US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

Sept. 14 2017, Updated 4:05 p.m. ET

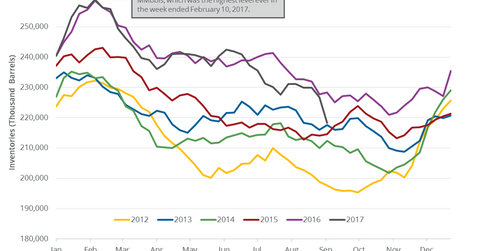

US gasoline inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13. It reported that US gasoline inventories fell 8.4 MMbbls (million barrels) to 218.3 MMbbls from September 1 to 8, the largest weekly drop in gasoline inventories in the last 27 years. Inventories fell 3.7% week-over-week and 10 MMbbls, or 4.4%, year-over-year. Inventories fell for the second consecutive week.

A market survey estimated that US gasoline inventories might have fallen by 2 MMbbls from September 1 to 8. US gasoline (UGA) futures fell 0.5% to $1.64 per gallon on September 13 despite the larger-than-expected fall in gasoline inventories. However, it supported crude (USO)(UCO)(USL) oil prices on September 13.

Higher crude oil (DIG)(DBO)(OIH) prices benefit oil and gas producers such as Northern Oil & Gas (NOG), Cobalt International Energy (CIE), and Apache (APA).

US gasoline production, imports, and demand

US gasoline production rose by 371,000 bpd (barrels per day) to 9.88 MMbpd (million barrels per day) from September 1 to 8. Production rose 3.9% week-over-week but fell 12,000 bpd, or 0.12%, year-over-year.

US gasoline imports rose by 81,000 bpd to 556,000 bpd from September 1 to 8. Imports fell 94,000 bpd, or 14.5%, year-over-year.

US gasoline demand rose by 456,000 bpd to 9.6 MMbpd from September 1 to 8. Demand rose 4.9% week-over-week and 213,000 bpd, or 2.2%, year-over-year.