Is Natural Gas Reacting to the US Dollar?

Between March 3, 2016–June 7, 2017, natural gas active futures rose 84.1% while the US dollar fell 0.8%.

June 9 2017, Updated 9:07 a.m. ET

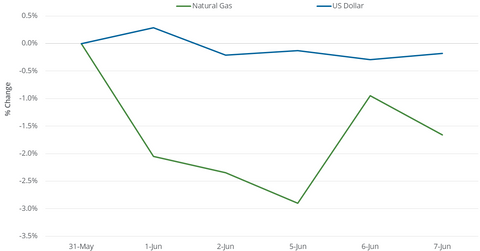

The US dollar and natural gas fell

Between May 31–June 7, 2017, natural gas active (GASL) (GASX) futures fell 1.7%. During this timeframe, the US dollar (UUP) (UDN) fell 0.2%.

Between May 31–June 7, 2017, natural gas active futures moved against US dollar in three instances. The correlation between the two was -53% during this timeframe.

In the trailing week, natural gas prices moved inversely to the US dollar. A weaker dollar could be a boost for commodities.

In the past, US natural gas was not exported in large quantities outside North America and as a result, the US dollar’s influence on natural gas prices was limited. However, in February 2016, the US started exporting natural gas in liquefied form from the lower 48 states to outside North America.

Impact of US dollar on natural gas since March 3, 2016

Between March 3, 2016–June 7, 2017, natural gas active futures rose 84.1% while the US dollar fell 0.8%. During the same timeframe, the correlation between the two stood at -7%.

Natural gas futures moved in the opposite direction of the US dollar in 168 of the last 319 trading sessions. The small magnitude of correlation doesn’t indicate an inverse relationship between the two over a longer timeframe.

US government policies and natural gas prices

Increased natural gas production in the US, which we discussed earlier in this series, could mean increased exports from the country. The US dollar’s influence on natural gas prices could increase, as demonstrated by crude oil prices.

This correlation could be vital for funds such as the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3x ETF (DRIP), the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and the PowerShares DWA Energy Momentum ETF (PXI).