OPEC’s Meeting Could Impact US Natural Gas Supply and Prices

PointLogic estimates that US natural gas production rose 0.4% to 75.9 Bcf (billion cubic feet) per day on November 16–22, 2017.

Nov. 24 2017, Published 7:42 a.m. ET

Weekly US natural gas production

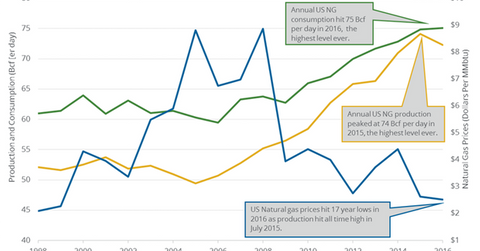

PointLogic estimates that US natural gas production rose 0.4% to 75.9 Bcf (billion cubic feet) per day on November 16–22, 2017. Production has risen 7% from the same period in 2016. High US natural gas production has a negative impact on natural gas (DGAZ) (UNG) prices.

So far, natural (BOIL) (FCG) gas futures trading in NYMEX have fallen ~21% in 2017 mainly due to high gas production. Lower gas prices have a negative impact on energy producers’ (IXC) (IYE) earnings like Southwestern Energy (SWN), EOG Resources (EOG), Newfield Exploration (NFX), and Rice Energy (RICE).

Weekly US natural gas consumption

US natural gas consumption rose 14.2% to 75.2 Bcf per day on November 16–22, 2017. It also rose ~18% from the same period in 2016. High consumption is bullish for natural gas (GASL) (FCG) prices.

OPEC meeting

OPEC’s meeting will be held on November 30, 2017. A Bloomberg survey estimated that OPEC could extend the ongoing production cuts for nine more months. The longer-than-expected extension could push oil (UWT) (USL) prices higher. Higher oil prices would increase US natural gas supplies.

EIA’s US supply and demand forecasts

According to the EIA, US gas production will average 78.9 Bcf per day in 2018. It also forecast that US gas consumption would average 76.8 Bcf per day during the same period.