How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

Nov. 20 2020, Updated 1:22 p.m. ET

Correlations of top energy ETFs with crude oil

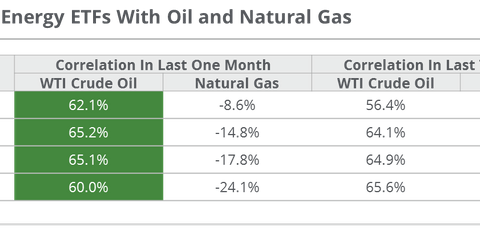

In the final part of this series, we’ll look at the correlations of top energy ETFs with crude oil (SCO) and natural gas (BOIL) (GASL). At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017. As crude oil lost 7% in the week between April 27–May 4, OIH lost 5.1%.

In comparison, the correlations of other energy ETFs with US crude oil over the last month are as follows:

- The Alerian MLP ETF (AMLP): 62.1%

- The Energy Select Sector SPDR ETF (XLE): 65.1%

- The SPDR S&P Oil & Gas Exploration & Production ETF (XOP): 60%

In the past month, the above ETFs except XOP saw their correlations with crude oil rise compared to their correlations over the past three months.

How do top energy ETFs correlate with natural gas?

The above ETFs witnessed a fall in their correlations with natural gas (UNG) in the past month compared to the three-month snapshot. However, they are more positively correlated with crude oil (USO) than natural gas (DGAZ). Right now, crude oil is the bigger driver for energy ETFs.

A high positive correlation with crude oil means that any movement in crude oil could impact these ETFs directly. If crude oil falls, these ETFs could fall as well. You should watch movements in crude oil (UCO) (BNO) (DBO) to understand how these ETFs could perform.

We expect US crude oil to post a weekly loss for the week ended May 5, 2017. At 6:11 AM EDT on May 5, 2017, US crude oil June futures were trading at $45.49 per barrel, a fall of 7.8% compared to the previous week’s closing price. Oil prices could be heading for their highest weekly loss since the week ended March 17, 2017.

If the fall continues and the high correlations hold, they could contribute to more downside in these energy ETFs. You should also track individual stocks during the earnings season

You can keep an eye on Market Realist’s earnings coverage on the Energy & Power page. You can also track our weekly quantitative coverage of crude oil prices on Wednesdays.