EnLink Midstream LLC

Latest EnLink Midstream LLC News and Updates

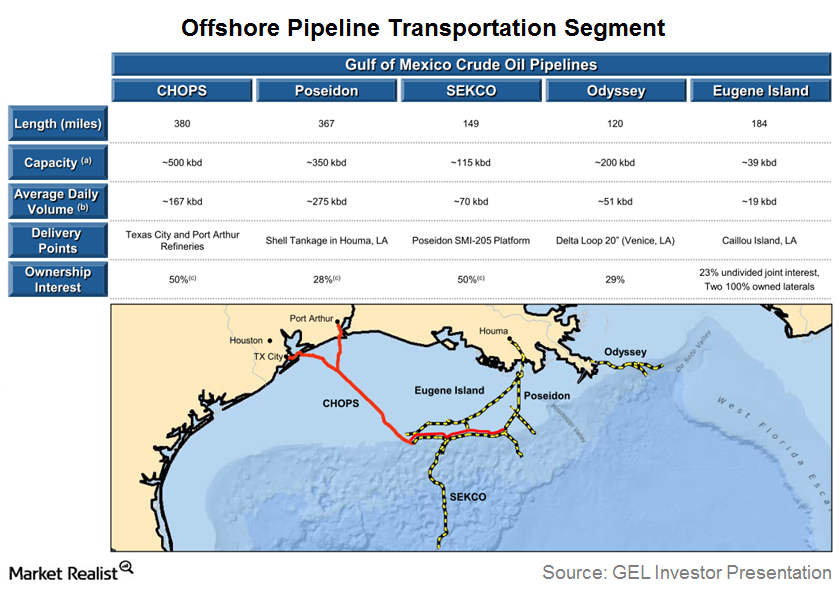

An Overview of Genesis Energy’s Offshore Pipeline Segment

Until recently, Genesis Energy’s Offshore Pipeline segment owned interest in ~1200 miles of offshore pipelines spread across five pipeline systems.

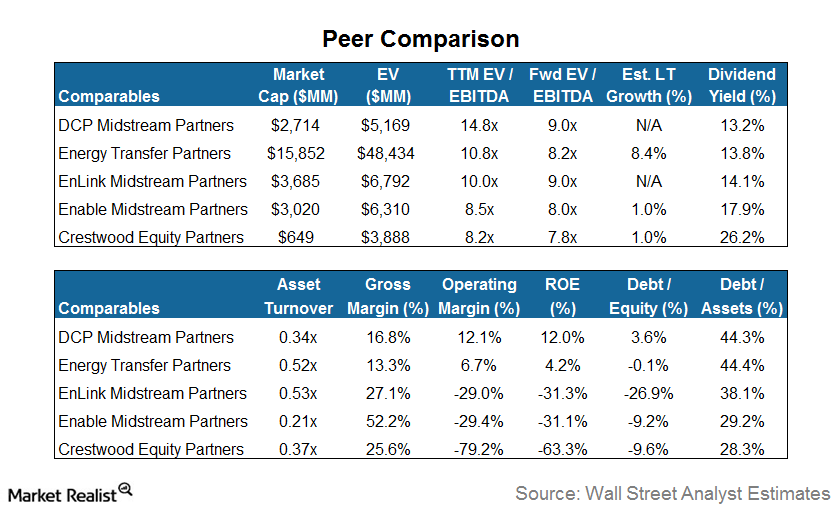

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

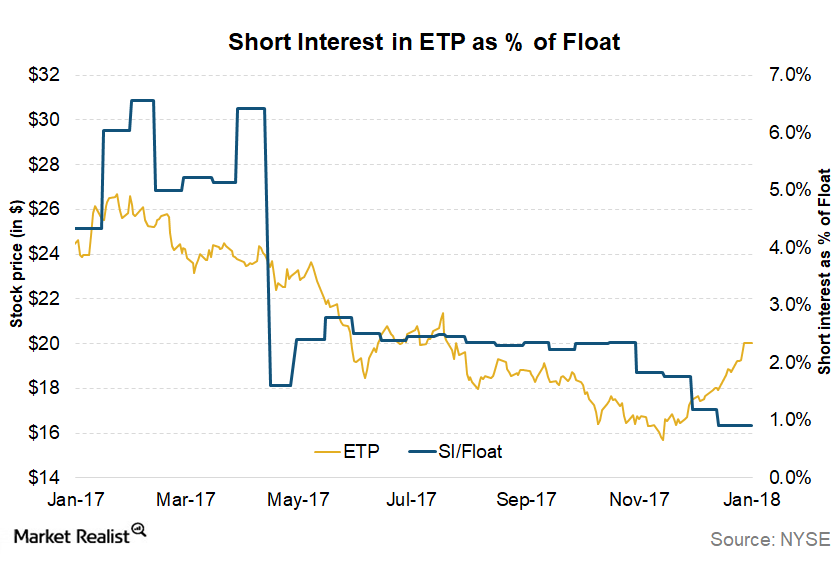

How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

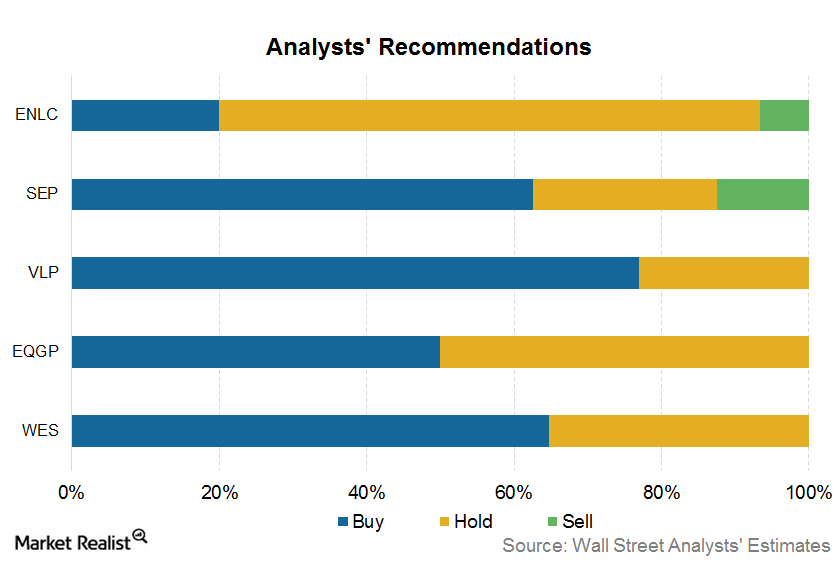

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

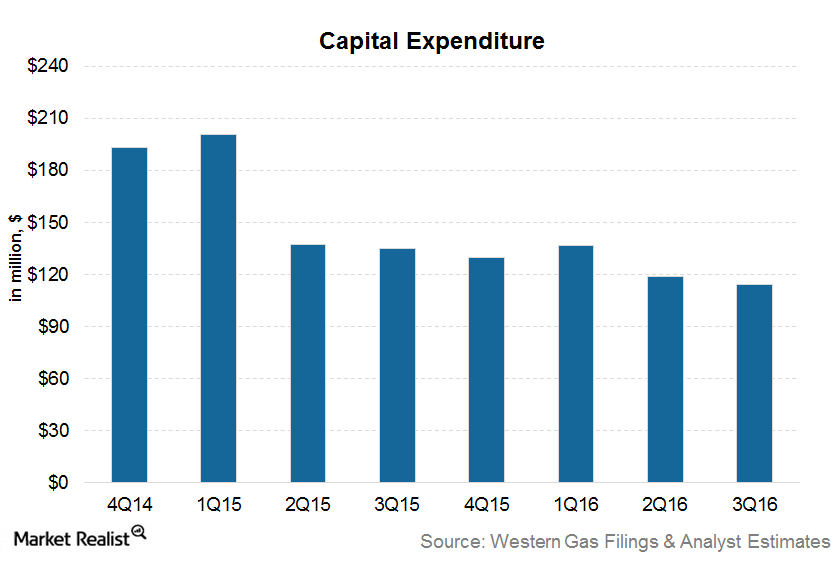

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

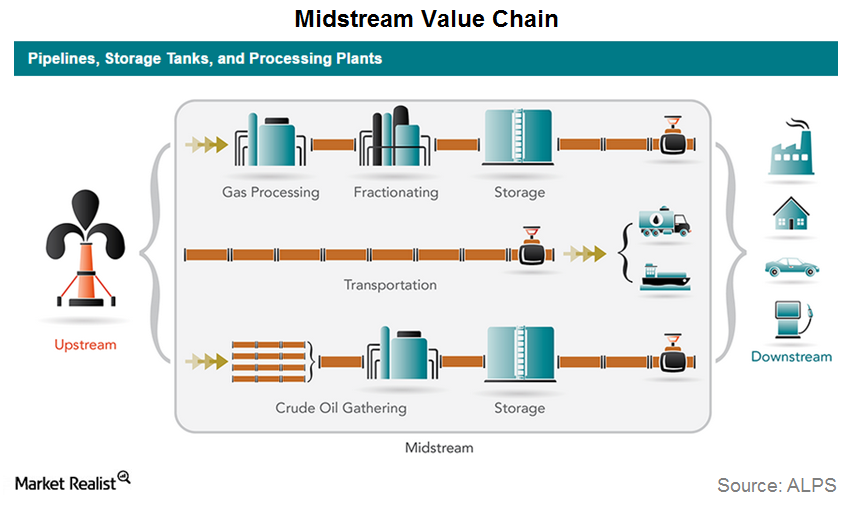

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

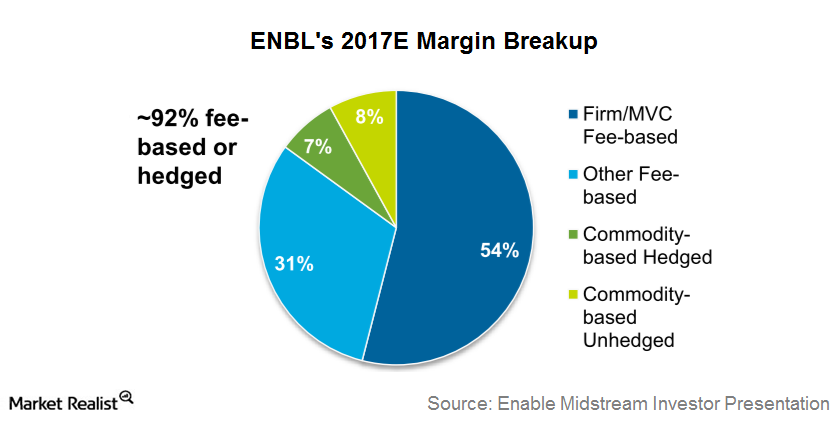

Getting Familiar with MLP Contracts

In this article, we’ll look at types of MLP contracts for midstream MLPs. Midstream MLPs generally have fixed-fee contracts.