Enbridge Inc

Latest Enbridge Inc News and Updates

What Are the Best Canadian Energy Stocks to Buy in September?

Energy prices are expected to rise more in 2021. What are the best Canadian energy stocks that you can buy in September?

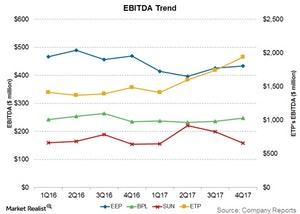

Why Energy Transfer Partners’ Earnings Are on the Rise

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.

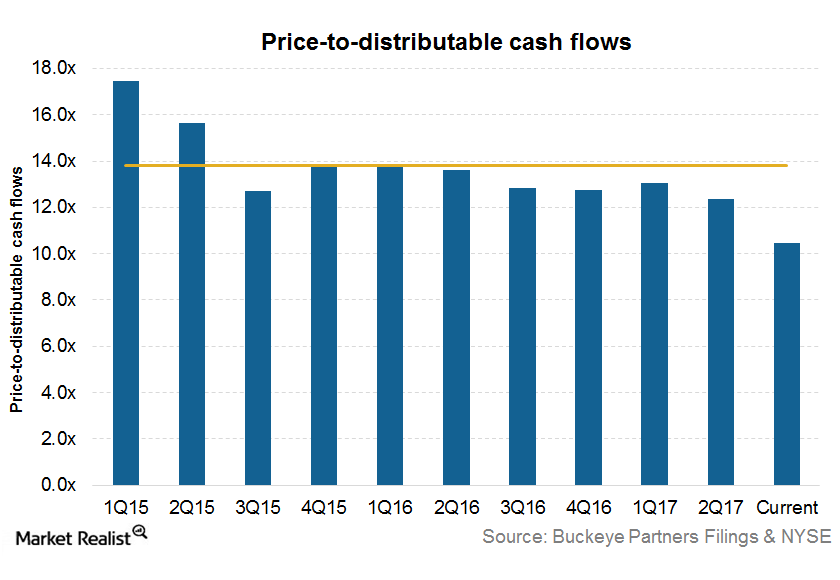

What Buckeye Partners’ Current Valuation Indicates

On October 31, 2017, Buckeye Partners (BPL) was trading at a price-to-distributable-cash-flow multiple of 10.4x, which is significantly below the historical ten-quarter average of 13.8x.

Must-Know: Enbridge’s Five Business Segments

Canadian energy giant Enbridge’s (ENB) operations are diverse. Enbridge accounts for roughly two-thirds of Canada’s crude oil exports to the US.

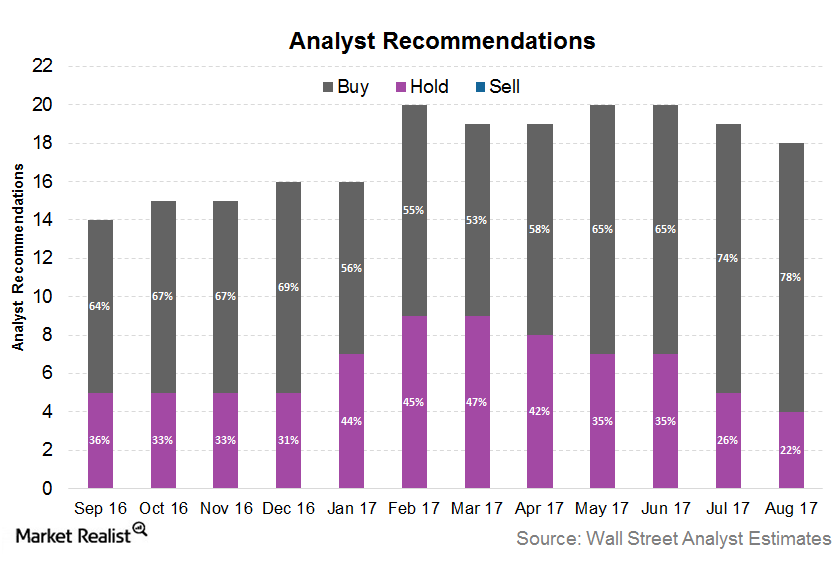

Are Analysts Bullish on Williams Companies?

About 78.0% of analysts rate Williams Companies (WMB) a “buy,” while the remaining 22.0% rate it a “hold” as of August 21, 2017.

Enbridge’s Line 3 Replacement Project Gets Delayed

On March 1, after the markets closed, Enbridge announced that it received a timeline for the permits for its Line 3 Replacement project.

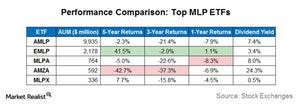

EMLP Generated the Highest Total Returns among the Top MLP ETFs

The First Trust North American Energy Infrastructure Fund (EMLP) generated total returns of 42% over a five-year period, the highest among the top five MLP ETFs that we are discussing in this series.

MLP Rating Updates Last Week

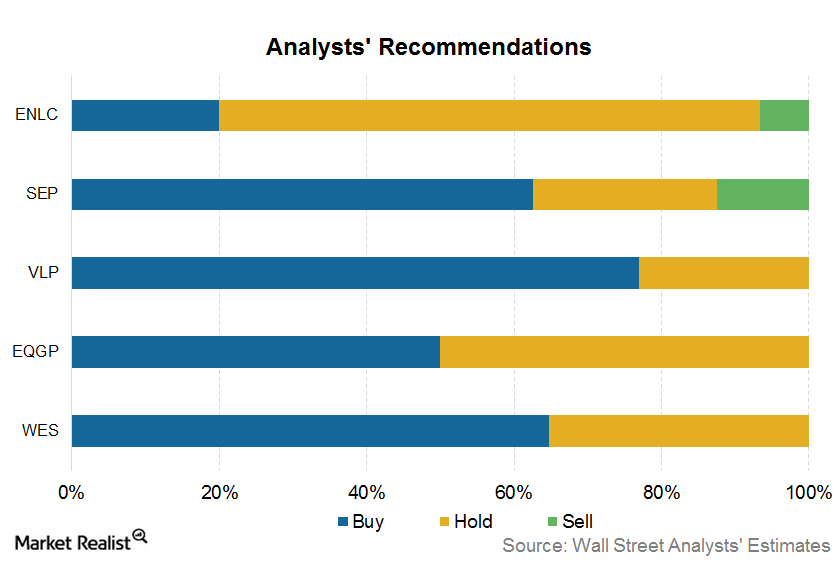

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

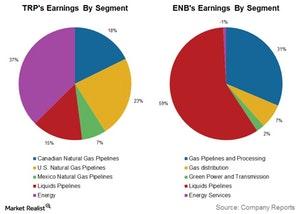

Enbridge and TransCanada’s Business Segments

With the completion of the merger with Spectra Energy in February 2017, Enbridge’s business mix has become more diversified.

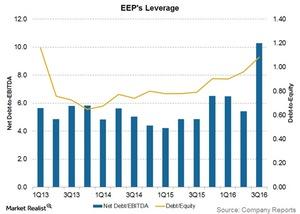

Is Enbridge Energy Partners’ Leverage a Concern?

Enbridge Energy Partners’ (EEP) debt-to-equity ratio is 1.1x. How do other midstream companies compare?

ONEOK: Trading 57% below Its 50-Day Moving Average

ONEOK (OKE) is currently trading 57% below its 50-day moving average. It’s generally been trading below its 50-day moving average since mid-2014 when energy prices began falling.

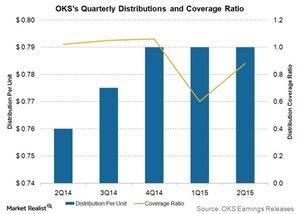

ONEOK Partners Reports Distribution Coverage Missed 2Q15 Target

Generally, MLPs with stable earnings target a distribution coverage ratio in the range of 1 to 1.1 times the distributable cash flow.

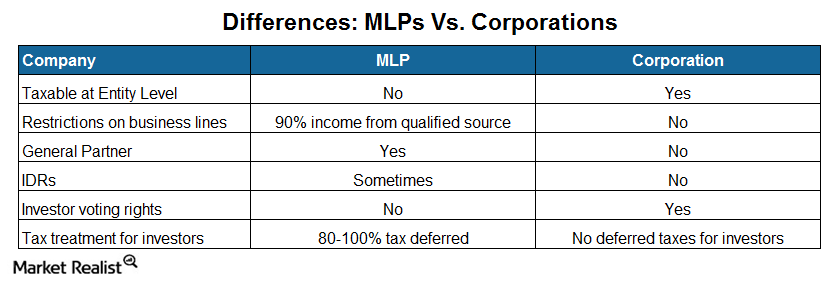

Analyzing the Differences: MLPs versus C Corporations

MLPs’ tax structure is the major difference that separates them from C Corps. MLPs’ earnings aren’t taxed at the partnership level. The taxes are passed to the unitholders.