US Dollar near 9-Month High: Is It Bearish for Crude Oil Prices?

December WTI crude oil futures contracts rose on October 21, 2016, due to expectations of OPEC and Russia reaching an agreement to cap production.

Nov. 20 2020, Updated 2:32 p.m. ET

Crude oil prices

December WTI (West Texas Intermediate) crude oil futures contracts rose 0.80% and settled at $50.85 per barrel on October 21, 2016. Prices rose due to expectations of OPEC (Organization of the Petroleum Exporting Countries) and Russia reaching an agreement to cap production. For more on this read, Part 4 of this series.

However, traders are skeptical about OPEC‘s plan to cap production. Brent crude oil futures rose 0.80% and closed at $51.78 per barrel on October 21.

ETFs such as the United States Oil ETF (USO) and the ProShares Ultra Bloomberg Crude Oil (UCO) rose 0.40% and 1.2%, respectively, on October 21, 2016.

US Dollar Index

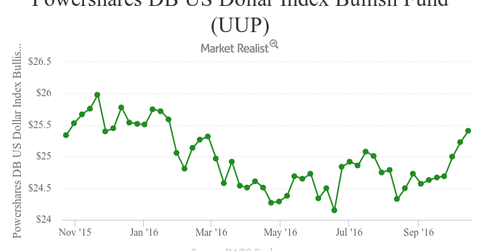

The US Dollar Index rose 0.40% to 98.7 on October 21, 2016. That’s the highest level since February 3, 2016. It rose due to increased expectations of an interest rate hike by the Fed. The index has risen 3.3% so far in October 2016. The expectation of an easing monetary policy by the European Central Bank also supported the US dollar.

The PowerShares DB US Dollar Bullish ETF (UUP) tracks the performance of the US dollar. It rose 0.40% on October 21, 2016.

[marketrealist-chart id=1690909]

US dollar and crude oil

The US dollar and crude oil are usually inversely related. A stronger US dollar makes crude oil more expensive for oil importers, and vice versa.

A recent survey suggested that 70.0% of traders expect an interest rate hike from the Fed in December 2016. An improvement in the US consumer price index would support an interest rate hike. So volatility in the US dollar could swing crude oil prices in 2016.

Impact on stocks and ETFs

Volatility in crude oil prices can impact the earnings of oil and gas exploration and production companies such as Warren Resources (WRES), QEP Resources (QEP), and Triangle Petroleum (TPLM).

Crude oil prices can also impact ETFs and ETNs such as the Direxion Daily Energy Bear 3x ETF (ERY), the Fidelity MSCI Energy ETF (FENY), the United States 12 Month Oil ETF (USL), the SPDR S&P Oil & Gas Equipment & Services ETF (XES), and the United States Brent Oil ETF (BNO).

What’s in this series?

In this series, we’ll focus on the major oil producers’ meeting, Cushing crude oil inventories, the US crude oil rig count, the Commodity Futures Trading Commission’s Commitments of Traders report, and some crude oil price forecasts.

Let’s start by looking at the energy calendar for this week.