Analyzing Iran’s Crude Oil Production and Export Plans

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016.

June 20 2017, Published 10:26 a.m. ET

Iran’s crude oil production

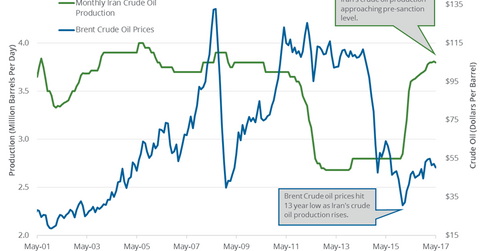

Iran is the third-largest crude oil producer among OPEC countries. The U.S. Energy Information Administration estimates that Iran’s crude oil production fell by 10,000 bpd (barrels per day) or 0.3% to 3.8 MMbpd (million barrels per day) in May 2017—compared to the previous month. Production rose 5.5% year-over-year.

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016. High production from Iran could weigh on oil (IEZ) (RYE) (VDE) prices. Lower crude oil prices have a negative impact on oil and gas producers like SM Energy (SM), Apache (APA), and Noble Energy (NBL).

Iran’s crude oil exports

Iran exported 2.1 MMbpd of crude oil in May 2017. Iran mainly exports crude oil to South East Asia. It plans to increase its exports to Africa and northern Europe in the coming months.

Iran and OPEC’s production cut deal

Iran’s crude oil production fell in May 2017 due to the production cut deal. According to the production cut deal, Iran can pump 3.8 MMbpd of crude oil until 1Q18. After the production cut deal expires in 1Q18, Iran will ramp up production.

Iran’s crude oil production plans

Iran’s crude oil production averaged 3.5 MMbpd and 2.8 MMbpd in 2016 and 2015, respectively. Iran’s oil minister plans to increase the country’s oil production by 700,000 bpd to 4.7 MMbpd by 2021. The expectation of a rise in production from Iran over the long term could weigh on oil (PXI) (USL) prices.

In the next part of this series, we’ll see how Libya’s crude oil production impacts crude oil prices.