EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

Aug. 10 2017, Published 9:51 a.m. ET

US crude oil production

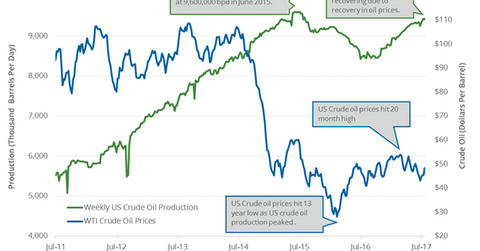

On August 9, 2017, the EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report. The EIA reported that US crude oil production fell by 7,000 bpd (barrels per day) to 9,423,000 bpd on July 28–August 4, 2017. US crude oil production fell 0.11% week-over-week and by 978,000 bpd or 11.6% YoY (year-over-year).

Production is near a two-year high. High US production is bearish for crude oil (ERY) (FXN) (FENY) prices in 2017. Prices have fallen 13% year-to-date due to the rise in US production. Lower crude oil prices have a negative impact on oil and gas producers like Apache (APA), Stone Energy (SGY), and Denbury Resources (DNR).

Peak and low production

US crude oil production hit 9.6 MMbpd in June 2015—the highest level since 1983. In contrast, production hit 8.4 MMbpd in July 2016—the lowest level since May 2014.

US crude oil production estimates

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017—0.1% higher than the previous estimates.

The EIA also estimates that US crude oil production could average 9.91 MMbpd in 2018—0.1% higher than the previous estimates.

The upward revision of US crude oil production for 2017 and 2018 would pressure crude oil (FENY) (DIG) prices. Production is expected to hit a record in 2018. US production averaged 8.9 MMbpd in 2016.

Why would US production rise in 2017 and 2018?

US crude oil production would rise in 2017 and 2018 due to the following factors:

- President Trump’s energy plans could impact production.

- The production cut deal would likely support oil prices. Higher oil prices would help shale oil producers drill more.

- US crude oil rigs have risen more than 100% YoY.

- Efficiency and technological advancement have improved.

- US crude oil exports rose in 2017.