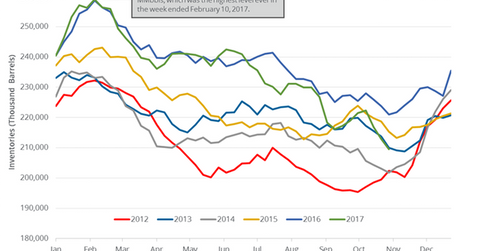

US Gasoline Inventories Hit 3-Year Low

The EIA reported that gasoline inventories in the US fell by 3,312,000 barrels to 209.5 MMbbls (million barrels) between October 27, 2017, and November 3, 2017.

Nov. 9 2017, Published 8:35 a.m. ET

US gasoline inventories

The EIA reported that gasoline inventories in the US fell by 3,312,000 barrels to 209.5 MMbbls (million barrels) between October 27, 2017, and November 3, 2017. Inventories are down 1.6% week-over-week and by 11.4 MMbbls, or 5.2%, compared to the corresponding period in 2016.

Wall Street analysts expected that US gasoline inventories would have fallen 1,938,000 barrels between October 27, 2017, and November 3, 2017. A larger-than-expected decline in gasoline inventories helped US gasoline (UGA) prices. They rose 0.3% to $1.82 per gallon on November 8, 2017. However, US crude oil (OIL) (DWT) (DBO) futures fell on the same day.

US gasoline production and demand

US gasoline production fell by 20,000 bpd (barrels per day) or 0.2% to 10,167,000 bpd between October 27, 2017, and November 3, 2017. Production declined 289,000 bpd or 2.8% from the same period in 2016.

US gasoline demand rose by 35,000 bpd to 9,496,000 bpd between October 27, 2017, and November 3, 2017. The demand rose 283,000 bpd, or 3%, from the corresponding period in 2016.

High gasoline demand drives gasoline prices, which in turn helps crude (USL) (UCO) prices. US crude oil futures are near a 30-month high. Oil and gas producers (VDE) (RYE) (PXI) like Chesapeake Energy (CHK), Chevron (CVX), Sanchez Energy (SN), and Goodrich Petroleum (GDP) benefit from higher oil prices.

Impact of gasoline inventories

The US gasoline inventories are at the lowest level since November 28, 2014. They are also down ~20% from their peak. Inventories are also below their five-year average. Any fall in gasoline inventories could help gasoline and crude oil (SCO) (UWT) prices.

Next, we’ll analyze how US distillate inventories affect oil prices.