Why Investors Are Tracking US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd to 9,237,000 bpd on April 14–21.

Nov. 20 2020, Updated 3:18 p.m. ET

US gasoline demand

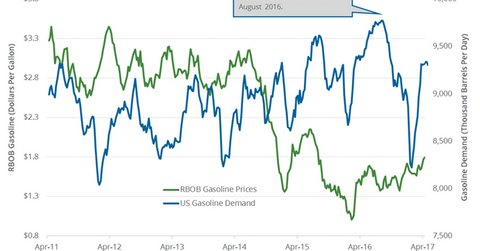

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd (barrels per day) to 9,237,000 bpd on April 14–21, 2017.

US gasoline demand fell 0.9% week-over-week and 1.7% year-over-year. The fall in gasoline demand is bearish for gasoline and crude oil (BNO) (USL) (PXI) prices. For more on crude oil prices, read Part 1 and Part 2 of this series.

Lower gasoline and crude oil (ERY) (DIG) (ERX) prices have a positive impact on refiners and oil producers’ earnings like Valero Energy (VLO), Western Refining (WNR), Northern Oil & Gas (NOG), and Triangle Petroleum (TPLM).

Gasoline prices

US gasoline prices hit $1.14 per gallon on March 15, 2016—the lowest price in 12 years. As of May 2, 2017, prices have risen 32.6% from their lows in February 2016 due to the increase in gasoline demand. Rising gasoline demand partially supported crude oil prices as well. US crude oil prices have risen ~88.2% during the same period. Changes in gasoline demand drive gasoline inventories. For updates on gasoline inventories, read the previous part of the series.

US gasoline consumption estimates for 2017 and 2018

The EIA estimates that US gasoline consumption will average 9,300,000 bpd and 9,340,000 bpd in 2017 and 2018, respectively. US gasoline consumption figures for 2018 will be the highest ever. US gasoline consumption averaged 9,330,000 bpd and 9,180,000 bpd in 2016 and 2015, respectively. US gasoline consumption hit a record in 2016.

The fall in gasoline consumption in 2017 could pressure gasoline and crude oil prices.

For more on crude oil prices, read What Can Investors Expect in the Crude Oil Market in 2017? and Why OPEC Needs to Extend Production Cut Deal beyond 2017.

Read Will Crude Oil Prices Test 3 Digits Again? for more on crude oil price forecasts.

For related analysis, visit Market Realist’s Energy and Power page.