What to Expect from Libya’s Crude Oil Production in September

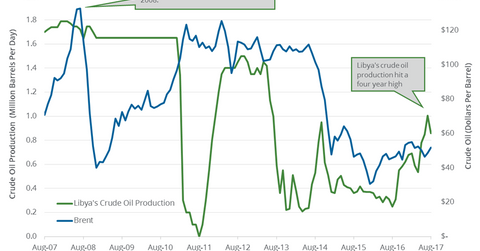

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Nov. 20 2020, Updated 4:31 p.m. ET

Libya’s crude oil production

Libya is an OPEC member. The EIA (U.S. Energy Information Administration) estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Production fell 14.4% month-over-month but rose by 610,000 bpd or 244% year-over-year. Libya’s crude oil production hit 1,005,000 bpd in July 2017, which is the highest level in four years. However, production fell in August 2017 due to militants attacking Libya’s oilfields.

Any fall in Libya’s production could have a positive impact on crude oil (IEZ) (XES) (IXC) prices. Higher crude oil prices have a positive impact on oil and gas producers like Chevron (CVX), ExxonMobil (XOM), Stone Energy (SGY), and Denbury Resources (DNR).

Libya and OPEC’s output cut deal

Libya was exempt from the output cut deal due to political and economic instability in the country. There was an OPEC and non-OPEC monitoring committee meeting on July 24, 2017, in Russia. The meeting participants decided to allow Libya to increase its production as high as 1.25 MMbpd. However, no official announcement has been made about capping its production. Libya can increase its production by more than 45% from the levels in August 2017.

Libya’s supply outage

The EIA estimates that Libya’s crude oil production outage rose by 145,000 bpd to 440,000 bpd in August 2017—compared to the previous month. The production outage fell to 295,000 bpd in July 2017. It was the lowest level in more than four years.

Libya’s Sharara oilfield

On September 6, 2017, Libya’s Sharara oilfield resumed production after the blockade that started on August 19, 2017, was lifted. The Sharara oilfield has a capacity of 270,000 bpd of crude oil—25% of Libya’s crude oil production.

On September 14, 2017, Reuters stated that Libya’s Sharara oilfield has been producing 180,000 bpd of crude oil due to security concerns.

Impact

The National Oil Corporation of Libya is the state monopoly company. It estimates that Libya’s crude oil production could hit 1.25 MMbpd in 2017.

Any rise in Libya’s crude oil production could pressure crude oil (RYE) (USL) (PXI) prices. However, militant attacks would limit the rise in crude oil production in Libya.

In the next part, we’ll discuss how OPEC’s crude oil production and exports impact crude oil prices.