These Energy Commodities Rose This Week

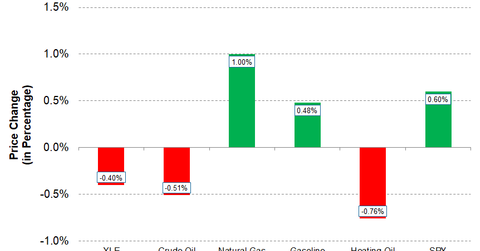

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE) has fallen ~0.4% this week.

Jan. 19 2018, Published 7:55 a.m. ET

Natural gas moving up

For the week starting January 15, 2018, natural gas (UGAZ) (DGAZ) (BOIL) prices increased from last week’s close of $3.20 per MMBtu (million British thermal units) on January 12 to $3.23 per MMBtu on January 17, an increase of almost 1%. However, crude oil prices are down ~0.5% from last week’s close of $64.30 per barrel to $63.97 per barrel on January 17.

Gasoline is up, but heating oil is down

For the week starting January 15, 2018, unleaded gasoline (UGA) prices are up marginally from last week’s close of $1.85 per gallon on January 12 to $1.86 per gallon on January 17, an increase of ~0.5%. Three weeks back, gasoline prices regained their 50-day moving average, which currently stands at $1.76. However, heating oil (UHN) prices are down this week by ~0.8%. Gasoline and heating oil prices impact refining companies (CRAK).

Energy stocks

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE), which represents an index of stocks across the energy sector, decreased by ~0.4%.

Stocks that are leading the decline in XLE are Range Resources (RRC), TechnipFMC (FTI), and Chesapeake Energy (CHK). These stocks are down by ~4.6%, ~4.4%, and ~3.2%, respectively, this week. In general, for the week starting January 15, XLE is underperforming the SPDR S&P 500 ETF (SPY). As of January 17, SPY increased ~0.6% this week.

In this series

In this series, we’ll also look at the performance of energy subsectors. Specifically, we’ll look at the gainers and losers from the refining and marketing and integrated energy sectors. We’ll also analyze any news or developments behind the moves.

Let’s begin with the refining and marketing sector.