Western Gas Partners, LP

Latest Western Gas Partners, LP News and Updates

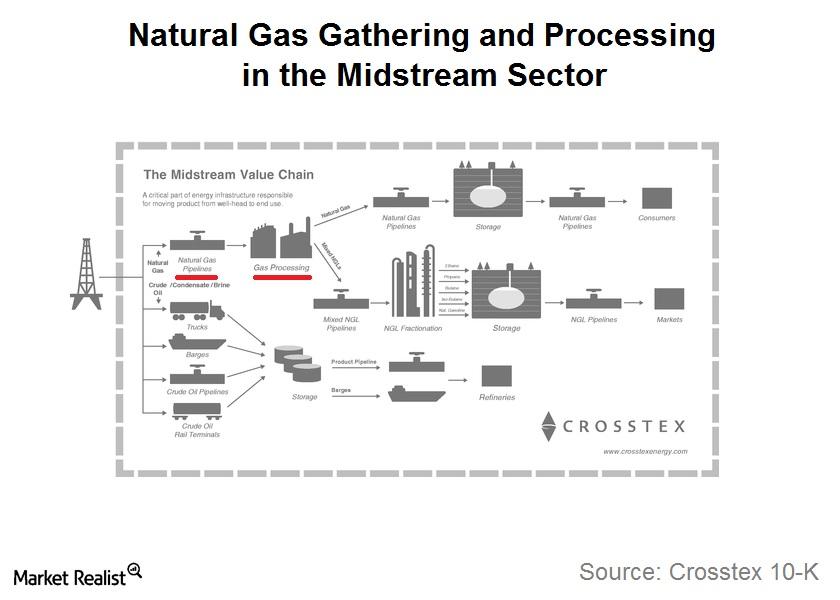

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

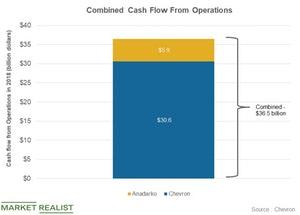

How Will the Anadarko Acquisition Benefit Chevron?

Chevron (CVX) has agreed to acquire Anadarko (APC) in a cash and equity deal.

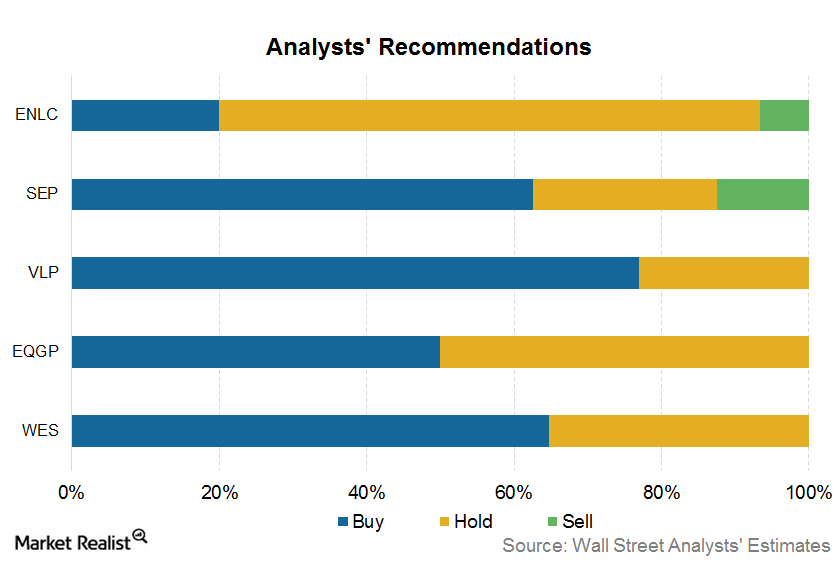

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

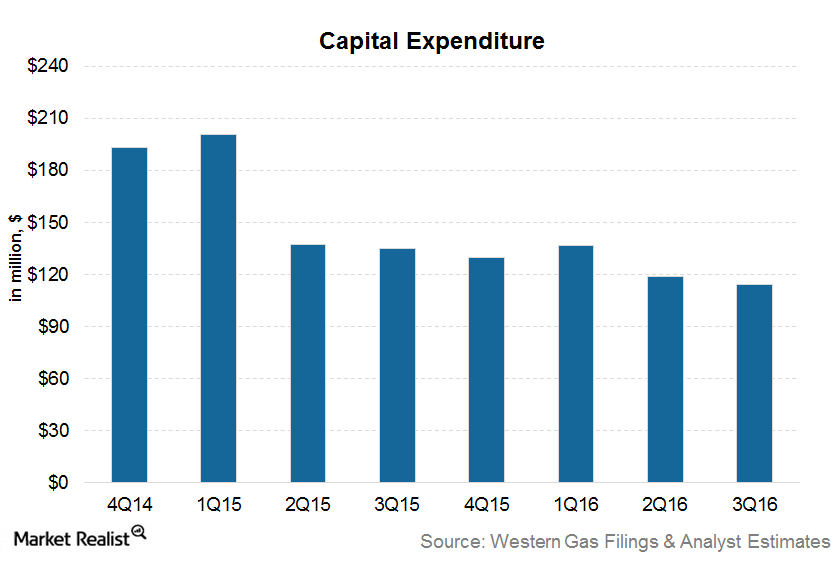

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

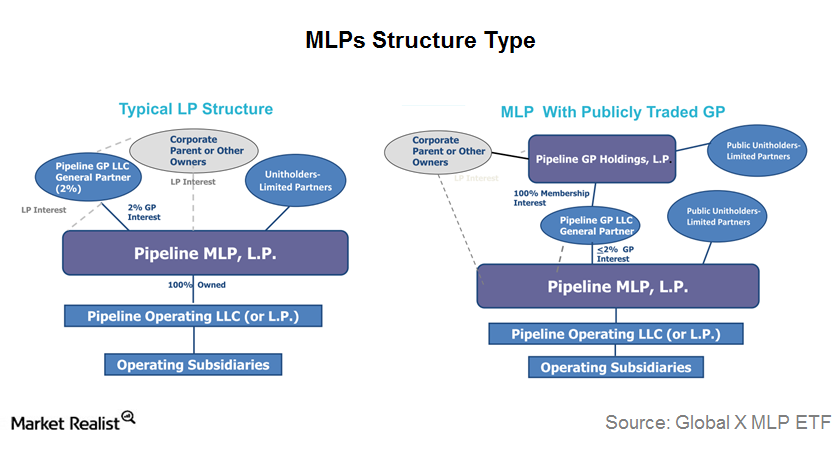

Do MLPs Benefit from the LP-GP Model?

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.