Bcf (billion cubic feet) or 1.2% to 3,726 Bcf on November 10–17, 2017.

Nov. 24 2017, Updated 9:15 a.m. ET

EIA’s natural gas inventories

The EIA (U.S. Energy Information Administration) released its “Weekly Natural Gas Storage Report” on November 22, 2017, at 12:00 PM EST. It estimated that US natural gas inventories fell by 46 Bcf (billion cubic feet) or 1.2% to 3,726 Bcf on November 10–17, 2017. Inventories have fallen by 319 Bcf or 7.8% from the same period in 2016.

The markets expected that US natural gas inventories would have fallen by 51 Bcf on November 10–17, 2017. A less-than-expected withdrawal in natural gas inventories weighed on US natural gas (UNG) (GASL) (FCG) prices on November 22, 2017.

US natural gas futures are near a one-month low. Lower gas (UNG) (UGAZ) prices have a negative impact on gas producers (IXC) (FENY) like WPX Energy (WPX), EOG Resources (EOG), Southwestern Energy (SWN), and Gulfport Energy (GPOR).

US natural gas inventories

Moves in US gas inventories for the storage regions on November 10–17, 2017, are mentioned below:

- East fell by 24 Bcf to 891 Bcf

- Midwest fell by 18 Bcf to 1,090 Bcf

- Mountain was flat at 220 Bcf

- Pacific fell by 1 Bcf to 314 Bcf

- South Central fell by 3 Bcf to 1,211 Bcf

Impact

US natural gas inventories are 3.1% below their five-year average for the week ending November 17, 2017. However, they were 21% above the five-year average in March 2017. Inventories rebalanced towards historical average levels. Any fall in US gas inventories is bullish for US natural gas (UGAZ) (BOIL) prices.

Next, we’ll focus on US natural gas rigs.