Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

Oct. 9 2019, Updated 9:24 p.m. ET

Crude oil futures

February WTI crude oil futures (USL) (SCO) contracts fell 0.9% to $63.73 per barrel on January 16, 2018. Brent oil (BNO) futures fell 1.6% to $69.15 per barrel on the same day.

Crude oil (DWT) prices fell due to profit-booking on January 16, 2018. However, oil (UWT) prices are near the highest level since December 2014. It favors funds like the United States Oil ETF (USO), which fell 0.8% to 12.76 on January 16, 2018.

Monthly drilling report

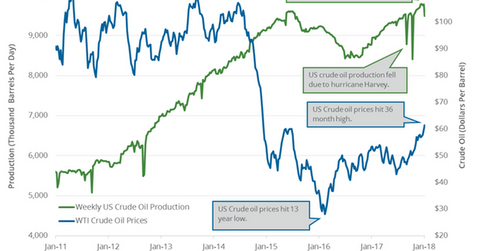

The EIA released the Monthly Drilling Productivity Report on January 16, 2018. It reported that US crude oil production in the seven major shale regions would rise by 111,000 bpd (barrels per day) to 6,549,000 bpd in February 2018—compared to the previous month. It would be the 14th consecutive rise in US shale oil production.

Meanwhile, the weekly US crude oil production has risen 13% since July 2016. The EIA will release weekly crude oil production data on January 18, 2018, for the week ending January 12, 2018. Any rise in US oil production is bearish for oil prices (DBO).

Lower oil (UWT) prices have a negative impact on energy companies (RYE) (VDE) like Gastar Exploration (GST) and Approach Resources (AREX).

Wall Street’s performance

The NASDAQ (QQQ), the S&P 500 (SPY) (SPX-INDEX), and the Dow Jones Industrial Average Index (DIA) declined 0.51%, 0.35%, and 0.04%, respectively, on January 16, 2018. All three of the indexes closed at a record level on January 12, 2018.

The fall in oil (DWT) prices dragged the energy (XLE) sector, which fell 1.2% on January 16, 2018. The energy sector dragged SPY the most on January 16, 2018.

The materials (XLB) and industrials (XLI) sectors fell 1.1% and 0.9% on January 16, 2018. These sectors also dragged SPY on the same day. Eight out of the 11 major sectors in SPY fell on January 16.

Series overview

In this series, we’ll discuss gasoline demand, the US dollar, Iraq’s crude oil production, and some crude oil price forecasts.