Are Crude Oil Futures Signaling a Breakout?

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trading at 2:10 AM EST on September 20, 2017.

Sept. 20 2017, Updated 11:36 a.m. ET

Crude oil futures

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trade at 2:10 AM EST on September 20, 2017. Prices rose due to the less-than-expected rise in US crude oil inventories, according to the API (American Petroleum Institute).

The E-Mini S&P 500 (SPY) December futures contracts fell 0.1% to 2,503.75 in electronic trading at 2:10 AM EST.

Higher crude oil prices have a positive impact on oil and gas producers (RYE) (VDE) like Denbury Resources (DNR), Warren Resources (WRES), and QEP Resources (QEP).

API’s Cushing crude oil inventories

The API reported that Cushing crude oil inventories rose 0.42 MMbbls (million barrels) on September 8–15, 2017. A rise in Cushing crude oil inventories could weigh on crude oil (SCO) (DBO) prices.

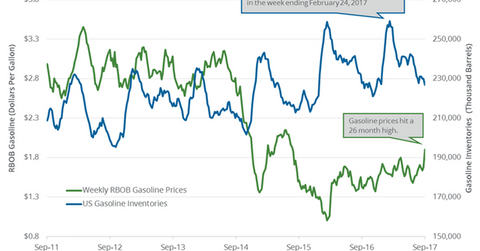

API’s gasoline and distillate inventories

The API also reported that US gasoline inventories fell by 5.1 MMbbls on September 8–15, 2017. A market survey estimated that US gasoline inventories would have fallen by 2.1 MMbbls during this period.

The API added that US distillate inventories fell by 6.1 MMbbls on September 8–15, 2017. A market survey estimated that distillate inventories would have fallen by 1.6 MMbbls during this period.

EIA crude oil inventory report

The EIA (U.S. Energy Information Administration) will release its weekly crude oil inventory report on September 20, 2017, at 10:30 AM EST.

If the EIA reports a less-than-expected rise in US crude oil inventories, it would support crude oil prices. A larger-than-expected fall in product inventories could push gasoline, diesel, and crude oil prices higher.

US crude oil futures breakout

November US crude oil futures have traded in a narrow range in the past few days. Prices have closed between $49 and $50 per barrel in the last five trading sessions. A bullish crude oil inventories report could push US crude futures above this narrow range.

In the next part, we’ll discuss gasoline demand.