EIA Upgrades US Natural Gas Production for 2018

US dry natural gas production was flat at 76.1 Bcf (billion cubic feet) per day on December 7–13, 2017, according to PointLogic.

Dec. 15 2017, Updated 11:00 a.m. ET

Weekly US natural gas production

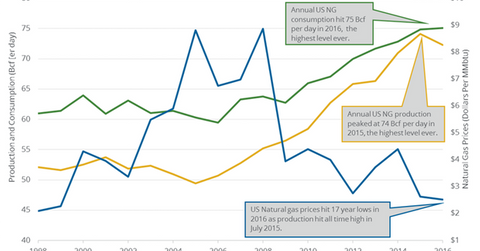

US dry natural gas production was flat at 76.1 Bcf (billion cubic feet) per day on December 7–13, 2017, according to PointLogic. Production increased by 6.1 Bcf per day or 8.7% YoY (year-over-year). The YoY increase in US natural gas production will pressure natural gas (DGAZ) (FCG) prices. US natural gas (UNG) prices have fallen ~25% year-to-date due to mild weather and oversupply. Higher crude oil (UWT) oil prices will also add to natural gas supplies.

Weekly US natural gas consumption

US natural gas consumption rose by 19.5 Bcf per day to 91.4 Bcf per day on December 7–13, 2017. Consumption rose 27% week-over-week and by 2.4 Bcf per day or 2.7% YoY. The rise in consumption from the power sector led to the rise in natural gas consumption during this period. Any rise in consumption is bullish for natural gas (BOIL) prices.

Moves in natural gas (UNG) prices impact energy producers (IXC) (IYE) like Gulfport Energy (GPOR), WPX Energy (WPX), and Cabot Oil & Gas (COG).

Impact

The EIA released its monthly STEO (Short-Term Energy Outlook) report on December 12, 2017. It estimates that US natural gas production could average 79.7 Bcf per day in 2018, which is 1% higher than the STEO report in November. It also estimates that consumption will average 76.9 Bcf per day in 2018. Production could surpass consumption in 2018, which would pressure natural gas (GASL) prices. However, a rise in exports would restrict the impact of excess supply.

In the final part in this series, we’ll discuss natural gas prices’ key drivers next week.