The Relationship between Natural Gas–Weighted Stocks and Oil

Natural gas supplies are linked to US crude oil prices. The entire energy sector tends to track oil prices.

Jan. 25 2018, Updated 3:34 p.m. ET

Natural gas–weighted stocks

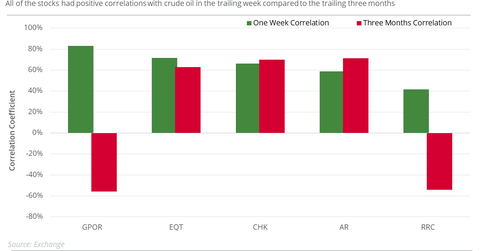

The natural gas–weighted stocks that could run with US crude oil’s (USO) (USL) upside based on the correlations with US crude oil futures between January 17 and January 24, 2018, are:

The same set of natural gas–weighted stocks had the highest correlations with natural gas prices among our list in Part 3. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) contains these energy stocks. These energy stocks operate with at least 60% production mixes in natural gas.

The natural gas–weighted stocks that could be less affected by oil’s upside based on the trailing week’s correlations with US crude oil futures are:

The same set of natural gas–weighted stocks also had the least or the most negative correlations with natural gas prices on our list.

Oil

Natural gas supplies are linked to US crude oil prices. The entire energy sector tends to track oil prices. As a result, most of these natural gas–weighted stocks also followed oil prices in the trailing week based on their correlations.