Will US Crude Oil and Gasoline Inventories Support Oil Prices?

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017.

Aug. 16 2017, Updated 10:15 a.m. ET

Crude oil futures

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017. Prices rose due to the massive fall in US crude oil inventories, according to the API’s (American Petroleum Institute) report. For more, read the previous part of this series.

US crude oil prices are down 16% year-to-date. Lower crude oil prices have a negative impact on oil and gas producers such as Comstock Resources (CRK), Northern Oil & Gas (NOG), and Triangle Petroleum (TPLM).

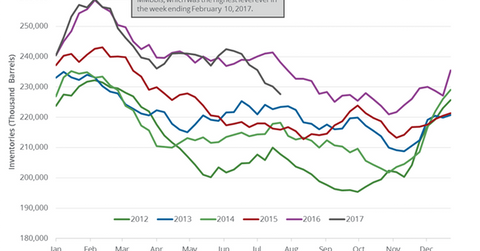

Cushing crude oil inventories

On August 15, 2017, the API (American Petroleum Institute) released its weekly crude oil inventory report. It reported that Cushing crude oil inventories rose by 1.7 MMbbls (million barrels) between August 4 and August 11, 2017. Cushing is the largest crude oil storage hub in the US. A rise in inventories at Cushing could pressure crude (XLE) (XOP) oil prices.

Gasoline and distillate inventories

The API reported that US gasoline inventories rose by 301,000 barrels between August 4 and August 11, 2017. However, market surveys had estimated that US gasoline inventories would fall by 1.1 MMbbls during this period.

The API also estimated that US distillate inventories would fall by 2.1 MMbbls (million barrels) between August 4 and August 11, 2017. A market survey estimated that distillate inventories fell by 572,000 barrels during the same period.

EIA crude oil inventory report

The EIA (U.S. Energy Information Administration) is scheduled to release its weekly crude oil inventory report on August 16, 2017, at 10:30 AM EST. A market survey estimated that US crude oil inventories would fall by 3.1 MMbbls between August 4 and August 11, 2017.

Impact

US crude oil inventories are below their five-year range and have fallen 11.3% from their peak. A higher-than-expected fall in crude oil, gasoline, and distillate inventories could support oil, gasoline, and diesel prices. Moves in crude oil prices impact oil producers like Northern Oil & Gas and Triangle Petroleum.

In the next part, we’ll analyze how US gasoline demand impacts oil prices.