Natural Gas Inventories Spread: What Investors Should Know

According to data from the EIA released on April 20, 2017, natural gas (GASX) (FCG) (GASL) inventories rose by 54 Bcf during the week ending April 14, 2017.

April 28 2017, Published 10:59 a.m. ET

Last week’s natural gas inventory data

According to data from the EIA (U.S. Energy Information Administration) released on April 20, 2017, natural gas (GASX) (FCG) (GASL) inventories rose by 54 Bcf (billion cubic feet) during the week ending April 14, 2017.

Natural gas inventories and prices

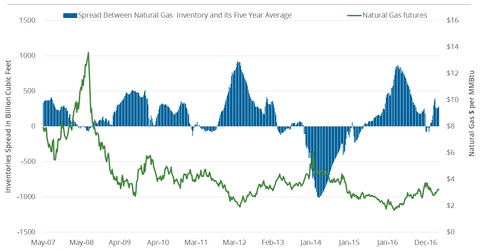

Natural gas prices are impacted by the spread between natural gas inventories and their five-year average. In the past ten years, whenever natural gas inventories have been higher than their five-year average, prices have fallen.

In contrast, between December 2013 and April 2014, when inventory levels fell short of the five-year average by the largest volume in the past ten years, natural gas (BOIL) prices rose to $6.14 per million British thermal units. The downturn in natural gas prices since June 2008 could be linked to higher inventories compared to the five-year average.

Natural gas inventories and prices in the past

In the 2015–2016 winter, natural gas usage for heating was weak due to mild temperatures. At the end of March 2016, US natural gas inventories were at 2.5 trillion cubic feet—67.0% higher than the levels in 2015 and 53.0% higher than the five-year average. As a result, natural gas futures hit a 17-year low of $1.64 on March 3, 2016.

At the beginning of the injection season on April 1, 2016, the spread between natural gas inventories and their five-year average was the widest since April 2012. However, the spread narrowed in the following months. In the week ending December 16, 2016, inventories fell below their five-year average for the first time in 19 months. Natural gas active futures prices rose 74.6% between April 1, 2016, and December 16, 2016.

Recent natural gas inventories and prices

The spread reversed again in the week ending January 27, 2017. During the week ending April 14, 2017, natural gas inventories were at 2,115 Bcf—15.4% more than the five-year average. In the 11 weeks since the reversal, natural gas prices have lost 3.6%. However, inventories are 14.8% lower than they were last year, which should ensure that prices don’t fall to the lows we saw at that time. During the week ending April 7, 2017, natural gas inventories were at 2,061 Bcf—14.6% more than the five-year average.

Market estimates

It will be interesting to see the impact of the EIA’s inventory data for the week ending April 21, 2017. Analysts’ estimates suggest a rise of 72 Bcf in natural gas inventories for the week ending April 21, 2017. If the inventories spread continues to expand, it will be bearish for natural gas prices.

Natural gas prices and energy ETFs

Natural gas prices impact ETFs like the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), the iShares US Energy (IYE), the ProShares Ultra Oil & Gas (DIG), the Vanguard Energy ETF (VDE), and the Fidelity MSCI Energy ETF (FENY).

In the next part of this series, we’ll look at the extent to which the US dollar drives natural gas prices.