Does the US Dollar Impact Natural Gas Prices?

In the past four trading sessions, natural gas futures and the US Dollar Index moved in opposite directions one out of four times.

Jan. 5 2017, Updated 7:37 a.m. ET

Natural gas and the US dollar

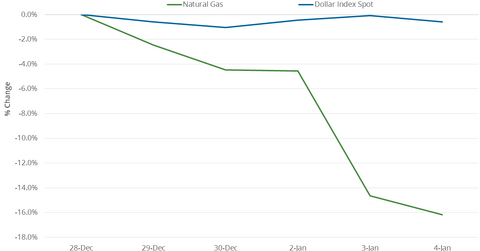

From December 28, 2016, to January 4, 2017, natural gas (UNG) (DGAZ) February futures fell 16.2%. The US Dollar Index (UUP) (UDN) fell 0.6% during that period.

In the past four trading sessions, natural gas futures and the US Dollar Index moved in opposite directions one out of four times. The correlation between the two over the past four trading sessions was -27.7%. There was only a mild inverse quantitative relationship between them during that short period. So, the two moved broadly independently.

When the dollar falls, it makes commodities cheaper for importing countries, which boosts prices. In the past, US natural gas wasn’t exported. Historically, there wasn’t a relationship between natural gas and the dollar. It will be interesting to see if natural gas and the dollar develop a more long-term fundamental relationship like the one between crude oil and the dollar.

In February 2016, the US started exporting natural gas in the form of liquefied natural gas from the lower 48 states to outside North America. President-elect Donald Trump’s aggressive energy policy could lead to higher natural gas production. It could boost natural gas exports. His policies could also mean the return of coal as a source of fuel for power generators. It would make even more gas available for exports.

So, natural gas prices could develop a relationship with the US Dollar Index that’s similar to the relationship between crude oil and the US Dollar Index.

Natural gas price movements

On March 3, 2016, natural gas futures closed at $1.64 per million British thermal units—a 17-year low. From March 3, 2016, to January 4, 2017, natural gas active futures rose ~99.2%, while the US Dollar Index rose 5.2%. During that period, the US Dollar Index and natural gas prices moved in opposite directions based on the closing prices in 118 of 214 trading sessions. The correlation was -11.2% during that period. It shows the lack of a relationship between the two over a longer period.

So, other factors, like the weather, are driving movements in natural gas.