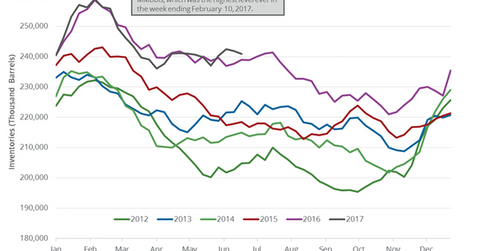

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

June 29 2017, Published 10:58 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls (million barrels) to 241 MMbbls on June 16–23, 2017.

Inventories fell 0.4% week-over-week but rose 0.8% year-over-year. A larger-than-expected fall in US gasoline inventories supported gasoline and crude oil (FENY) (ERY) (ERX) futures on June 28, 2017.

US gasoline prices rose 1.6% to $1.48 per gallon on June 28, 2017. Higher gasoline prices have a positive impact on refiner’s earnings like Western Refining (WNR), Phillips 66 (PSX), Tesoro (TSO), and Valero (VLO). Likewise, higher crude oil prices have a positive impact on oil producers like ConocoPhillips (COP), Sanchez Energy (SN), and Stone Energy (SGY).

US gasoline production and import

US gasoline production rose by 171,000 bpd (barrels per day) to 10,334,000 bpd on June 16–23, 2017.

US gasoline imports fell by 338,000 bpd to 571,000 bpd on June 16–23, 2017.

Gasoline exports

The EIA estimates that US gasoline exports have risen 125% since 2010. The increase in gasoline exports benefits US gasoline demand. Mexico is the key US gasoline importer. US exports to Mexico accounted for 53% of US gasoline exports in 2016.

Gasoline demand

The EIA estimates that US gasoline demand fell 2.8% to 9,538,000 bpd on June 16–23, 2017.

Impact of gasoline inventories

High gasoline inventories at this time of the year could weigh on gasoline prices. However, an expectation of record gasoline demand this summer could support gasoline and crude oil prices.

In the next part of this series, we’ll take a look at US distillate inventories.