Will US Crude Oil Futures Fall from 4-Month Highs?

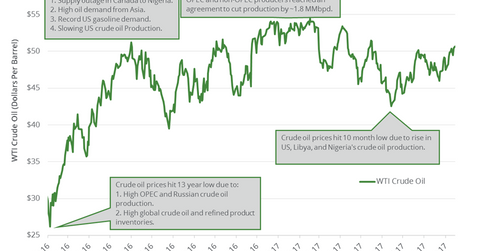

WTI (West Texas Intermediate) crude oil (RYE) (VDE) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than a decade.

Nov. 20 2020, Updated 4:03 p.m. ET

Energy calendar

Let’s track some important events for crude oil and natural gas traders on September 25–29, 2017.

- Tuesday, September 26, 2017 – the American Petroleum Institute’s crude oil inventory report

- Wednesday, September 27, 2017 – the EIA’s (U.S. Energy Information Administration) US crude oil and gasoline inventory report

- Thursday, September 28, 2017 – the EIA’s US natural gas storage report

- Friday, September 29, 2017 – Baker Hughes’s US crude oil and natural gas rig count report

High and low

WTI (West Texas Intermediate) crude oil (RYE) (VDE) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than a decade. On the other hand, prices hit $54.45 per barrel on February 23, 2017—the highest level since July 2015.

Crude oil futures drivers for this week

WTI crude oil (USO) (UCO) prices are at a four-month high. Crude oil futures could fall due to profit-taking as major oil producers delayed the decision to extend the production cut deal beyond March 2018. The expectation of a rise in US crude oil inventories and production could also cap the upside for crude oil prices. However, improving US refinery crude oil demand could benefit US crude oil prices.

Moves in crude oil prices impact oil and gas producers (XES) (IEZ) like ExxonMobil (XOM), Hess (HES), Sanchez Energy (SN), and Bonanza Creek Energy (BCEI).

WTI crude oil price forecast

The EIA estimates that US crude oil (UWT) (DWT) prices will average $48.83 per barrel in 2017 and $49.58 per barrel in 2018. A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018.

In the next part of this series, we’ll see how Cushing crude oil inventories impact prices.