MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

Oct. 31 2017, Published 3:43 p.m. ET

EnLink Midstream LLC

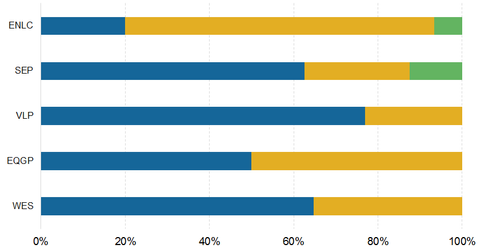

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.” Overall, ENLC has seen five rating updates in 2017, including two upgrades and three new coverages with a “hold” rating. Now, 73.3% of analysts surveyed by Reuters rate ENLC a “hold,” 20% rate it a “buy,” and the remaining 6.7% rate it a “sell.” ENLC is currently trading close to the low range ($15) of analysts’ target price. ENLC’s average target price of $18.9 implies a ~20% upside potential from the current price levels.

Spectra Energy Partners

Spectra Energy Partners (SEP), the midstream MLP now owned by Enbridge (ENB), saw a price target cut last week. Barclays cut SEP’s target price to $50 from $52. Moreover, Goldman Sachs recently downgrade SEP to “sell” from neutral, which is equivalent to “hold.” Now, 62.5% of analysts rate SEP a “buy,” 25% rate it a “hold,” and the remaining 12.5% rate it a “sell.” SEP’s average target price of $49.7 implies a ~16% upside potential from the current price levels.

Valero Energy Partners

Valero Energy Partners (VLP), the midstream MLP formed by Valero Energy (VLO) to provide crude oil and refined products transportation and terminaling services, saw a price target cut from Suntrust Robinson last week. Suntrust Robinson has cut VLP’s target price to $48 from $54. VLP has a “buy” rating from 76.9% of analysts while the remaining 23.1% rate it a “hold.” VLP is currently trading significantly below the low range ($46.5) of analysts’ target price. VLP’s average target price of $51.4 implies a ~20% upside potential from the current price levels.

EQT GP Holdings

EQT GP Holdings (EQGP), the GP of EQT Midstream Partners (EQM), saw a price target cut last week. RBC Capital Markets cut EQGP’s target price to $34 from $37. EQGP has a “buy” rating from 50% of analysts while the remaining 50% rate it a “hold.” EQGP’s average target price of $32 implies a ~16% upside potential from the current price levels.

Western Gas Partners

Western Gas Partners (WES) was upgraded at Stifel last week. Stifel raised WES to “buy” from “hold.” Overall, WES has seen four rating updates in 2017, including one downgrade, one upgrade, and two new coverages with “buy” ratings. Now, 64.7% of analysts surveyed rate WES a “buy” and the remaining 35.3% rate it a “hold.” WES is currently trading significantly below the low range ($54) of analysts’ target price. WES’ average target price of $62.6 implies a massive ~31% upside potential from the current price levels.