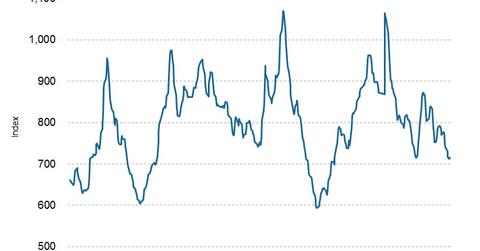

BDTI, Crude Tanker Stock Prices Inch Higher in Week 22

The BDTI stood at 739 on June 7, 2016. For the week ending June 3 (Week 22), the BDTI rose to 759 from 735 at the beginning of the week.

Nov. 20 2020, Updated 5:23 p.m. ET

Baltic Dirty Tanker Index

The BDTI (Baltic Dirty Tanker Index) stood at 739 on June 7, 2016. For the week ending June 3 (Week 22), the BDTI rose to 759 from 735 at the beginning of the week. The index rose for all days of the week except the last day.

The BDTI tracks shipping rates for the transportation of crude oil (DBO) on representative routes. Researchers and analysts follow this index to assess companies’ revenues and earnings potential.

In Week 22 of 2016, the index was lower than last year’s level at this time. On average, the index was 11% lower than this time last year. But the crude tanker business is seasonal. It’s important to check its year-over-year performance.

Stock performance

In Week 22, only two crude tanker stocks traded in negative territory. The best performer of the week was Frontline (FRO), which jumped by 12%. What follows are the stock returns on June 3, 2016, as compared to their prices one week previously:

- Nordic American Tankers (NAT) fell by 1%.

- Teekay Tankers (TNK) rose by 1%.

- Tsakos Energy Navigation (TNP) fell by 3%.

- Navios Maritime Midstream Partners (NAP) rose by 3%.

- General Maritime Partners (GNRT) rose by 6%.

Shipping companies account for 19.7% of the Guggenheim Shipping ETF (SEA). SEA rose by 1% in week 22. Investors who are interested in broader exposure to the industrials sector can invest in the SPDR Dow Jones Industrial Average ETF (DIA).

Series focus

Having looked at tanker stock performances for Week 22, we’ll now check out which tanker performed best. We’ll also see how analysts have changed their recommendations or target prices for crude tanker stocks in the past week and examine the cost side of the tanker industry by reviewing bunker fuel costs.