Will US Natural Gas Futures Fall More?

US natural gas (GASL) futures contracts for January delivery were below their 20-day, 50-day, and 100-day moving averages on December 14, 2017.

Nov. 20 2020, Updated 11:51 a.m. ET

Moving averages

US natural gas (GASL) futures contracts for January delivery were below their 20-day, 50-day, and 100-day moving averages on December 14, 2017. The moving averages suggest that prices could trend lower.

US natural gas prices are near a ten-month low due to oversupply and forecasts of a warm winter. Lower gas (UGAZ) prices have a negative impact on energy producers’ (IEZ) (VDE) profitability like Exco Resources (XCO), Range Resources (RRC), and EQT (EQT).

Natural gas futures contracts

The premium for January 2019 US natural gas futures over January 2018 US natural gas futures was at $0.33 per MMBtu (million British thermal units) on December 14, 2017. The premium between these contracts was at $0.34 per MMBtu on December 7, 2017, which was the highest level since July 2010. A higher premium indicates that prices could fall.

Natural gas price drivers

A less-than-expected withdrawal in US natural gas inventories compared to the historical and seasonal average could weigh on natural gas prices next week. Forecasts of a warm winter could also weigh on natural gas (DGAZ) prices. However, any fall in US natural gas production, short covering, and a cold winter forecast could benefit gas prices.

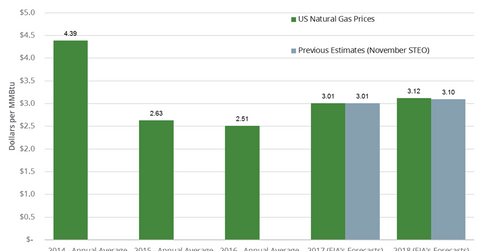

EIA’s forecast

The EIA released its monthly STEO (Short-Term Energy Outlook) report on December 12, 2017. It estimates that US natural gas prices could average $3.12 per MMBtu in 2018, which is 0.7% higher than the STEO report in November. World Bank expects that US natural gas prices will average $3.1 per MMBtu in 2018.

Read Gasoline Inventories and Crude Oil Production Impact Oil Prices for the latest updates on crude oil.