US Natural Gas Futures Might Continue to Fall Next Week

December natural gas (GASL) (BOIL) futures were below their 50-day and 100-day moving averages of $3.12 per MMBtu and $3.16 per MMBtu on November 16, 2017.

Nov. 17 2017, Published 9:45 a.m. ET

Hedge funds

The U.S. Commodity Futures Trading Commission will release its weekly “Commitment of Traders” report on November 17, 2017. In the last report, it reported that hedge funds’ net bullish positions in US natural gas futures and options contracts were at 41,563 for the week ending November 10, 2017. The net-bullish positions fell by 2,291 contracts or 6% year-over-year.

Hedge funds’ net bullish positions are at four-week lows. It indicates that hedge funds are bearish or less bullish on US natural gas (UNG) (UGAZ) (GASL) prices.

Moving averages

December natural gas (GASL) (BOIL) futures were below their 50-day and 100-day moving averages of $3.12 per MMBtu (million British thermal units) and $3.16 per MMBtu on November 16, 2017. Prices are also below their 20-day moving averages of $3.07 per MMBtu. The moving averages suggest that prices could trend lower next week. High natural gas production could also pressure natural gas prices.

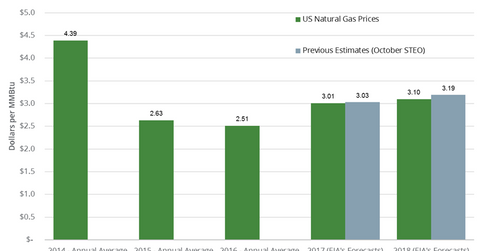

EIA’s forecast

The EIA estimates that US natural gas (UGAZ) (DGAZ) prices could average $3.01 per MMBtu in 2017 and $3.10 per MMBtu in 2018. Higher gas prices are bullish for gas producers (XLE) (PXI) like Exco Resources (XCO), EOG Resources (EOG), and Antero Resources (AR).

World Bank estimates that US natural gas prices will average $3.1 per MMBtu in 2018. High prices could be driven by rising natural gas exports, strong US consumption, and a marginal rise in natural gas production.

Read Crude Oil: Will the Bears Overshadow the Bulls? for the latest updates on crude oil.