Oil Prices Fell despite the Draw in US Crude Oil Inventories

US crude oil (USL) (DBO) (OIL) prices fell on October 4, 2017, despite the massive draw in US crude oil inventories.

Oct. 5 2017, Updated 12:36 p.m. ET

Crude oil prices

US crude oil (DWT) (USO) (SCO) futures contracts for November delivery fell 0.08% and were trading at $49.94 per barrel in electronic trade at 1:55 AM on October 5, 2017. Likewise, the E-Mini S&P 500 (SPY) December futures contracts fell 0.05% to 2,535 during the same period in electronic trade.

US crude oil inventories

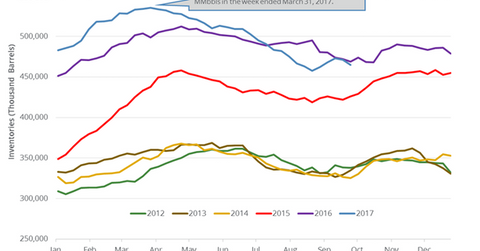

The EIA (U.S. Energy Information Administration) released its crude oil inventory report on October 4, 2017. It estimates that US crude oil inventories fell by 6 MMbbls (million barrels) to 464.9 MMbbls on September 22–29, 2017. Inventories fell 1.3% week-over-week and by 4.1 MMbbls or 0.8% from the same period in 2016.

A Reuters survey estimated that US crude oil inventories would have fallen by 0.8 MMbbls on September 22–29, 2017. US crude oil (USL) (DBO) (OIL) prices fell on October 4, 2017, despite the massive draw in US crude oil inventories.

US crude oil (UCO) prices have fallen 4.2% since September 25, 2016, due to the bearish drivers that we discussed previously in this series. Crude oil prices have fallen 12.5% year-to-date. Moves in crude oil prices impact oil and gas exploration and production companies (XLE) (XOP) like PDC Energy (PDCE), Hess (HES), and WPX Energy (WPX).

US crude oil inventories by region

The EIA divides the US into five storage regions. Let’s assess the changes in crude oil inventories on September 22–29, 2017.

- East Coast inventories fell by 1.7 MMbbls to 11.3 MMbbls.

- Midwest inventories rose by 3.4 MMbbls to 149.3 MMbbls.

- Gulf Coast inventories fell by 4.4 MMbbls to 236.7 MMbbls.

- Rocky Mountain inventories fell by 0.2 MMbbls to 20.9 MMbbls.

- West Coast inventories fell by 3.2 MMbbls to 46.7 MMbbls.

Impact of US crude oil inventories

For the week ending September 29, 2017, US crude oil inventories are 23% above their five-year average. High US crude oil inventories could pressure crude oil (OIL) (USO) prices.

In the next part, we’ll discuss the biggest bearish catalyst for US crude oil prices.