US Crude Oil Prices Are Trading Near a 2016 High!

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.5% and settled at $50.44 per barrel on October 13.

Nov. 20 2020, Updated 12:00 p.m. ET

Crude oil prices

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.5% and settled at $50.44 per barrel on October 13. Brent crude oil futures rose 0.4% and settled at $52.03 per barrel. The decline in US refined product inventories pushed crude oil prices higher.

The United States Oil ETF (USO) and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose 0.5% and 0.9%, respectively, on October 13, 2016.

US crude oil inventories

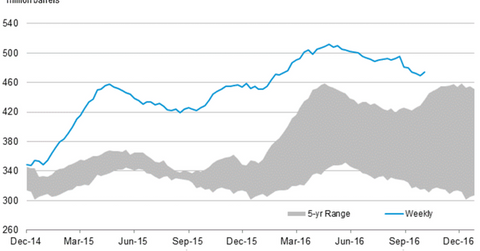

The U.S. Energy Information Administration released its weekly crude oil inventory report on October 13, 2016. It reported that US crude oil inventories rose by 4.9 MMbbls (million barrels) between September 30 and October 7.

We’ll look at US crude oil inventories and their regional breakdown in Part 3 of this series. For details on gasoline and distillate inventories, read Part 9 and Part 11 of this series. Earlier, the American Petroleum Institute estimated that US crude oil inventories would rise by 2.7 MMbbls between September 30 and October 7.

OPEC and Oil producers’ meetings

Rising OPEC (Organization of the Petroleum Exporting Countries) crude oil production and skepticism around OPEC’s plans to cap production pulled crude oil prices from 2016 highs on October 12. However, crude oil prices were trading near a 2016 high on October 13.

For more on oil producers’ meetings, read Crude Oil Prices and Oil Producers’ Meeting in Istanbul and Decoding the Major Oil Producers’ Meeting in Algeria.

Crude oil volatility index

The CBOE crude oil volatility index fell 4.7% to 37.22 on October 13. It hit its highest level in the last five months at 45.7 on August 2.

Volatility in crude oil prices impacts oil and gas producers’ earnings, including Synergy Resources (SYRG), Range Resources (RRC), Northern Oil & Gas (NOG), and QEP Resources (QEP).

It also impacts funds such as the iShares Global Energy ETF (IXC), the iShares U.S. Energy ETF (IYE), the Guggenheim S&P 500 Equal Weight Energy ETF (RYE), the United States 12 Month Oil ETF (USL), the Direxion Daily Energy Bear 3x ETF (ERY), and the United States Brent Oil ETF (BNO).

Series focus

In this series, we’ll look at US crude oil production, refinery demand, imports, and US gasoline and distillate prices and inventories. We’ll start by looking at US crude oil prices in early morning trade on October 14.