Crude Oil and Gasoline Inventories Could Impact Crude Oil Futures

December US crude oil (DWT) (DBO) futures contracts fell 0.56% to $56.88 per barrel in electronic trade at 1:10 AM EST on November 8, 2017.

Nov. 8 2017, Published 9:34 a.m. ET

Crude oil futures

December US crude oil (DWT) (DBO) futures contracts fell 0.56% to $56.88 per barrel in electronic trade at 1:10 AM EST on November 8, 2017. Prices fell due to profit-booking—they were trading near a 30-month high. Higher oil prices benefit energy producers (VDE) (IEZ) like ConocoPhillips (COP), PDC Energy (PDCE), Occidental Petroleum (OXY), and Sanchez Energy (SN).

Meanwhile, the December 2017 E-Mini S&P 500 (SPY) futures contracts fell 0.12% to 2,583.75 in an electronic exchange at the same time on November 8, 2017.

API’s crude oil inventory estimates

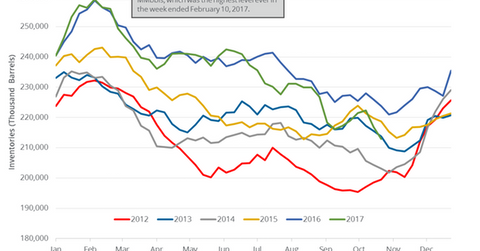

The API (American Petroleum Institute) released its crude oil inventory report on November 7, 2017. It reported that US crude oil inventories fell by 1,562,000 barrels on October 27–November 3, 2017. US crude oil inventories have fallen by 36.8 MMbbls (million barrels) since the beginning of 2017, according to the API.

A Platts survey estimated that US crude oil inventories would have fallen by ~2,700,000 barrels on October 27–November 3, 2017. US oil (USO) (UCO) prices fell in post-settlement trade on November 7, 2017, despite the fall in US crude oil inventories.

API’s gasoline and distillate inventories

The API estimates that US gasoline inventories rose by 520,000 barrels on October 27–November 3, 2017. However, distillate inventories fell by 3,133,000 barrels during the same period.

Wall Street analyst expected that US gasoline and distillate inventories could have fallen by 2,250,000 barrels and 1,850,000 barrels during the same period.

EIA’s US crude oil inventories

The EIA (U.S. Energy Information Administration) will release its weekly crude oil inventory report at 10:30 AM EST on November 8, 2017. If the EIA reports a larger-than-expected fall in US crude oil, gasoline, and distillate inventories, it could help oil (OIL) (USL), gasoline (UGA), and diesel prices.

In the next part, we’ll discuss how gasoline demand impacts crude oil prices.