US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

Oct. 9 2019, Updated 9:00 p.m. ET

Hedge funds

The CFTC released its weekly “Commitment of Traders” report on January 5, 2018. According to the CFTC report, hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018—near the lowest level in the last 12 months. It suggests that hedge funds were bearish on US natural gas (GASL) (BOIL) prices.

Lower gas (UNG) prices have a negative impact on energy producers’ (RYE) (VDE) profitability like Antero Resources (AR), Rex Energy (REXX), and WPX Energy (WPX).

Moving averages

US natural gas (UGAZ) futures contracts for February delivery were above their 20-day moving averages on January 5, 2018. However, February US natural gas (GASL) futures contracts were below their 50-day and 100-day moving averages on January 5, 2018. Prices fell 5.3% last week. The bearish momentum could push natural gas prices lower this week.

Natural gas futures drivers

A larger-than-expected withdrawal in US natural gas inventories compared to the historical averages could support natural gas prices this week. Any fall in natural gas production could also support prices. However, moderate weather could pressure natural gas (UNG) prices.

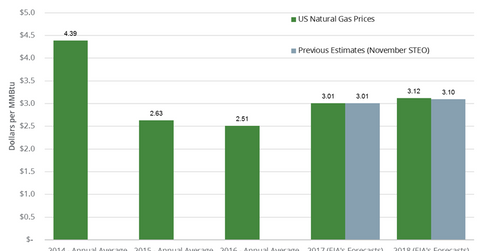

EIA’s forecast

US natural gas prices will average $3.12 per MMBtu in 2018, according to the EIA. The World Bank forecast that US natural gas prices could average $3.1 per MMBtu in 2018. The expectation of a rise in US natural gas demand and exports will support natural gas prices in 2018.

Read Most Important Threat for Crude Oil Prices in 2018 for the latest updates on crude oil.